- United States

- /

- IT

- /

- NYSE:DOCN

Some Confidence Is Lacking In DigitalOcean Holdings, Inc.'s (NYSE:DOCN) P/S

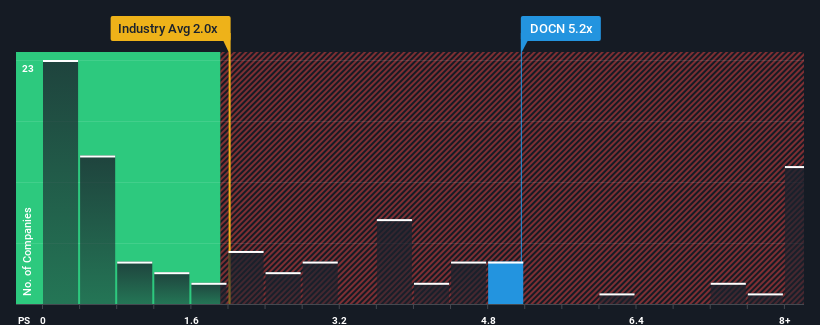

When you see that almost half of the companies in the IT industry in the United States have price-to-sales ratios (or "P/S") below 2x, DigitalOcean Holdings, Inc. (NYSE:DOCN) looks to be giving off strong sell signals with its 5.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for DigitalOcean Holdings

How Has DigitalOcean Holdings Performed Recently?

With revenue growth that's superior to most other companies of late, DigitalOcean Holdings has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on DigitalOcean Holdings will help you uncover what's on the horizon.How Is DigitalOcean Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like DigitalOcean Holdings' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 20% gain to the company's top line. The latest three year period has also seen an excellent 118% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the twelve analysts covering the company suggest revenue should grow by 13% each year over the next three years. With the industry predicted to deliver 12% growth per annum, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that DigitalOcean Holdings' P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What Does DigitalOcean Holdings' P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Analysts are forecasting DigitalOcean Holdings' revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

It is also worth noting that we have found 3 warning signs for DigitalOcean Holdings (2 are concerning!) that you need to take into consideration.

If you're unsure about the strength of DigitalOcean Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DOCN

DigitalOcean Holdings

Through its subsidiaries, operates a cloud computing platform in North America, Europe, Asia, and internationally.

Proven track record with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026