- United States

- /

- IT

- /

- NYSE:GLOB

Did Globant's (GLOB) Bold New AI Deals and Buyback Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, Adobe and Red Sea Global revealed a partnership positioning Globant as the lead technology partner for implementing a new AI-powered digital visitor experience for VisitRedSea.com, while Globant also announced a multi-year collaboration with AWS to deliver advanced cloud and AI solutions across major industries and launched a US$125 million share repurchase program to run through late 2026.

- This series of collaborations and the buyback program together highlight Globant's intent to reinforce shareholder value and expand its footprint in digital transformation and emerging technology services.

- We’ll explore how Globant’s new share buyback program may influence its longer-term investment outlook and digital transformation narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Globant Investment Narrative Recap

To see promise in Globant, investors must believe that accelerating AI adoption and digital transformation across industries will reignite demand and lift revenue growth from recent lows. While the new Adobe and AWS partnerships strengthen Globant’s credentials as a preferred technology partner, they may not materially shift the near-term revenue trajectory or resolve the ongoing softness in client demand, which remains a key risk. Among the company’s recent moves, the announcement of a US$125 million share repurchase program stands out. While buybacks can provide support to shareholder value in the short term, the long-term success of this initiative will likely be influenced by Globant’s ability to convert new partnerships and AI offerings into recurring, higher-margin business, helping to counterbalance any margin pressure arising from slow demand recovery. However, it’s equally important for investors to be aware that, in contrast to the visible momentum from recent client wins, persistent soft demand and extended sales cycles still represent ...

Read the full narrative on Globant (it's free!)

Globant's outlook anticipates $3.0 billion in revenue and $242.1 million in earnings by 2028. This projection is based on a 6.1% annual revenue growth rate and a $131.8 million increase in earnings from the current $110.3 million.

Uncover how Globant's forecasts yield a $100.79 fair value, a 70% upside to its current price.

Exploring Other Perspectives

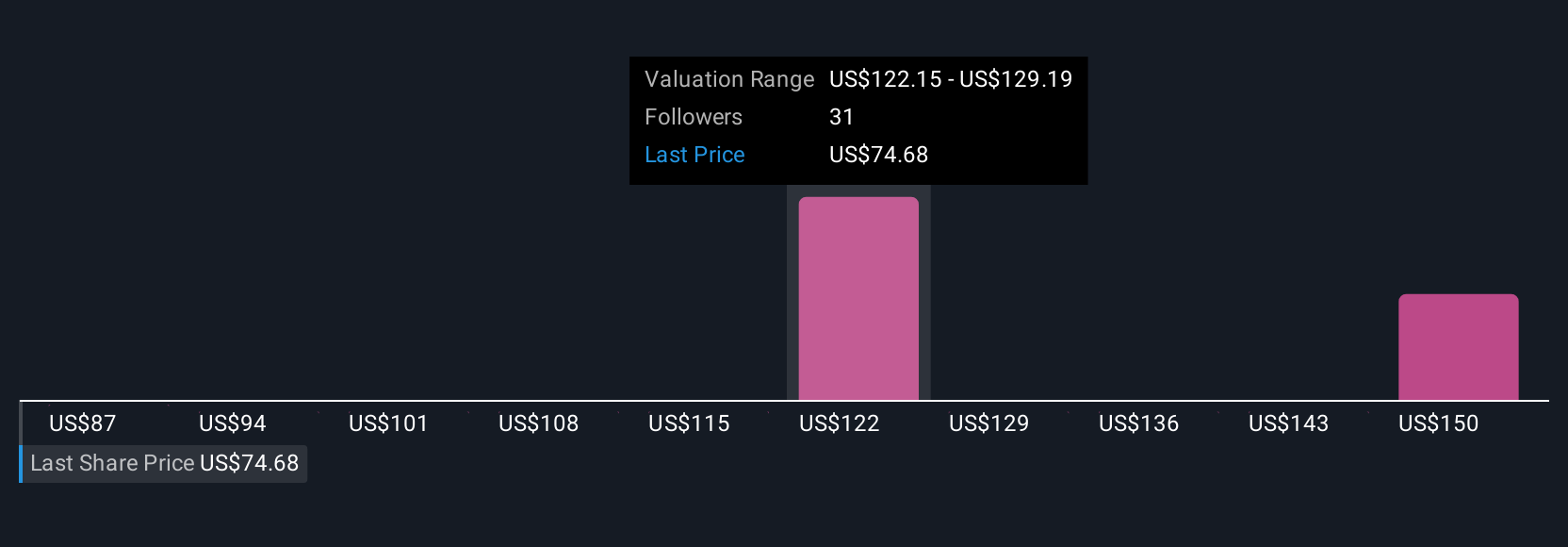

Five fair value estimates from the Simply Wall St Community range from US$61.97 to US$118.63 per share. While many see undervaluation, concerns about sluggish revenue growth and uncertain client conversion highlight the importance of understanding different viewpoints.

Explore 5 other fair value estimates on Globant - why the stock might be worth just $61.97!

Build Your Own Globant Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Globant research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Globant research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Globant's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GLOB

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives