- United States

- /

- Software

- /

- NYSE:ESTC

How Investors May Respond To Elastic (ESTC) Surpassing Industry Leaders in AV-Comparatives Security Test

Reviewed by Sasha Jovanovic

- Elastic Security recently achieved Certified status in the AV-Comparatives Endpoint Prevention and Response Test 2025, earning 99.3% effectiveness in both automated blocking and alerting, and outperforming major competitors such as CrowdStrike, Palo Alto Networks, and Fortinet on threat detection and total cost of ownership.

- This recognition highlights Elastic's technical leadership in cybersecurity, particularly its AI-driven approach, validating the company’s capabilities in protecting businesses against advanced cyber threats.

- We'll now explore how Elastic Security's strong performance in industry testing may bolster the company's position within its broader investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Elastic Investment Narrative Recap

To invest in Elastic, you need to believe that its platform can carve out sustainable differentiation amid tough competition from larger cloud providers and rapidly evolving security tech. While Elastic’s standout AV-Comparatives rating confirms technical prowess in cybersecurity, this validation alone may not immediately shift the biggest short-term catalyst, which is accelerating enterprise adoption of its AI-powered solutions, nor does it materially reduce the major risk of pricing and margin pressures from hyperscaler rivals.

Of Elastic’s recent product initiatives, the August launch of the AI SOC Engine (EASE) is especially relevant, reinforcing its commitment to advanced threat detection and AI integration. Achievements in independent security tests support the case for Elastic’s investment in innovative, AI-driven features as key to customer adoption and cross-selling success, both of which underpin management’s current growth strategy.

However, investors should also recognize that, despite these tech wins, Elastic’s open source roots continue to expose it to the risk of “free rider” usage and lower-cost competitive offerings, which means...

Read the full narrative on Elastic (it's free!)

Elastic's narrative projects $2.3 billion revenue and $50.5 million earnings by 2028. This requires 13.9% yearly revenue growth and a $134 million increase in earnings from the current level of $-83.5 million.

Uncover how Elastic's forecasts yield a $120.16 fair value, a 37% upside to its current price.

Exploring Other Perspectives

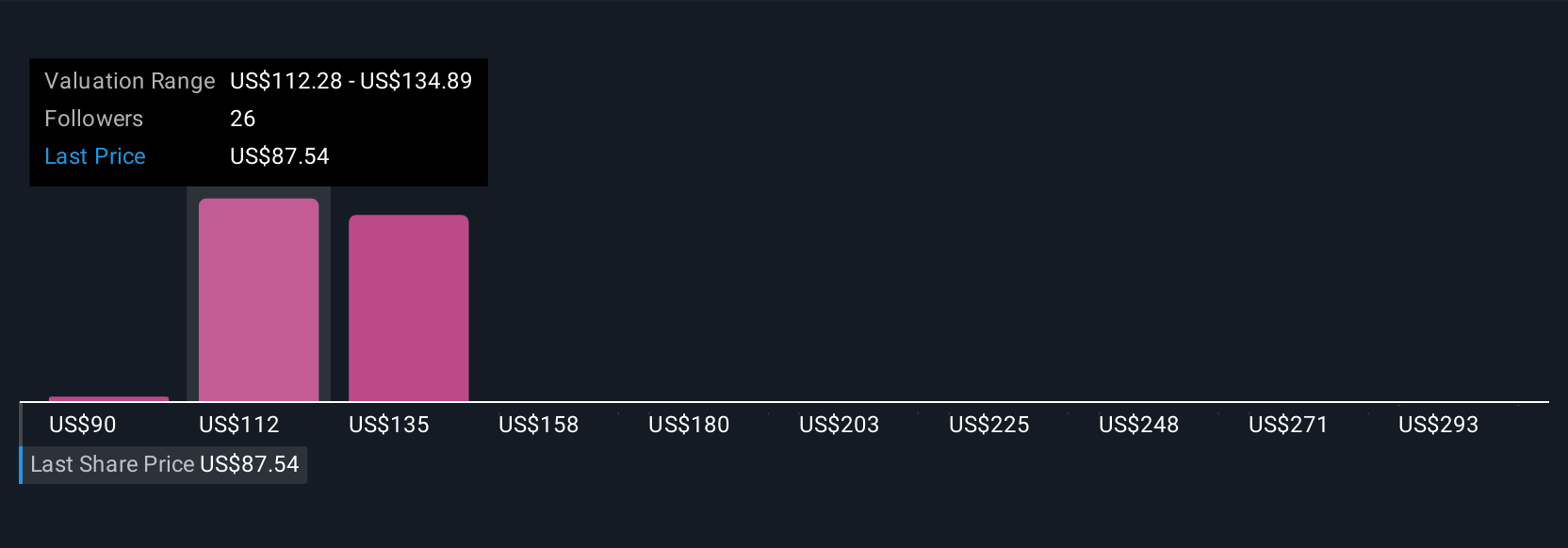

Six private investors in the Simply Wall St Community estimate Elastic’s fair value between US$89.66 and US$315.80 per share. With rising enterprise demand for AI-driven solutions cited as a key catalyst, these varied outlooks show just how differently stakeholders weigh potential against competitive and margin risks, consider checking out these contrasting views before forming your own opinion.

Explore 6 other fair value estimates on Elastic - why the stock might be worth just $89.66!

Build Your Own Elastic Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Elastic research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Elastic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Elastic's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elastic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESTC

Elastic

A search artificial intelligence (AI) company, provides software platforms to run in hybrid, public or private clouds, and multi-cloud environments in the United States and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives