- United States

- /

- Software

- /

- NYSE:FICO

A Closer Look at Fair Isaac (FICO) Valuation as Shares Gain Recent Momentum

Reviewed by Kshitija Bhandaru

See our latest analysis for Fair Isaac.

Fair Isaac’s share price has shown modest gains in recent weeks, signaling that investors may be regaining confidence after a more muted 1-year total shareholder return. Momentum appears steady but not spectacular, with the stock holding its ground as broader tech valuations shift.

Thinking about where else opportunity might be building? Broaden your investing horizons and discover fast growing stocks with high insider ownership

With Fair Isaac posting respectable growth and its stock trading just below analyst targets, investors face a crucial question: is the current price a bargain or is the market already anticipating further upside?

Most Popular Narrative: 6.7% Undervalued

Fair Isaac’s narrative-implied fair value points notably higher than the latest closing price. This sets up a debate over whether future growth and profitability can justify analyst optimism.

The ongoing transition to SaaS and cloud-based delivery, evidenced by double-digit growth in FICO Platform ARR and emphasis on conversion to next-generation AI-driven decisioning solutions, is increasing recurring revenues, supporting margin expansion and greater earnings predictability.

Want to uncover what’s fueling this bullish outlook? The story is not just about strong recurring revenue. A future profit margin and a lofty multiple are at play, potentially shifting how Fair Isaac is valued. See what assumptions are shaping this ambitious price target and why analysts see more upside.

Result: Fair Value of $1,913.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising regulatory pressure and emerging competitors such as VantageScore could threaten Fair Isaac’s market dominance and present challenges to its robust growth outlook.

Find out about the key risks to this Fair Isaac narrative.

Another View: High Multiple Flags Caution

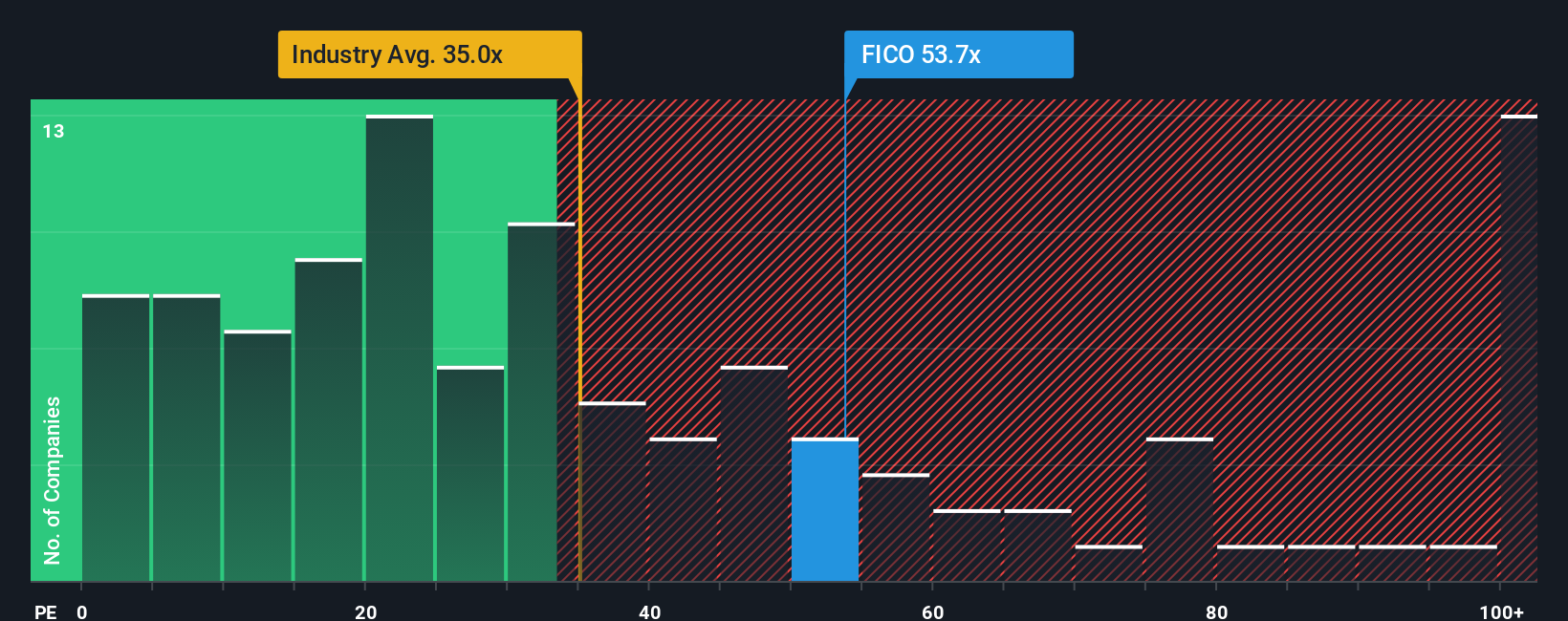

Taking a different angle, Fair Isaac’s valuation based on its current price-to-earnings ratio of 67.7 times earnings stands out as much steeper than the US Software industry average of 35.6 and the peer average of 43.3. This is also well above a fair ratio of 39.7, suggesting investors are paying a substantial premium for future growth. Is the market right to stay this optimistic, or could expectations hit a reality check?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fair Isaac Narrative

If you want to draw your own conclusions or approach the data from a different angle, you can put together your own narrative in just a few minutes. Do it your way

A great starting point for your Fair Isaac research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors stay ahead by searching beyond the obvious. Uncover unique opportunities that others miss and put yourself in a prime position for the next breakout.

- Capitalize on the surge in artificial intelligence by choosing these 24 AI penny stocks to benefit from cutting-edge machine learning and automation advancements.

- Capture steady income flows when you select these 19 dividend stocks with yields > 3% with yields above 3%, combining growth potential with powerful compounding.

- Position yourself early in the world of digital assets by targeting these 78 cryptocurrency and blockchain stocks and harnessing disruptive blockchain and cryptocurrency innovations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FICO

Fair Isaac

Provides analytics software in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion