- United States

- /

- IT

- /

- NYSE:FSLY

Evaluating Fastly After Shares Jump 14% Amid Renewed Tech Infrastructure Interest

Reviewed by Bailey Pemberton

If you have been following Fastly’s stock, you know it has been quite a ride for investors weighing their next move. Whether you are contemplating holding on, jumping in, or heading for the exit, it is hard to ignore the back-and-forth in Fastly’s share price. Over the past week, the stock dipped by 0.7%. However, if you look at the past month, you see a much brighter picture with shares up 14.1%. On a one-year basis, Fastly has climbed 16.1%. It is worth remembering that the longer-term journey has not been as smooth, with a significant 93.0% pullback over five years.

Recent optimism seems to be tied to broader market interest in tech infrastructure names and a shift in how investors are assessing risk and long-term growth prospects. Fastly finds itself at the center of these changing tides as market developments hint at renewed potential for platforms powering the internet’s backbone.

But is Fastly undervalued, fairly priced, or just reflecting a new reality? According to valuation models, Fastly currently passes 3 out of 6 checks for being undervalued, giving it a value score of 3. While that might sound middling, it suggests there is more to this stock than meets the eye.

Let us take a closer look at the most relevant valuation approaches investors use today. Later on, we will explore one often-overlooked method that may offer the clearest snapshot of what Fastly is really worth.

Why Fastly is lagging behind its peers

Approach 1: Fastly Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to the present. This process aims to determine what the business is really worth based on its ability to generate cash in the years to come.

For Fastly, the latest twelve months of Free Cash Flow stood at $7.98 Million, with analysts forecasting steady growth over the next decade. By 2027, projections show Free Cash Flow rising to $28.8 Million, driven by a mix of analyst estimates and further extrapolations. Looking ahead to 2035, the model anticipates Free Cash Flow could reach $111.79 Million, though these later years rely on assumptions about ongoing growth.

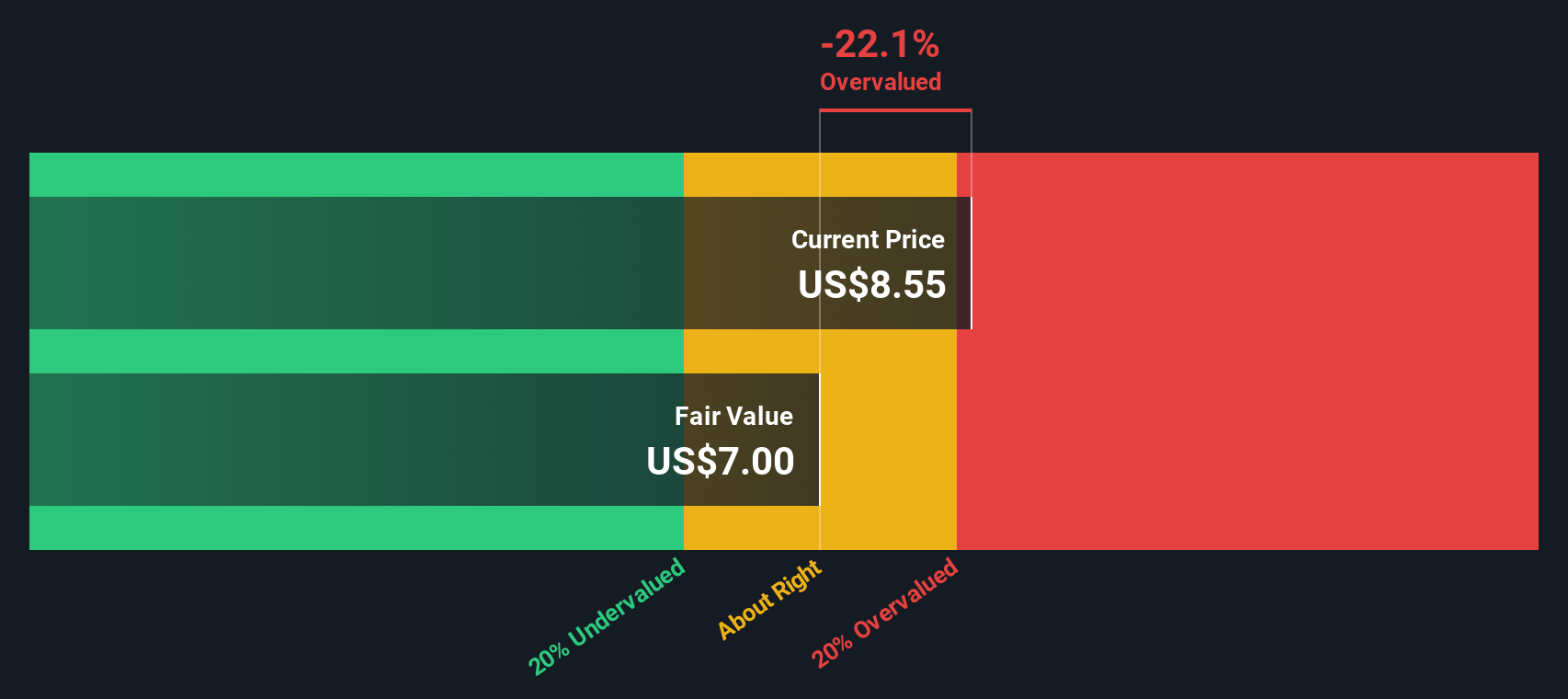

Using this cash flow outlook, the DCF model calculates an intrinsic value of $7.00 per share. This is 22.6% below the current share price, indicating that Fastly’s stock is trading well above its fundamental estimate based on cash flows. In other words, the DCF approach suggests the market is pricing in more optimism than what the underlying cash generation supports right now.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Fastly may be overvalued by 22.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Fastly Price vs Sales

When evaluating companies that are not consistently profitable, like Fastly, investors often turn to the Price-to-Sales (P/S) multiple instead of the more commonly used Price-to-Earnings (P/E). The P/S ratio helps compare the market value of a company to its total revenue, making it a useful tool for growth tech companies reinvesting heavily for future gains.

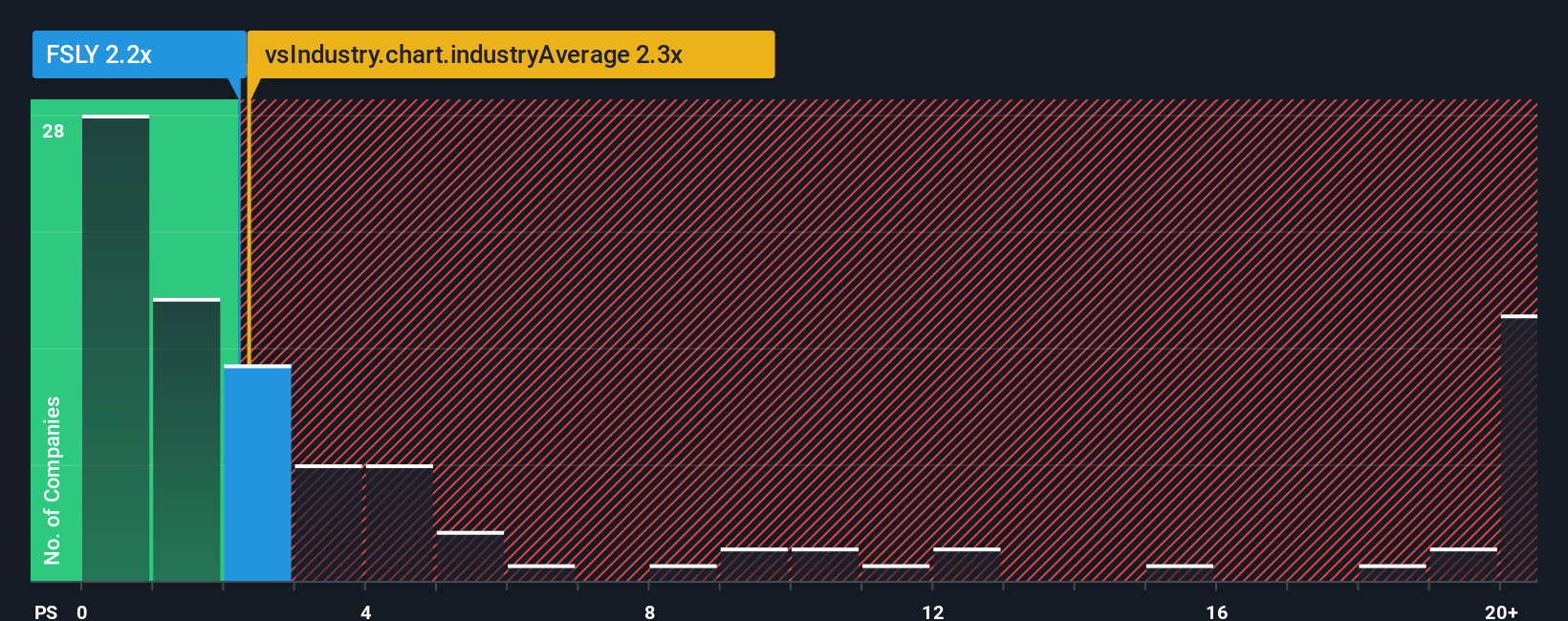

Fastly’s current P/S ratio stands at 2.21x. To understand what that means, consider that the average P/S for Fastly’s IT industry peers is 2.34x, while the average among direct competitors is a much higher 7.66x. A "normal" or "fair" sales multiple typically depends on factors like anticipated revenue growth, profit margin potential, and risk profile. Higher growth and lower risk tend to justify higher multiples.

This is where Simply Wall St’s proprietary "Fair Ratio" comes in. The Fair Ratio is designed to be a more holistic benchmark than simple peer or industry averages, as it factors in Fastly's specific growth forecasts, profit margins, risk level, market cap, and the characteristics of its industry. For Fastly, the calculated Fair Ratio is 2.44x, which is just slightly above its present P/S of 2.21x.

Given that Fastly’s actual P/S is just 0.23x below its Fair Ratio, which is well within the threshold for a meaningful valuation difference, this suggests the stock’s price is about right when viewed through the lens of its fundamentals and prospects.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fastly Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a forward-thinking tool designed to help you invest with clarity and conviction. A Narrative is simply your story about a company, but with numbers; it connects your view of Fastly’s future (such as expected growth, earnings, and margins) with a full financial forecast and a clear, fair value conclusion.

Narratives are available on Simply Wall St’s Community page, allowing millions of investors to build, share, and compare forecasts in just a few minutes, whether you are a seasoned expert or just starting out. By comparing your Narrative’s fair value to Fastly’s current share price, you get a grounded framework for deciding whether to buy, hold, or sell. Because Narratives are dynamically updated with every major news or earnings development, your perspective is always up to date.

For Fastly, for example, some investors may see long-term edge security trends and award a fair value nearer the highest analyst target, around $10.00 per share, while others emphasize risks and lean towards the lowest target of $6.00. Narratives help you understand and act on your own outlook in a transparent, data-backed way.

Do you think there's more to the story for Fastly? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FSLY

Fastly

Operates an edge cloud platform for processing, serving, and securing its customer’s applications in the United States, the Asia Pacific, Europe, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives