- United States

- /

- IT

- /

- NYSE:FSLY

Fastly's, Inc. (NYSE:FSLY) Investors may need to be Cautious about the Future

Last week, you might have seen that Fastly, Inc. (NYSE:FSLY) released its quarterly result to the market. The early response was not positive, with shares down 8.5% to US$42.30 in the past week.

Fastly reported revenues of US$85m, in line with expectations, but it unfortunately also reported (statutory) losses of US$0.51 per share, which were slightly larger than expected.

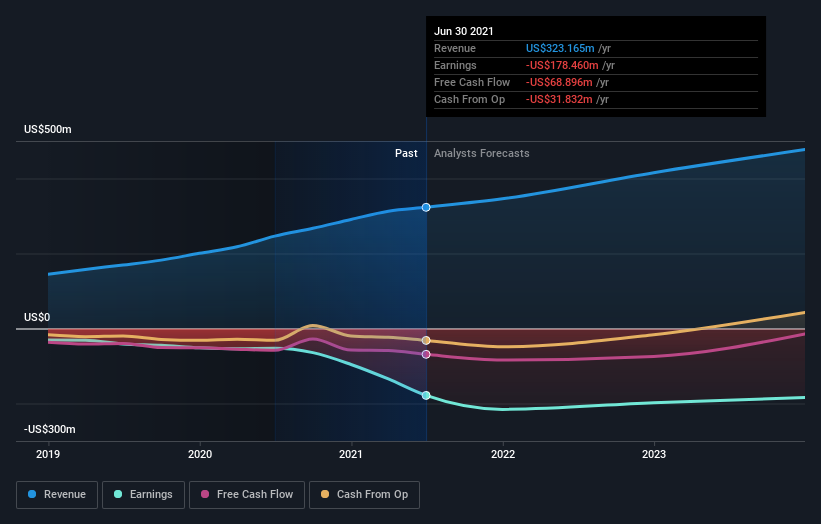

Following the result, the analysts have updated their earnings model, here is how the future is estimated:

View our latest analysis for Fastly

After the latest results, the eleven analysts covering Fastly are now predicting revenues of US$345.8m in 2021. If met, this would reflect a reasonable 7.0% improvement in sales compared to the last 12 months. A 7% improvement is a very bad signal for a company hoping to tap into their total market potential.

Losses are expected to increase substantially, hitting US$1.91 per share. Yet prior to the latest earnings, the analysts had been forecasting revenues of US$382.5m and losses of US$1.36 per share in 2021. So it's pretty clear the analysts have mixed opinions on Fastly after this update. Revenues were downgraded and per-share losses are expected to increase. This wouldn't be such a problem, since young companies are expected to invest into future growth and run deficits. The worrying part comes because growth is not quite optimistic yet, and an increase in losses just means the company will be less effective in the future.

The average price target fell 30% to US$36.22, implicitly signalling that lower earnings per share are a leading indicator for Fastly's valuation. Currently, the most bullish analyst values Fastly at US$49.00 per share, while the most bearish prices it at US$30.00.

The market price history, indicates high optimism in the beginning of May 2020, followed by a burst of the price bubble when faced with the actual financial fundamentals. The stock has some risky points (4 warning signs we've spotted with Fastly) and may not have bottomed out, so investors should monitor with caution.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We would highlight that Fastly's revenue growth is expected to slow, with the forecast 14% annualized growth rate until the end of 2021 being well below the historical 31% growth over the last year. Compare this to the 229 other companies in this industry with analyst coverage, which are forecast to grow their revenue at 15% per year. Factoring in the forecast slowdown in growth, it looks like Fastly is forecast to grow at about the same rate as the wider industry.

This is less than optimal for investors, since it means that the company has nothing better to offer than the average competitor in the same segment.

Key Takeaways

Performance has been disappointing in the previous period, and the price has slowly converged to reality. The company is not estimated to outperform the industry and may lose its treatment as a high performer.

There are multiple risks beyond the estimated future losses, and investors may want to be cautious moving forward.

Analysts increased their loss per share estimates for next year. They also downgraded their revenue estimates, although as we saw earlier, forecast growth is only expected to be about the same as the wider industry.

The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of Fastly's future valuation.

With that in mind, we wouldn't be too quick to come to a conclusion on Fastly. Long-term earnings power is much more important than next year's profits. We have forecasts for Fastly going out to 2023, and you can see them free on our platform here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:FSLY

Fastly

Operates an edge cloud platform for processing, serving, and securing its customer’s applications in the United States, the Asia Pacific, Europe, and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives