- United States

- /

- IT

- /

- NYSE:DOCN

DigitalOcean Holdings (DOCN) Reports Strong Earnings Growth in Q2

Reviewed by Simply Wall St

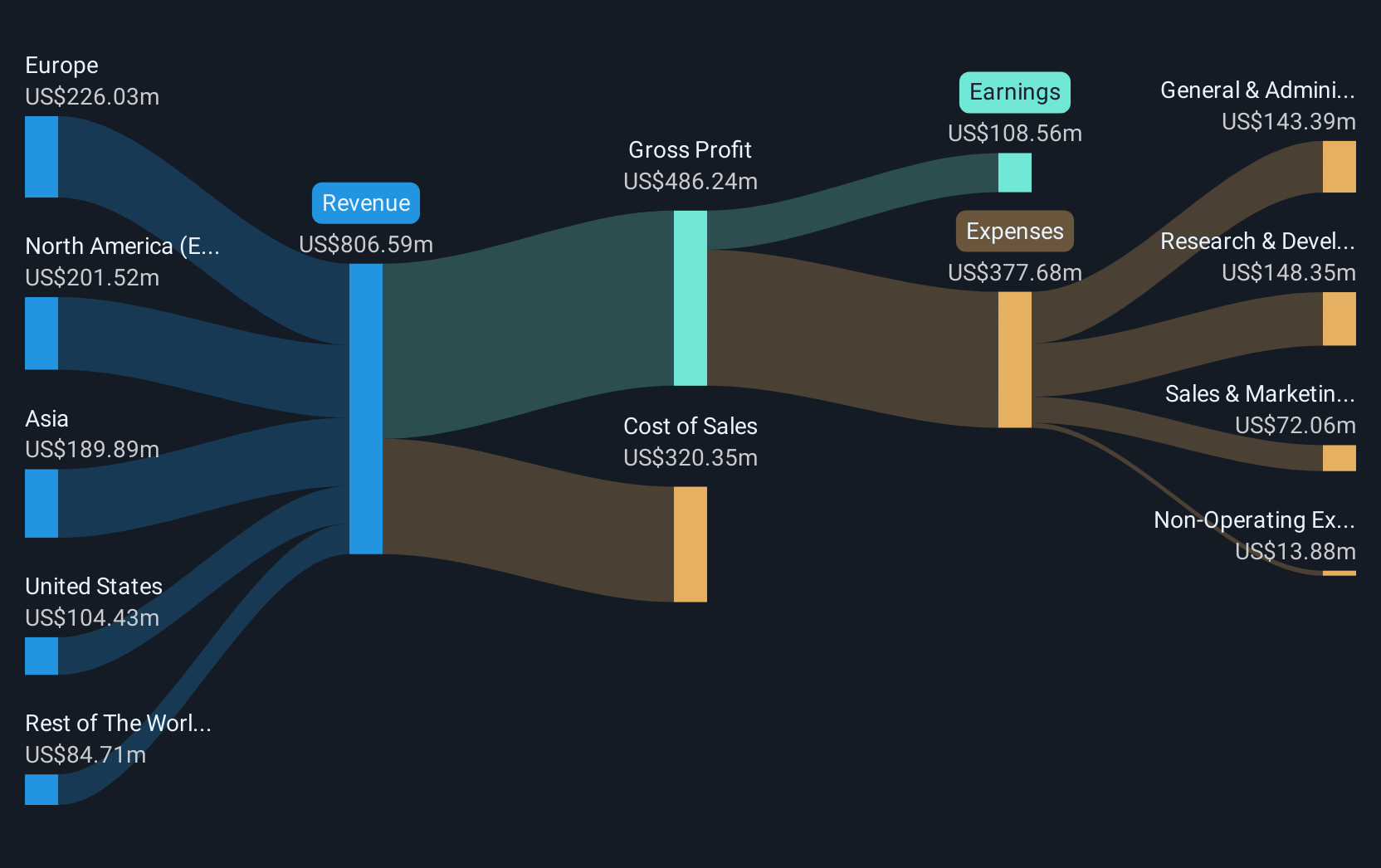

DigitalOcean Holdings (DOCN) reported strong earnings growth for the second quarter, which likely influenced its stock price increase of 18% over the last quarter. The company's sales and net income showed notable year-over-year increases, creating a positive impact on investor sentiment. Additionally, ongoing share repurchase programs and new product launches like the AI platform may have supported this upward trend. The broader market also posted gains during the same period, characterized by a buoyant market trajectory despite some volatility in tech stocks. This favorable environment suggests that while some market-specific factors were at play, DigitalOcean's specific corporate updates would have added weight to the positive pricing momentum.

Outshine the giants: these 22 early-stage AI stocks could fund your retirement.

The recent momentum following DigitalOcean's robust earnings report and share repurchase initiatives could underpin further confidence in its long-term growth narrative. Over the past year, however, the company's total return, including share price and dividends, saw a decline of 10.66%. This contrasts with the broader US IT industry's return of 18.9% over the same period, suggesting that DigitalOcean has failed to keep pace with its peers despite recent quarterly gains.

The company's latest developments, like the AI platform launch, could positively influence revenue and earnings projections by expanding its market reach and enhancing customer retention. However, the potential risks associated with scaling AI services and growing competition could impact these forecasts. The analysts' consensus price target of US$41.6 places the current trading price of US$33.36 at a 26% discount, indicating potential room for upward movement if the company navigates competitive pressures successfully. Despite this, the company's PE ratio remains notably below the industry average, hinting at possible undervaluation if future earnings materialize as predicted.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOCN

DigitalOcean Holdings

Through its subsidiaries, operates a cloud computing platform in North America, Europe, Asia, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives