- United States

- /

- Software

- /

- NYSE:FICO

Fair Isaac (NYSE:FICO) Announces US$1 Billion Buyback Plan Despite Recent Share Dip

Reviewed by Simply Wall St

On June 19, 2025, Fair Isaac (NYSE:FICO) completed its buyback plan and announced a new one, reinforcing its commitment to enhancing shareholder value. Over the past month, FICO's share price increased by 3%, contrasted with a flat broader market. The company's buyback activity likely bolstered investor confidence amid stable market conditions and fluctuating oil prices. In addition, FICO's new partnerships, like adopting FICO Score 10 T, could signal future growth prospects. These factors appeared to underpin the company's stock performance, slightly countering broader market movements impacted by geopolitical tensions and oil price uncertainty.

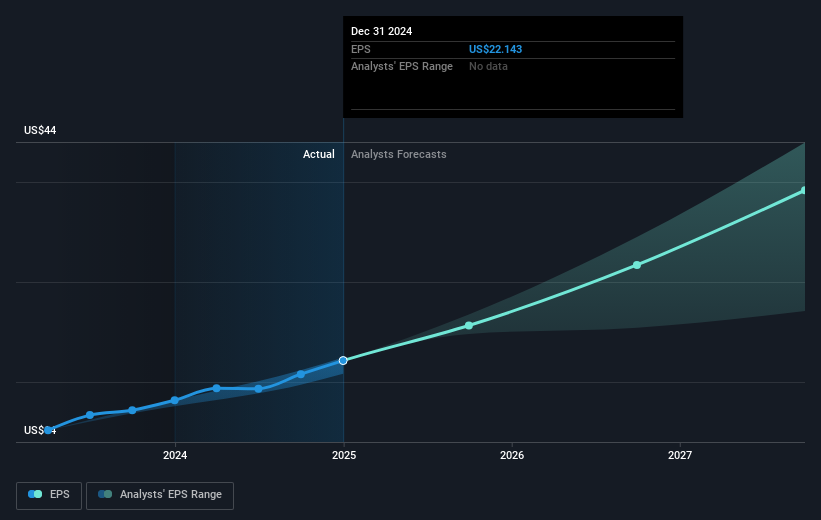

The completion of Fair Isaac's buyback plan and the introduction of a new one underscore the company's proactive approach to enhancing shareholder returns, potentially driving its recent share price increase. Over the past five years, Fair Isaac's total shareholder return, including dividends, reached 334.18%, highlighting strong long-term performance. In comparison to its recent performance against a relatively flat broader market, the company outperformed the US Software industry over the past year, reinforcing its robust market position.

The introduction of new partnerships and the expansion of products like FICO Score 10 T are likely to positively influence revenue and earnings forecasts. Such initiatives open avenues for growth in international markets and diversify revenue streams, potentially mitigating risks associated with dependence on traditional finance sectors. However, these changes could also heighten exposure to macroeconomic factors that might impact future performance.

With the current share price close to the analysts' price target of US$2,116, the price movement underlines the market's alignment with analysts' consensus on Fair Isaac's valuation. This modest variance suggests that investors should weigh their assumptions against the analysts' expectations of continued revenue growth and enhanced earnings. Overall, while the company shows promise for growth, the small percentage increase over the price target implies potential caution in market optimism.

Explore historical data to track Fair Isaac's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FICO

Fair Isaac

Develops software with analytics and digital decisioning technologies that enable businesses to automate, enhance, and connect decisions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives