- United States

- /

- Software

- /

- NYSE:FICO

Is Brown Advisory’s New Stake in FICO a Vote of Confidence in Its Mortgage Solutions?

Reviewed by Simply Wall St

- During the second quarter of 2025, Brown Advisory initiated a position in Fair Isaac Corporation, emphasizing its integral role in the mortgage ecosystem and credit risk management despite recent challenges posed by higher interest rates.

- This new institutional support highlights how Fair Isaac's dominant market share and reputation for innovation continue to attract long-term investor interest even in softer lending conditions.

- We'll examine how Brown Advisory's confidence in Fair Isaac's mortgage and credit risk solutions may influence key aspects of its investment outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Fair Isaac Investment Narrative Recap

To own shares in Fair Isaac today, you have to believe that the company’s position at the center of credit risk assessment, especially in the US mortgage market, remains essential amid structural change. The recent addition of Brown Advisory as a shareholder underscores confidence in Fair Isaac’s resilience, but this new support does not alter the short-term spotlight on regulatory risk, particularly competition from alternatives like VantageScore and potential margin pressure from market shifts.

Among recent developments, the adoption of FICO Score 10 T by Guild Mortgage is most relevant, showing continued client uptake of next-generation scoring models even as headwinds persist for mortgage volume. This supports the notion that product innovation may help offset some near-term challenges, especially if broader adoption follows.

On the other hand, investors should keep in mind the implications of possible regulatory changes that could threaten FICO’s longstanding market share and revenue concentration risk if...

Read the full narrative on Fair Isaac (it's free!)

Fair Isaac's narrative projects $2.9 billion revenue and $1.1 billion earnings by 2028. This requires 14.3% yearly revenue growth and a $467 million earnings increase from $632.6 million today.

Uncover how Fair Isaac's forecasts yield a $1875 fair value, a 21% upside to its current price.

Exploring Other Perspectives

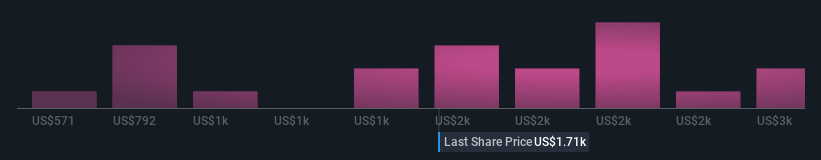

Nineteen members of the Simply Wall St Community estimate FICO’s fair value from as low as US$1,005 to over US$2,627 per share. While opinions widely vary, many are watching whether regulatory shifts or competition from alternative scoring models could affect FICO’s long-term earnings and pricing power.

Explore 19 other fair value estimates on Fair Isaac - why the stock might be worth as much as 70% more than the current price!

Build Your Own Fair Isaac Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fair Isaac research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fair Isaac research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fair Isaac's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FICO

Fair Isaac

Provides analytics software in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion