- United States

- /

- Software

- /

- NYSE:FICO

Should You Rethink FICO After Its Recent 23% Drop and Fintech Partnerships?

Reviewed by Bailey Pemberton

- Wondering if Fair Isaac is a bargain or overpriced right now? You are not alone, as the company’s unique position in the software industry keeps investors guessing about its true worth.

- After years of remarkable long-term growth, Fair Isaac's stock has dipped. It is down 12.8% year-to-date and 23.0% over the past year, though it is up 7.8% in the last month and has soared over 200% in three years.

- Recently, the company was in the headlines after strengthening its partnerships within the financial technology space and announcing new product initiatives. These developments have contributed to the recent rebound, offering context to the shifting risk and optimism around Fair Isaac’s future potential.

- As for value, our checks rate Fair Isaac just 1 out of 6 for being undervalued, suggesting there may be better-priced options out there. We'll break down exactly how that score is calculated, but stick around because there is a smarter way to figure out if a stock like this is truly a deal.

Fair Isaac scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Fair Isaac Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true worth by projecting future free cash flows and then discounting them back to today’s dollars. This gives investors a look at what Fair Isaac could be worth based on realistic future expectations rather than current stock market hype.

For Fair Isaac, analysts report a last twelve months (LTM) free cash flow of $768 million. Looking ahead, free cash flow is projected to grow each year and could reach about $1.55 billion by the end of the 2030 fiscal year. Analyst estimates are available for the next five years, while figures beyond that are forecasted using industry-standard extrapolation techniques. All amounts are reported in US dollars.

Based on these cash flow projections and the DCF methodology, Fair Isaac’s estimated intrinsic value is $965.15 per share. In comparison with the current market price, the analysis suggests the stock trades at a sizable premium and is approximately 80.4% overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Fair Isaac may be overvalued by 80.4%. Discover 886 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Fair Isaac Price vs Earnings

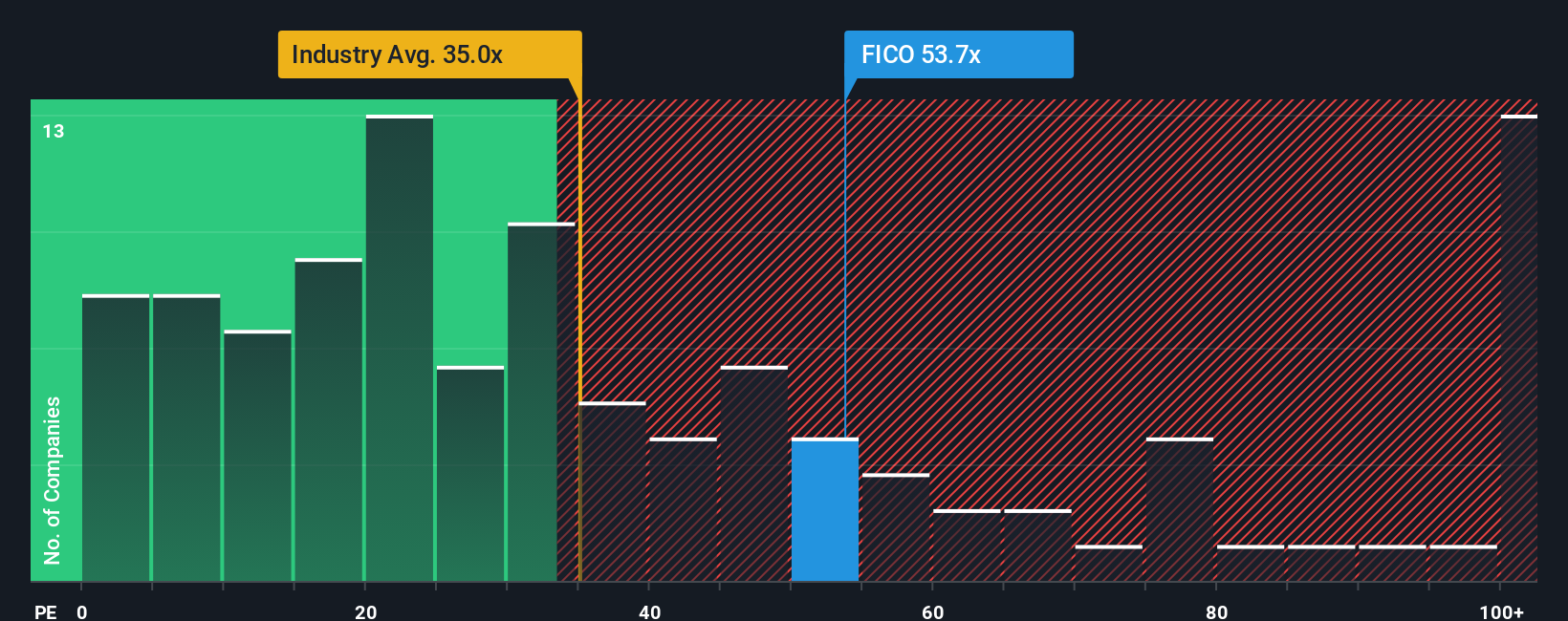

For profitable companies like Fair Isaac, the price-to-earnings (PE) ratio is a popular and telling valuation marker. The PE ratio allows investors to gauge how much they are paying for every dollar of current earnings and helps compare companies with similar profitability profiles. Growth expectations and perceived risk play a critical role in shaping what is considered a "normal" or "fair" PE multiple, as higher growth or lower risk usually justifies a higher ratio.

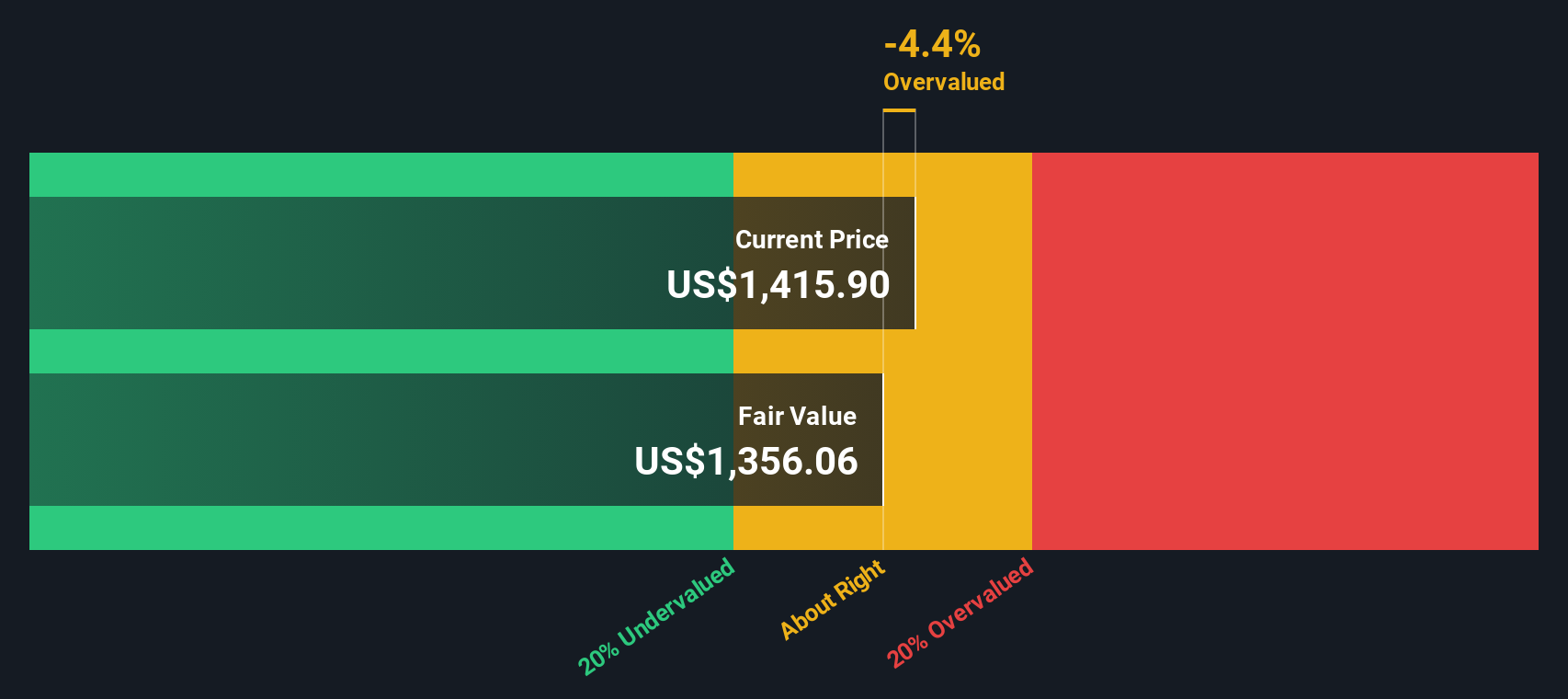

Currently, Fair Isaac trades at a lofty PE of 63.3x. This is notably higher than both the software industry’s average PE of 31.2x and the peer group average of 64.9x. However, the real insight comes from looking at the “Fair Ratio,” a proprietary calculation by Simply Wall St that tailors a justifiable PE ratio based on Fair Isaac’s unique mix of factors such as growth trends, profit margins, company size, and risk profile. For Fair Isaac, this algorithm outputs a Fair Ratio of 39.4x.

The Fair Ratio goes beyond conventional peer or industry benchmarks, providing a more tailored perspective that blends growth prospects, risks, profitability, and market cap. Because of this, it gives a superior sense of whether the stock’s valuation truly stacks up against its own merits. Comparing Fair Isaac’s actual PE of 63.3x to its Fair Ratio of 39.4x reveals the stock is trading well above what is fundamentally justified.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fair Isaac Narrative

Earlier we mentioned a smarter way to understand valuation, so let’s introduce you to Narratives. Rather than relying solely on analyst formulas or ratios, a Narrative lets you build your own story about Fair Isaac by connecting what you believe about the company’s future, including its growth drivers, risks, and key trends, to your own financial forecasts and fair value estimate.

This approach allows you to link your perspective on the business directly to real forecasts and updated values, giving clarity to why a stock is considered a bargain or overpriced. Narratives are easy to use and available for anyone on Simply Wall St's Community page, which millions of investors use to compare and share their views.

Each Narrative shows your calculated Fair Value alongside the current share price, so you can make more informed decisions about buying or selling, especially as the story changes. Narratives automatically update with new information such as earnings results or major news.

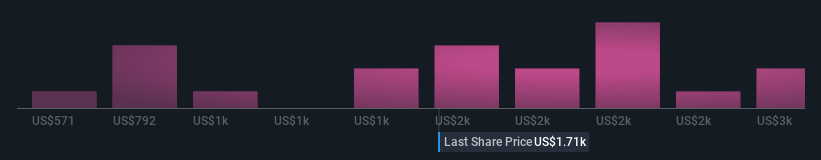

For example, right now some investors see Fair Isaac’s international expansion and AI product launches as reasons it could be worth $2,300 per share, while others warn that regulatory and competitive risks could justify a target as low as $1,230. No matter where you stand, Narratives give you a customizable, dynamic view of Fair Isaac based on your own convictions.

Do you think there's more to the story for Fair Isaac? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FICO

Fair Isaac

Provides analytics software in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record with limited growth.

Similar Companies

Market Insights

Community Narratives