- United States

- /

- IT

- /

- NYSE:DOCN

DigitalOcean (DOCN): Assessing Valuation After Analyst Highlights Turnaround Signs and New AI Initiatives

Reviewed by Kshitija Bhandaru

DigitalOcean Holdings (NYSE:DOCN) is drawing renewed attention after a leading analyst pointed to early signs of a business turnaround and fresh momentum from its expanded AI initiatives and new partnerships. Recent moves are sparking optimism among investors.

See our latest analysis for DigitalOcean Holdings.

DigitalOcean’s latest AI expansion and high-profile Laravel partnership have injected fresh energy into the story, sparking a sharp 32% share price gain over the past three months. While the 1-year total shareholder return is down 15%, momentum is clearly building again as investors focus on the company’s turnaround potential and growing role in the AI and developer ecosystem.

If you’re watching the cloud space evolve, it’s worth discovering See the full list for free.

With shares recently surging and analyst upgrades coming in, the question now is whether DigitalOcean’s accelerating growth is still undervalued by the market or if investors are already pricing in the next leg higher.

Most Popular Narrative: 10% Undervalued

With the narrative's fair value of $41.60 well above DigitalOcean Holdings’ last close of $37.29, sentiment tilts in favor of further upside potential if company targets are met.

Accelerating adoption among digital native enterprises and AI-native customers, coupled with robust product innovation (over 60 new products/features released in the quarter and strong uptake of recent releases by top customers), is expanding DigitalOcean's addressable market and driving higher incremental annual recurring revenue, which impacts future top-line revenue and customer retention.

Want to understand what powers this bullish view? The secret lies in bold profit projections and a growth cadence that only ambitious tech companies dare to forecast. What drives these headline numbers, and are they truly sustainable? Only a full read reveals the pivotal assumptions behind this valuation logic.

Result: Fair Value of $41.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, competitive pressure from hyperscalers and the challenge of scaling new AI services could temper DigitalOcean's growth expectations if trends shift unexpectedly.

Find out about the key risks to this DigitalOcean Holdings narrative.

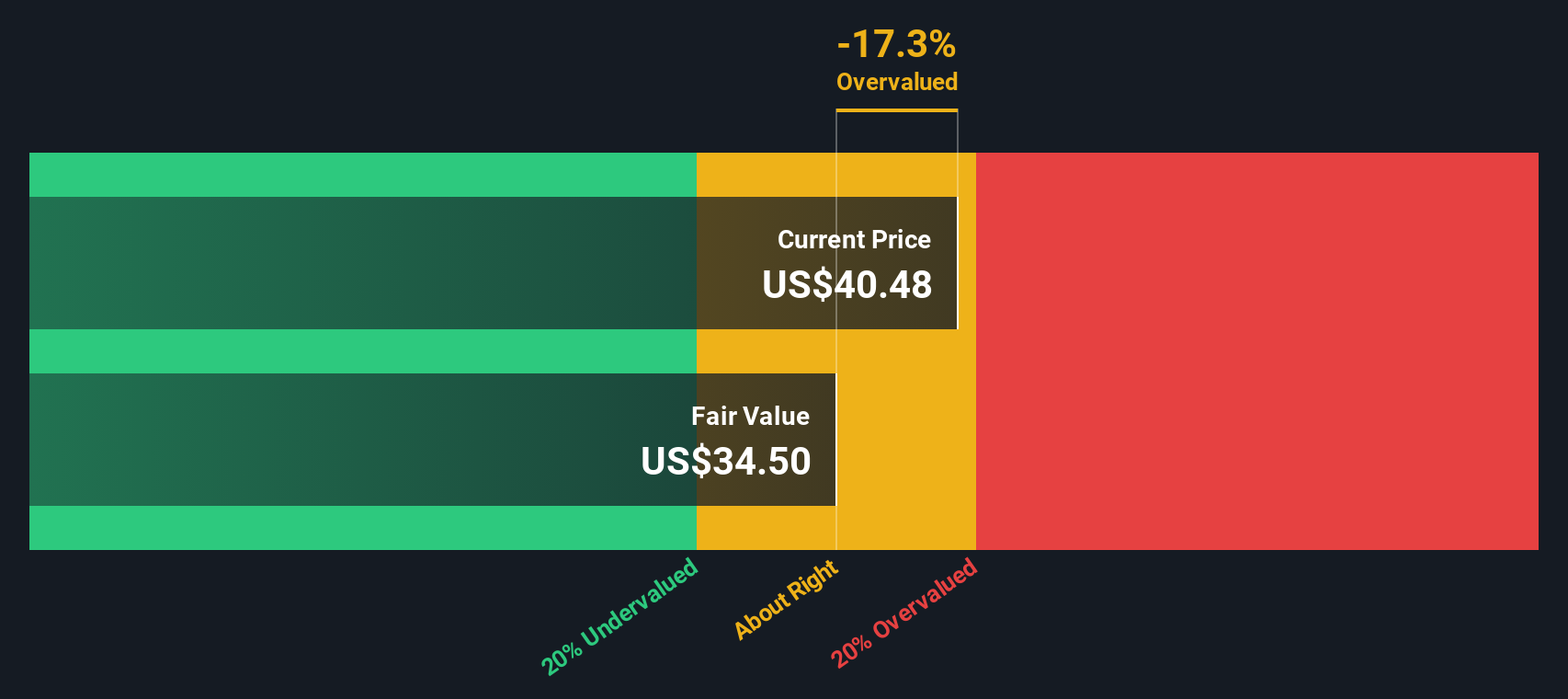

Another View: Our DCF Model Says Slightly Overvalued

While many see upside based on analyst consensus, our SWS DCF model values DigitalOcean at $34.33 per share, which is below its recent price of $37.29. In practical terms, this suggests the market may already be factoring in much of the optimism. Which perspective will prove more accurate as the company evolves?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DigitalOcean Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DigitalOcean Holdings Narrative

Prefer to dive into the numbers on your own terms or chart a different course? It only takes a few minutes to build your own perspective and Do it your way.

A great starting point for your DigitalOcean Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know the best opportunities rarely wait around. Give yourself an edge and uncover fresh angles with these handpicked screens from Simply Wall Street:

- Uncover under-the-radar potential by tapping into these 3577 penny stocks with strong financials, which spotlights promising companies with robust fundamentals and untapped growth stories.

- Target unstoppable trends and stay ahead of the curve by checking out these 24 AI penny stocks. This screener features innovators poised to benefit from the AI boom.

- Capture impressive returns and safeguard your portfolio by locking in income from these 19 dividend stocks with yields > 3%, which features businesses delivering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOCN

DigitalOcean Holdings

Through its subsidiaries, operates a cloud computing platform in North America, Europe, Asia, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives