- United States

- /

- IT

- /

- NYSE:GLOB

A Fresh Look at Globant (NYSE:GLOB) Valuation After Landmark FIFA Digital Partnership Expansion

Reviewed by Simply Wall St

Globant (NYSE:GLOB) is expanding its collaboration with FIFA by signing a new agreement to enhance the digital experience across FIFA’s ecosystem. The partnership includes developing digital platforms and a mobile app ahead of major tournaments.

See our latest analysis for Globant.

Globant’s partnership expansion with FIFA has drawn fresh attention, yet the share price has struggled to maintain momentum over the past year. Despite small recent gains, the year-to-date share price return sits at -69.56%, while the total shareholder return over twelve months is even weaker at -70.78%. In the short term, momentum appears to be building modestly off a low base. However, the broader trend highlights the risk perception that has dominated the stock’s recent journey.

If Globant’s focus on digital transformation has your interest, now’s a great time to broaden your search and discover See the full list for free.

With shares trading at a steep discount compared to analyst targets and signs of improving fundamentals, investors now face a timely question: Is Globant undervalued, or is the market already accounting for future recovery?

Most Popular Narrative: 25% Undervalued

With the narrative’s fair value at $86.48 and Globant's last close at $64.86, the stage is set for enthusiastic debate over whether the stock is truly overlooked or if market skepticism is warranted.

The rapid adoption of AI and generative AI across industries is dramatically increasing the complexity of enterprise technology environments. This is driving greater demand for specialist partners to design, implement, and maintain tailored AI solutions. Globant's differentiated Enterprise AI platform, AI pods subscription model, and recent multiyear partnership wins (for example, OpenAI and AWS) position the company to capture a greater share of this accelerating market. These factors could boost both revenue growth and long-term margins as more high-value, recurring AI engagements convert in the pipeline.

Curious what numbers could justify such a valuation gap? The most popular narrative banks on a technology supercycle, recurring revenues, and bold profit margin bets. Want to see which ambitious growth rates and future earnings underlie their fair value math? Click through to see the numbers they are counting on before you make your own call.

Result: Fair Value of $86.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, substantial macroeconomic headwinds and slower than expected adoption of new AI offerings could undermine Globant's near-term growth trajectory and investor confidence.

Find out about the key risks to this Globant narrative.

Another View: What Do the Numbers Say?

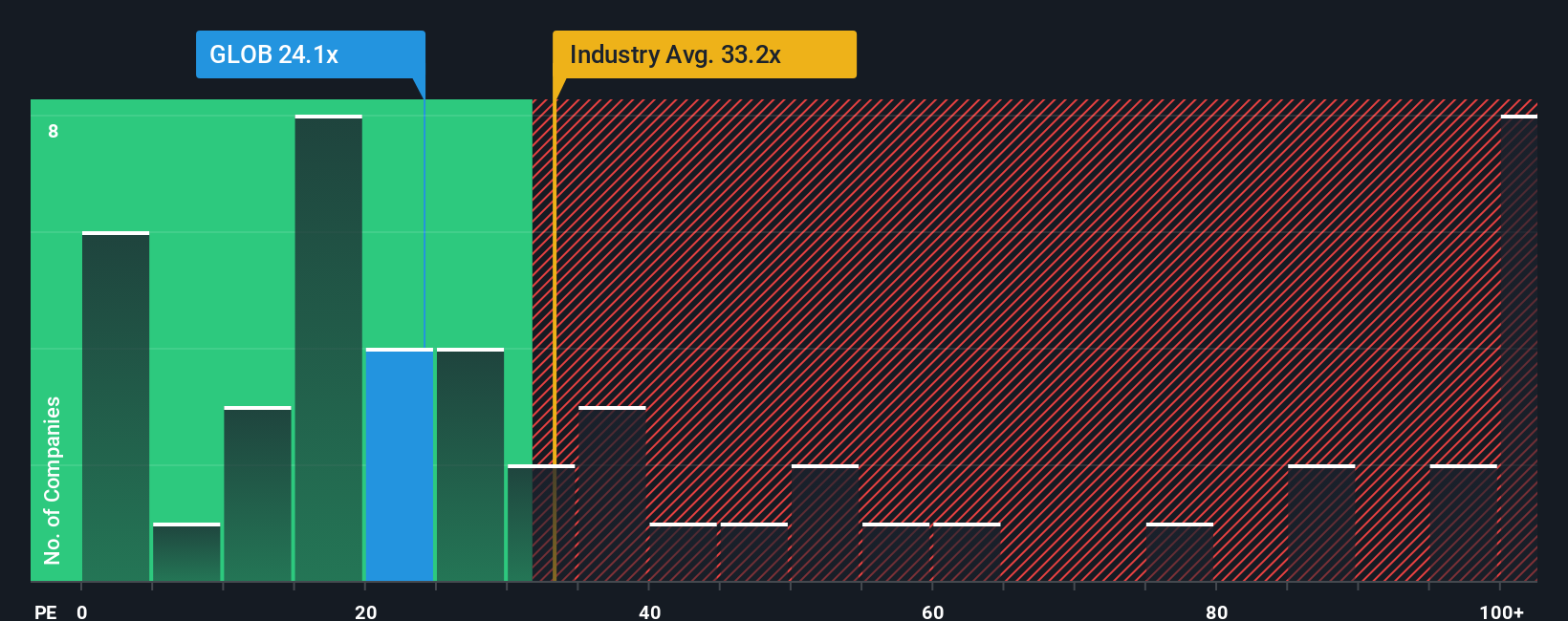

While fair value models suggest Globant is 25% undervalued, a look at its price-to-earnings ratio tells a different story. The company trades slightly above both the industry average (28.6x vs 28.3x) and its peer group (12.6x average), yet remains well below its fair ratio of 40.4x. This gap signals that investor sentiment is cautious, but could shift if results improve. Are the risks already priced in, or is there more to uncover here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Globant Narrative

If the current narrative doesn’t quite fit your perspective or you’d rather draw your own conclusions from the numbers, it only takes a few minutes to craft a custom analysis. Do it your way

A great starting point for your Globant research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stand still. Amplify your portfolio by targeting emerging trends and untapped growth stories. Here are three power plays you should not miss:

- Unlock growth potential by scouting out these 930 undervalued stocks based on cash flows primed for a rebound, thanks to robust fundamentals and low valuations.

- Capture tomorrow’s winners as you tap into these 25 AI penny stocks, set to benefit from AI’s explosive impact across industries.

- Boost your passive income with these 14 dividend stocks with yields > 3% offering steady yields above 3% and reliable, long-term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GLOB

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026