- United States

- /

- IT

- /

- NYSE:EPAM

EPAM Systems (NYSE:EPAM) investors are sitting on a loss of 64% if they invested three years ago

While it may not be enough for some shareholders, we think it is good to see the EPAM Systems, Inc. (NYSE:EPAM) share price up 19% in a single quarter. But that doesn't change the fact that the returns over the last three years have been disappointing. Tragically, the share price declined 64% in that time. So the improvement may be a real relief to some. While many would remain nervous, there could be further gains if the business can put its best foot forward.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

View our latest analysis for EPAM Systems

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate three years of share price decline, EPAM Systems actually saw its earnings per share (EPS) improve by 1.6% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

It's pretty reasonable to suspect the market was previously to bullish on the stock, and has since moderated expectations. But it's possible a look at other metrics will be enlightening.

Revenue is actually up 7.2% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching EPAM Systems more closely, as sometimes stocks fall unfairly. This could present an opportunity.

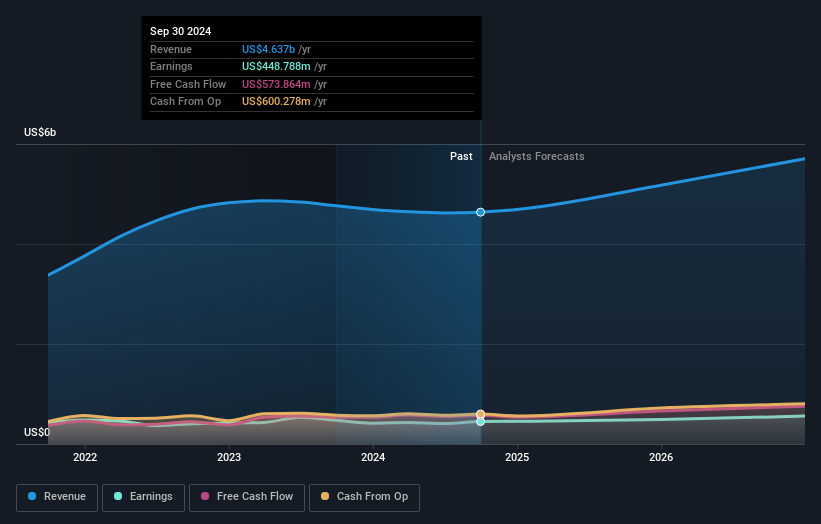

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free report showing analyst forecasts should help you form a view on EPAM Systems

A Different Perspective

EPAM Systems shareholders are down 11% for the year, but the market itself is up 34%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before spending more time on EPAM Systems it might be wise to click here to see if insiders have been buying or selling shares.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if EPAM Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:EPAM

EPAM Systems

Provides digital platform engineering and software development services worldwide.

Flawless balance sheet and undervalued.