- United States

- /

- IT

- /

- NYSE:GLOB

Does the Recent 70% Drop Signal an Opportunity in Globant for 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Globant stock right now? You are not alone. After a rollercoaster ride over the past year, many investors are pausing to reassess whether this is a moment of risk, opportunity, or both. The stock closed recently at $57.34, and the price has been through some dramatic moves: down nearly 5% over the past week, close to flat for the past month, and a huge drop of more than 70% from its levels one year ago.

Behind these numbers, there have been market-wide dynamics at play, with the tech sector in general facing shifting investor sentiment and tighter liquidity. While no single headline seems to be behind each swing, the overall environment has led many investors to question the right way to value innovative companies like Globant. That is where crunching the numbers comes in.

Globant currently earns a value score of 4 out of 6, meaning it looks undervalued by several key measures. But what does that really signal for the future? The next section will dive into the details behind these valuation markers, and I will wrap up with what could be an even more insightful way to think about the company's long-term prospects.

Why Globant is lagging behind its peers

Approach 1: Globant Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the true worth of a company by projecting its future cash flows and discounting them back to today's value. This approach is especially useful for innovative tech companies like Globant, because growth may be rapid but uncertain.

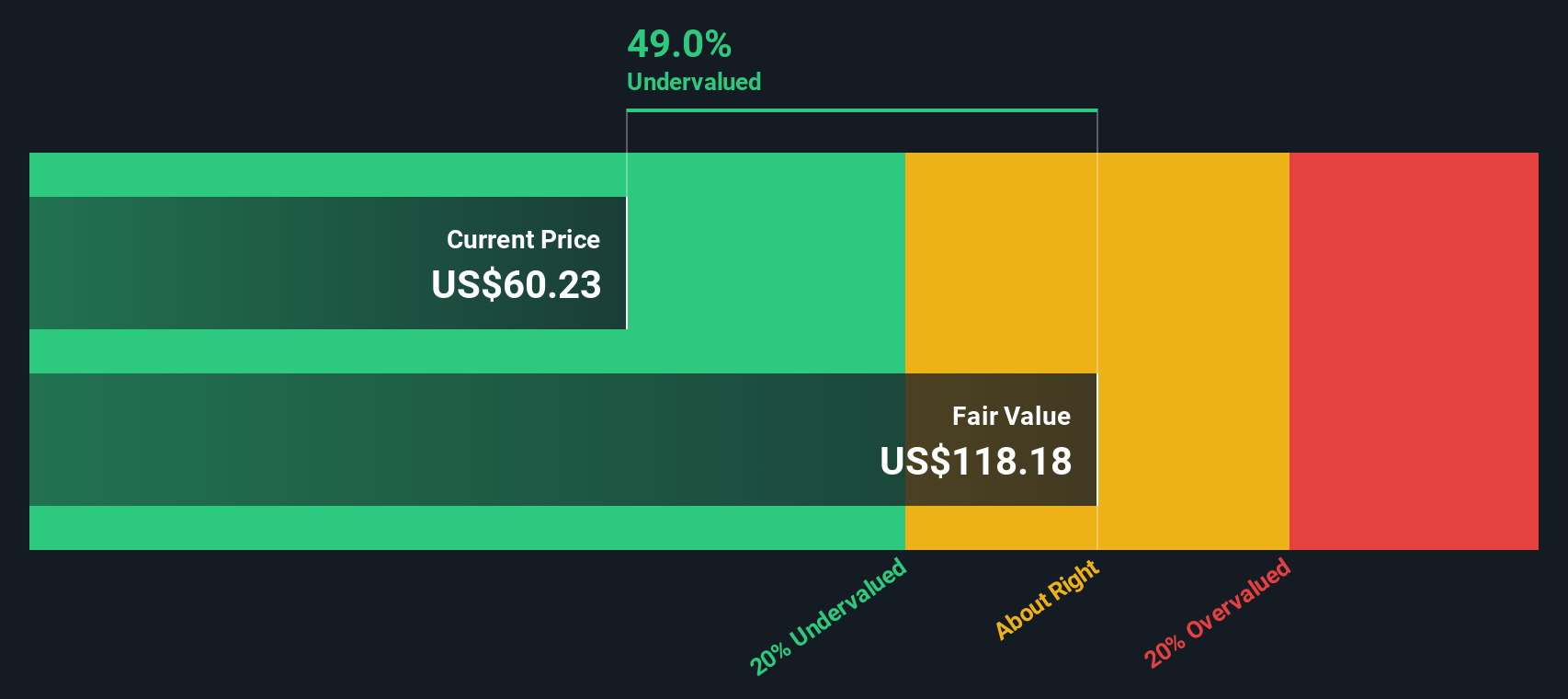

For Globant, current Free Cash Flow stands at $130.8 million, with analysts forecasting strong growth in the years ahead. Projections place annual Free Cash Flow at $323.6 million by 2029, with each year's estimate factoring in both analyst inputs and methodical extrapolation for later years. Over the next decade, Globant's cash flow is expected to nearly triple, reflecting considerable optimism about the company's market opportunities.

Based on this model, Globant’s estimated intrinsic value is $118.16 per share. Compared to the recent price of $57.34, the DCF analysis suggests the stock is currently trading at a 51.5% discount, indicating there may be significant upside.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Globant is undervalued by 51.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Globant Price vs Earnings

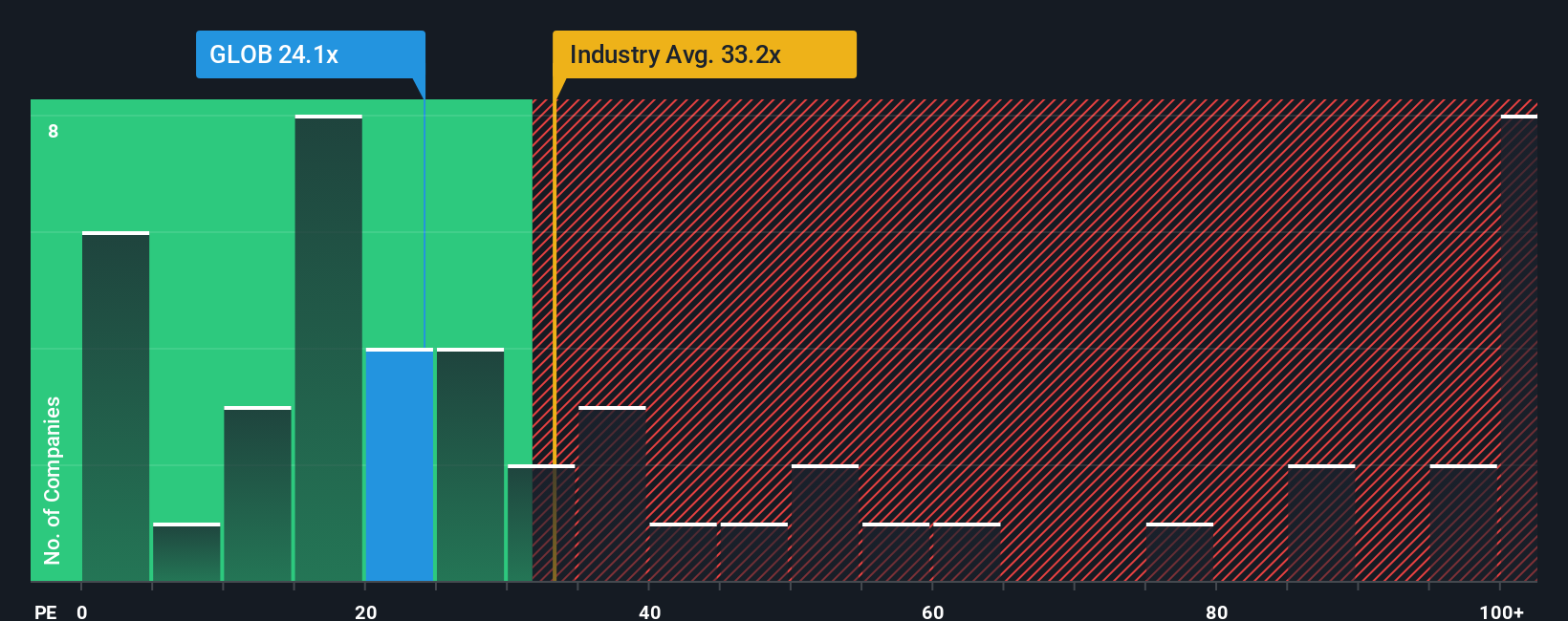

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies, as it directly relates a stock's price to its earnings power. For firms like Globant that generate steady profits, this ratio helps investors gauge how much they are paying for each dollar of earnings, making it a helpful tool for cross-company and industry comparisons.

However, what counts as a "normal" or "fair" PE ratio can vary considerably. Companies with superior growth prospects and lower risk profiles tend to command higher PE ratios, as investors are willing to pay a premium for future earnings expansion. Conversely, slower-growing or riskier businesses usually trade at lower multiples to account for uncertainties.

Currently, Globant trades at a PE ratio of 22.9x. This figure sits notably below the IT industry average PE of 30.7x and is higher than the average for its peers at 19.95x. To provide a more tailored benchmark, Simply Wall St calculates a proprietary "Fair Ratio" for each stock based on multiple factors, including expected earnings growth, profitability, risk, industry trends, and market capitalization. Unlike broader industry measures or simple peer averages, the Fair Ratio is designed to reflect what a company like Globant should reasonably trade at given its unique characteristics. In Globant's case, the Fair Ratio stands at 38.27x, which is much higher than the current multiple. This suggests that, even when accounting for its individual strengths and risks, the stock could be undervalued at present levels.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Globant Narrative

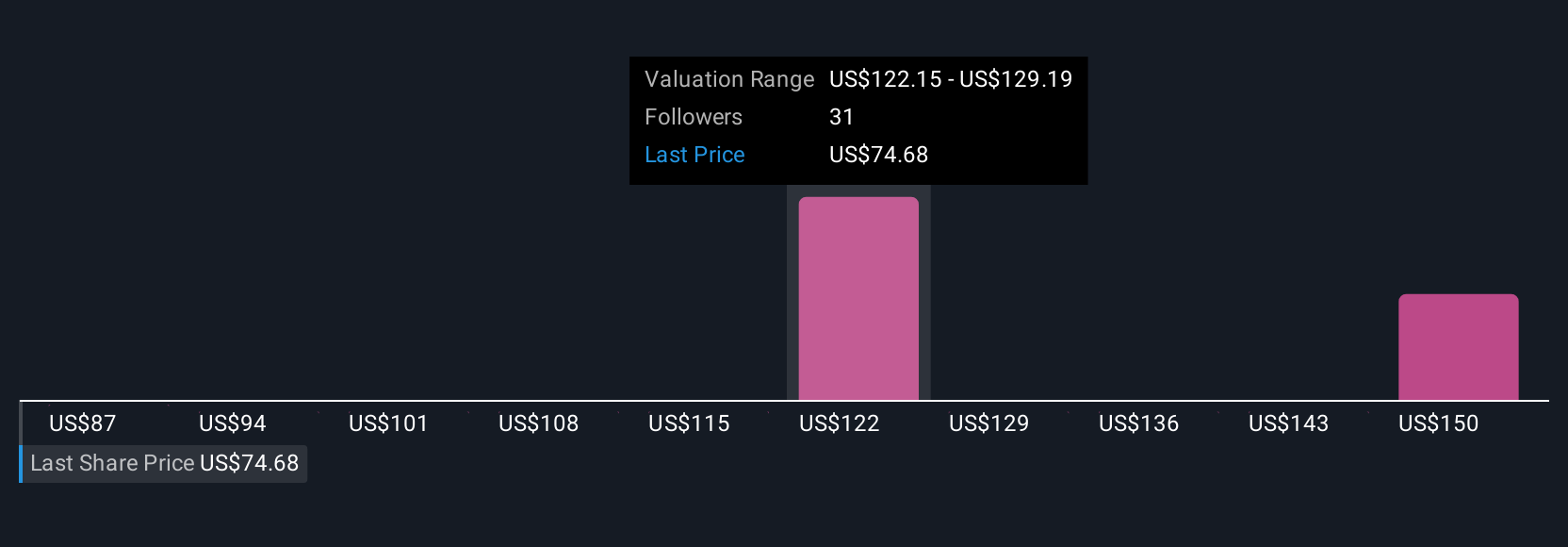

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story you believe about a company, blending your views on its business, future earnings, and risk, and then tying that story directly to a personal financial forecast and fair value estimate.

Narratives put the numbers in context, allowing investors to clearly map out their forecasts and connect the dots between industry changes, company strategy, and what they think Globant is really worth. On Simply Wall St's Community page, anyone can create or follow Narratives, making it easy to compare perspectives and see how others justify their bullish or bearish views. By comparing your Narrative's Fair Value to the latest Share Price, you instantly see whether you think it's time to buy, hold, or sell.

What’s more, Narratives update dynamically as new news, earnings reports, or fundamentals are released, keeping your investment logic always current. For example, some investors reviewing Globant's prospects see rapid enterprise AI adoption and margin expansion, setting a Fair Value as high as $240, while others, focused on slowdowns and margin pressure, estimate as low as $74. Narratives let you express your outlook and test it against real market data with confidence and clarity, so your decisions are always grounded in both story and numbers.

Do you think there's more to the story for Globant? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GLOB

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives