- United States

- /

- IT

- /

- NYSE:EPAM

Will EPAM Systems' (EPAM) New Ibero-America Unit Accelerate Its AI Ambitions or Test Focus?

Reviewed by Sasha Jovanovic

- EPAM Systems announced the unification of its engineering, consulting, and AI-native services in Ibero-America under the EPAM NEORIS brand, combining global expertise with regional capabilities to support digital transformation for Spanish- and Portuguese-speaking markets.

- This move leverages partnerships with major technology providers and a focus on AI-driven solutions, positioning EPAM NEORIS to address the region's growing technology spending and demand for digital modernization.

- We'll now examine how this regional consolidation and emphasis on cloud and AI services may influence EPAM's long-term investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

EPAM Systems Investment Narrative Recap

To be a shareholder in EPAM Systems, you need to believe that the company can evolve from traditional custom software services toward delivering higher-value, AI-driven transformation projects as enterprise clients shift to digital modernization. The recent EPAM NEORIS unification in Ibero-America aligns with this long-term vision but does not significantly alter the most important short-term catalyst, the company’s ability to win and deliver larger, multi-year AI and cloud transformation deals; the biggest risk remains margin pressure from talent costs and integration challenges.

EPAM’s expanded collaboration with Oracle, announced in early October 2025, is especially relevant. The partnership focuses on integrating Oracle Cloud Infrastructure and AI services, reinforcing EPAM’s push toward cloud and AI-led initiatives while enhancing its portfolio for clients looking to scale their digital operations, a critical support to the company’s pursuit of high-value engagements.

By contrast, investors should be aware that despite these initiatives, ongoing wage inflation and competition for IT talent could continue to weigh on EPAM’s operating margins if...

Read the full narrative on EPAM Systems (it's free!)

EPAM Systems' narrative projects $6.5 billion revenue and $582.4 million earnings by 2028. This requires 8.8% yearly revenue growth and an earnings increase of $181.2 million from $401.2 million.

Uncover how EPAM Systems' forecasts yield a $211.12 fair value, a 48% upside to its current price.

Exploring Other Perspectives

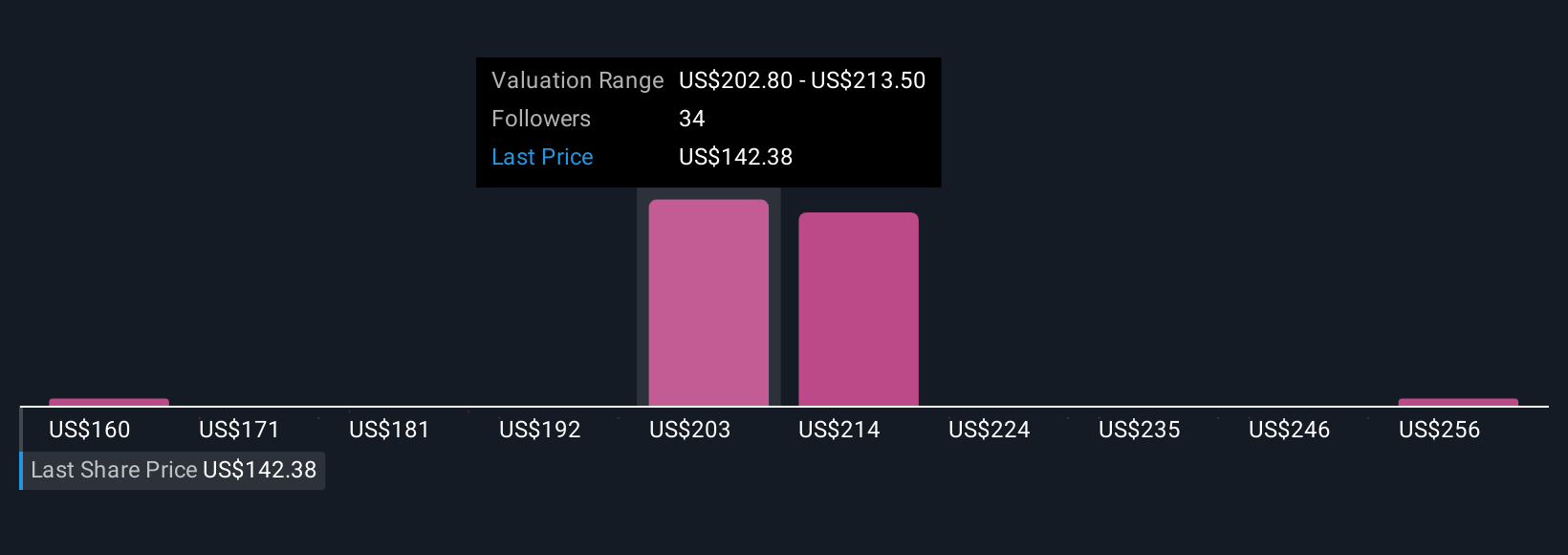

Simply Wall St Community members provided 8 fair value estimates for EPAM ranging from US$160 to US$267 per share. Against this backdrop of differing opinions, the company’s earnings growth forecasts and focus on emerging digital services show how market outlooks can rapidly evolve; consider reviewing these diverse perspectives to understand all sides of the investment debate.

Explore 8 other fair value estimates on EPAM Systems - why the stock might be worth as much as 88% more than the current price!

Build Your Own EPAM Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EPAM Systems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free EPAM Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EPAM Systems' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EPAM Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EPAM

EPAM Systems

Provides digital platform engineering and software development services worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives