- United States

- /

- Software

- /

- NYSE:FICO

Fair Isaac (FICO): Evaluating Valuation After Strong Earnings Beat, Buyback, and Strategic Innovation Partnerships

Reviewed by Simply Wall St

Fair Isaac (FICO) recently shared quarterly results that exceeded Wall Street’s expectations, showing double-digit revenue and earnings growth. Alongside this achievement, management announced a record stock buyback and raised forward guidance.

See our latest analysis for Fair Isaac.

Fair Isaac’s momentum has rebounded lately. After a tougher start to the year and regulatory headwinds, the share price has climbed 19.3% over the past 90 days, even though the year-to-date share price return remains negative. While the company’s impressive three- and five-year total shareholder returns underline strong long-term value creation, its recent run reflects growing investor confidence that new partnerships and tech initiatives can help offset new industry pressures.

If Fair Isaac’s renewed energy has you curious about where else growth and leadership are converging, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With Fair Isaac’s recent surge and upbeat guidance, the central question now is whether shares remain attractively valued as momentum returns, or if the market has already priced in the company’s renewed growth prospects and innovation pipeline.

Most Popular Narrative: 10.9% Undervalued

At $1,797.27 per share, Fair Isaac trades below the narrative’s estimated fair value of $2,016.44, which suggests the market may be missing the company’s forward earnings growth and margin expansion potential.

“The ongoing transition to SaaS and cloud-based delivery, evidenced by double-digit growth in FICO Platform ARR and emphasis on conversion to next-generation AI-driven decisioning solutions, is increasing recurring revenues. This supports margin expansion and greater earnings predictability. Sustained investment in explainable AI and machine learning, as showcased by new FICO-focused foundation models and decisioning innovations, is enhancing competitive differentiation and supporting premium product offerings. As a result, average selling prices and net margins are increasing.”

Want to see what's really driving this premium valuation? A bold set of top-line and bottom-line estimates, plus a surprising future profit multiple. Which critical numbers fuel this price? Click through to uncover the hidden assumptions shaping this outlook.

Result: Fair Value of $2,016.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory shifts and alternative scoring models remain key risks that could impact Fair Isaac’s growth momentum and market dominance in the coming years.

Find out about the key risks to this Fair Isaac narrative.

Another View: Is FICO’s Premium Justified?

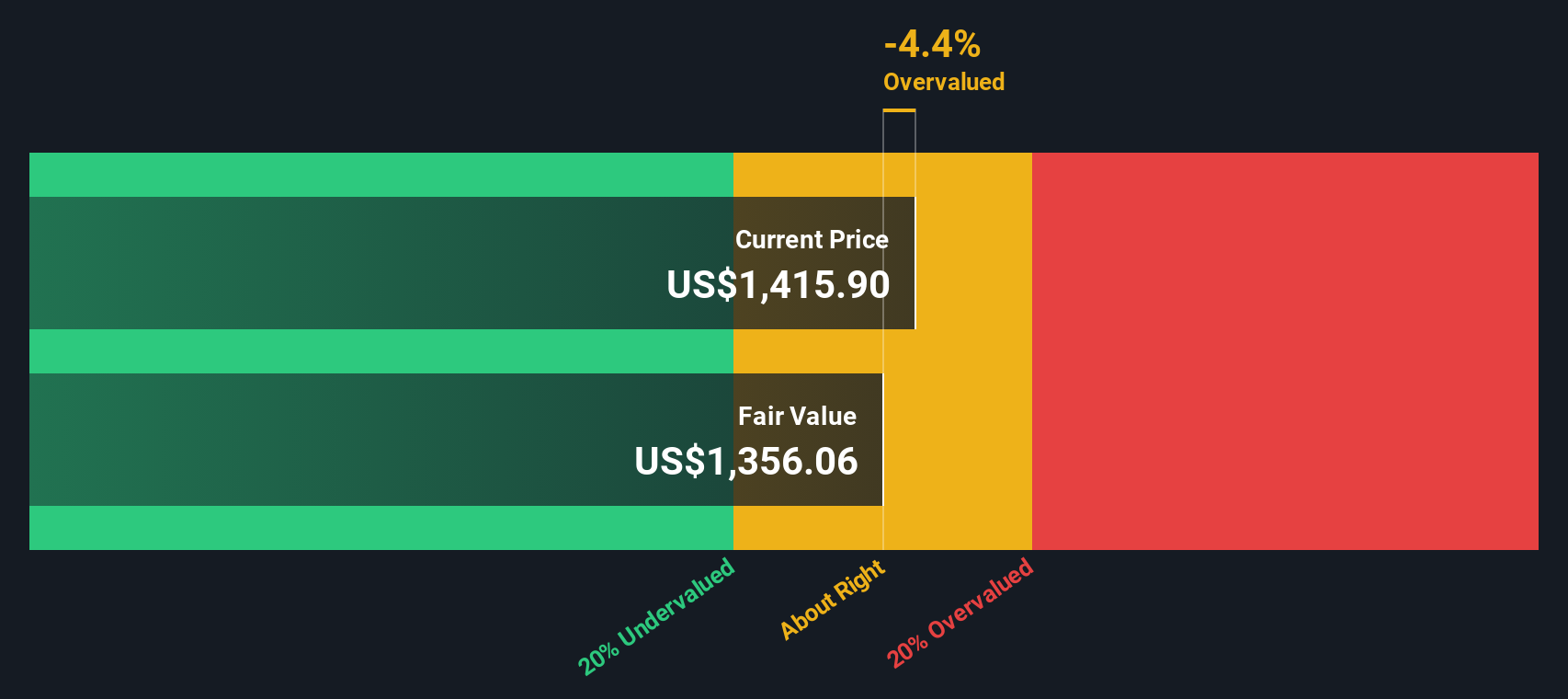

While the fair value narrative points to hidden upside, our DCF model offers a different picture. According to the SWS DCF model, FICO is actually trading above our fair value estimate, signaling the shares may be overvalued if growth stalls or expectations shift. Which outlook will play out?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Fair Isaac Narrative

If you have a different perspective, or want to review the data firsthand, you can craft your own narrative and investment case in just a few minutes. Do it your way

A great starting point for your Fair Isaac research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

There’s no reason to stop at Fair Isaac. Set yourself up for smarter investing moves by checking out high-potential stocks in sectors that could surprise the market next.

- Capitalize on the AI revolution and see which companies could lead the next wave of innovation with these 25 AI penny stocks.

- Secure reliable returns by reviewing these 15 dividend stocks with yields > 3% that consistently deliver payouts above 3% for income-focused investors.

- Be ahead of financial trends with these 81 cryptocurrency and blockchain stocks making breakthroughs in blockchain and digital asset adoption before the mainstream catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FICO

Fair Isaac

Provides analytics software in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success