- United States

- /

- Biotech

- /

- NasdaqGM:ADMA

Exploring High Growth Tech Stocks In The United States October 2024

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, yet it has risen by 30% over the past year with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability in a rapidly evolving sector.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.86% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.67% | 43.81% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Ardelyx | 27.19% | 66.44% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Amicus Therapeutics | 20.32% | 62.45% | ★★★★★★ |

| AsiaFIN Holdings | 60.53% | 81.55% | ★★★★★★ |

| Travere Therapeutics | 26.51% | 69.33% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 252 stocks from our US High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

ADMA Biologics (NasdaqGM:ADMA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ADMA Biologics, Inc. is a biopharmaceutical company that focuses on developing, manufacturing, and marketing specialty plasma-derived biologics for treating immune deficiencies and infectious diseases globally, with a market cap of $4.70 billion.

Operations: ADMA Biologics generates revenue primarily from its ADMA Biomanufacturing segment, contributing $326.70 million, and Plasma Collection Centers, adding $3.41 million. The company is involved in the production and sale of plasma-derived biologics aimed at addressing immune deficiencies and infectious diseases on a global scale.

ADMA Biologics, recently added to the S&P 600 and 1500 indices, is demonstrating robust growth with its latest earnings revealing a significant turnaround: a net income of $32.06 million from a loss last year and revised upward revenue projections for 2024 and 2025. This surge in performance is underpinned by an aggressive R&D strategy that allocates substantial resources towards innovation—critical in the biotech sector where development cycles are long but potentially lucrative. The company's commitment to R&D, marked by expenses aligning closely with industry demands for cutting-edge biologic treatments, positions it well for sustained growth amidst forecasts of revenue increasing at 14.8% annually and earnings expected to rise by approximately 26% per year.

- Take a closer look at ADMA Biologics' potential here in our health report.

Understand ADMA Biologics' track record by examining our Past report.

DigitalOcean Holdings (NYSE:DOCN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DigitalOcean Holdings, Inc. operates a global cloud computing platform through its subsidiaries across North America, Europe, Asia, and other international markets with a market cap of approximately $3.84 billion.

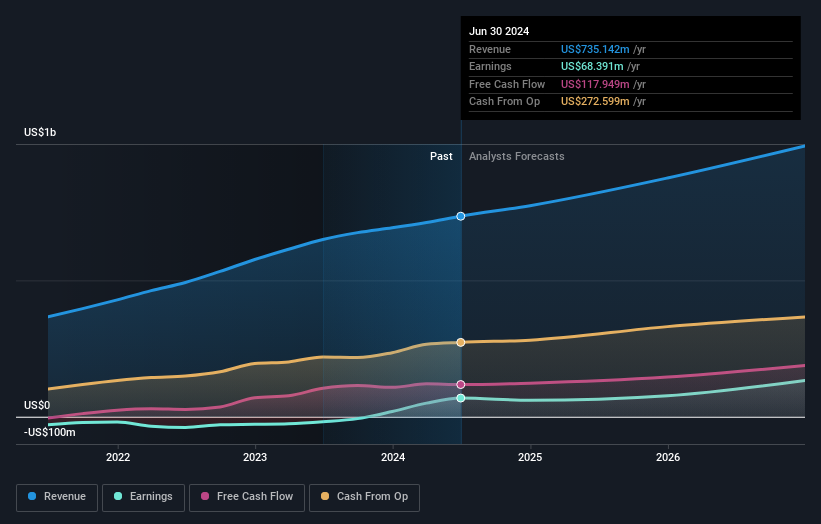

Operations: DigitalOcean generates revenue primarily from its Internet Software & Services segment, reporting $735.14 million in this category. The company focuses on providing cloud computing solutions across various international markets.

DigitalOcean Holdings is carving a niche in the high-growth tech landscape, notably with its recent unveiling of GPU Droplets aimed at simplifying AI development. This move, coupled with robust financials—revenue up 12.7% annually and earnings growth forecast at 28.1%—positions it as an emerging force in cloud computing for AI applications. The firm's strategic focus on R&D, which aligns with a $32.2M investment this past year, underscores its commitment to innovation and market adaptation, essential for staying competitive in a rapidly evolving tech environment.

- Navigate through the intricacies of DigitalOcean Holdings with our comprehensive health report here.

Evaluate DigitalOcean Holdings' historical performance by accessing our past performance report.

Grindr (NYSE:GRND)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Grindr Inc. operates a social networking and dating application catering to the LGBTQ community globally, with a market capitalization of approximately $2.08 billion.

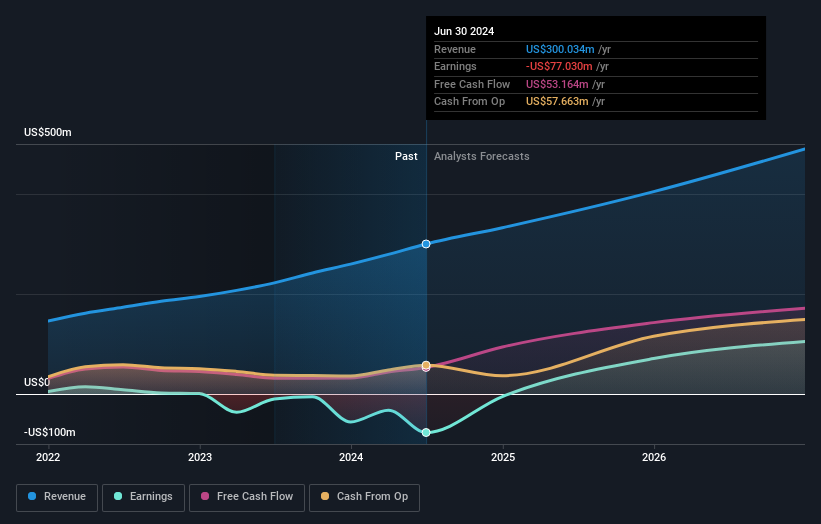

Operations: The company generates revenue primarily from its internet information provider segment, totaling approximately $300.03 million.

Grindr, despite its current unprofitability, is poised for significant transformation with a forecasted revenue growth of 18.6% annually, outpacing the US market's average of 8.8%. This growth trajectory is supported by strategic R&D investments that align with its ambitious projections to turn profitable within three years—a potential above-average market growth. Recent earnings reflect a challenging phase with a net loss widening to $31.83 million in the first half of 2024 from $10.57 million year-over-year; however, Grindr's proactive adjustments in executive leadership and engineering capabilities signal robust preparatory steps towards scaling operations and enhancing product offerings in the competitive tech landscape.

- Dive into the specifics of Grindr here with our thorough health report.

Explore historical data to track Grindr's performance over time in our Past section.

Turning Ideas Into Actions

- Navigate through the entire inventory of 252 US High Growth Tech and AI Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ADMA

ADMA Biologics

A biopharmaceutical company, engages in developing, manufacturing, and marketing specialty plasma-derived biologics for the treatment of immune deficiencies and infectious diseases in the United States and internationally.

Flawless balance sheet with reasonable growth potential.