- United States

- /

- Software

- /

- NYSE:CWAN

Clearwater Analytics Holdings (CWAN): Valuation Insights Following $100M Share Buyback and Deleveraging Strategy

Reviewed by Simply Wall St

Clearwater Analytics Holdings (NYSE:CWAN) just got a lot more interesting for investors after announcing a substantial $100 million share repurchase program. The company’s board has signed off on this plan, signaling management’s confidence in the underlying business and willingness to use free cash flow to boost shareholder value. Beyond just returning capital, this buyback is also designed to offset the impact of earlier share issuances and trim down the public float, which could subtly reshape supply and demand dynamics for the stock itself.

This fresh buyback news arrives as Clearwater has been navigating mixed momentum in the market. While the company rode a powerful wave of revenue gains in recent years, its stock price has drifted down 15% over the last year and is sitting lower for 2025 so far. A closer look at the big picture shows waning momentum compared to the more energetic growth phases of the recent past, even as revenue expansion stays solid. Recent board moves and the repurchase announcement both indicate Clearwater is looking to steady the ship amid shifting investor expectations.

With these capital moves and strategy updates on the table, investors have a clear decision. Does this set up a compelling opportunity, or is the market already pricing in Clearwater Analytics Holdings’ next act?

Most Popular Narrative: 33% Undervalued

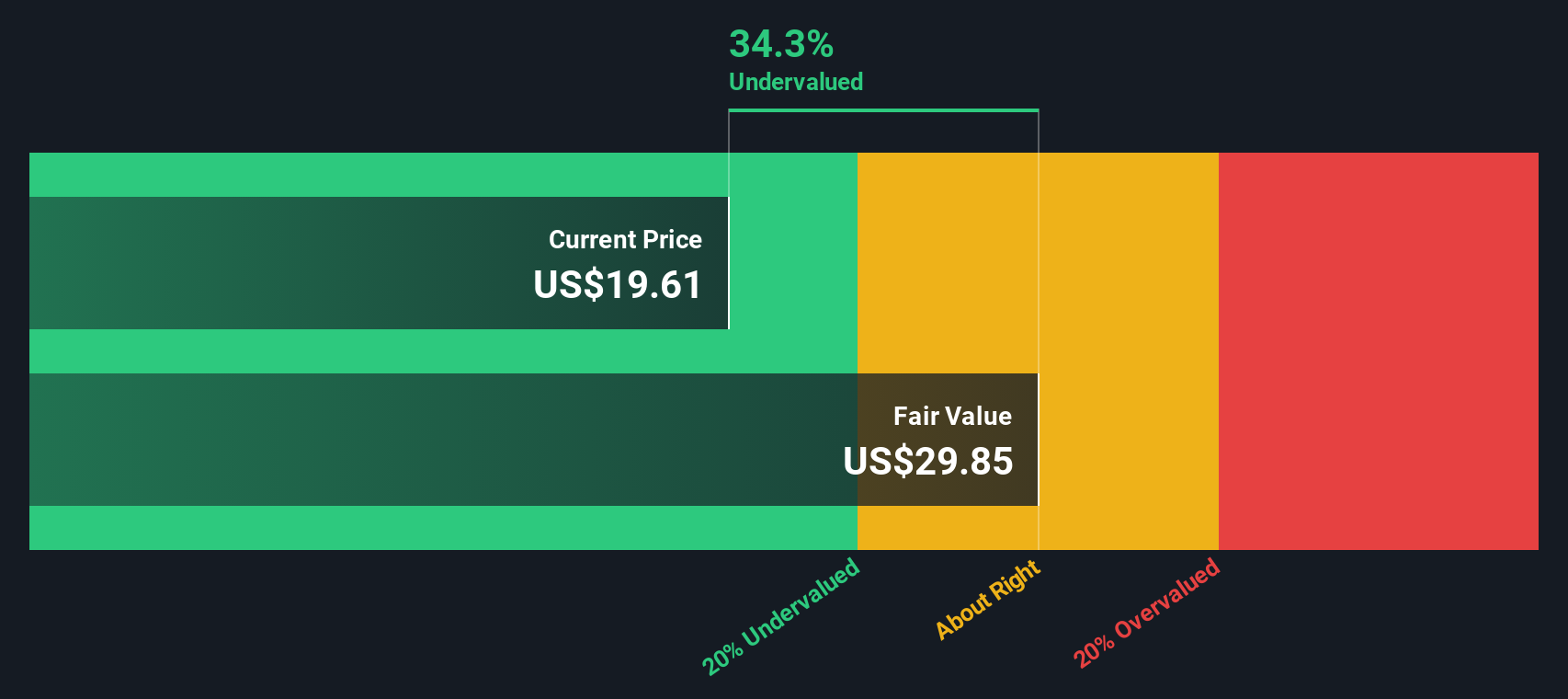

The dominant narrative views Clearwater Analytics Holdings as significantly undervalued, pointing to a fair value around a third higher than the current price.

Continuous product innovation, especially the integration of generative AI, the launch of proprietary data and risk platforms (e.g., Helios), and the buildout of a unified, front-to-back, multi-asset SaaS solution, positions the company to increase cross-sell and upsell to its existing sticky client base. This could drive up net revenue retention and average revenue per customer.

Curious about what fuels this bullish call? The narrative teases bold, market-beating growth targets, supported by ambitious plans for margin expansion and operational upgrades. What is behind the eye-catching valuation gap compared to today's market price? The underlying numbers might surprise you.

Result: Fair Value of $30.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing integration challenges from recent acquisitions and pressure to meet ambitious growth targets could complicate the long-term outlook for Clearwater Analytics Holdings.

Find out about the key risks to this Clearwater Analytics Holdings narrative.Another View: Our DCF Model Weighs In

Taking a different approach, the SWS DCF model also signals Clearwater Analytics Holdings is undervalued, using future cash flows rather than market multiples or analyst targets. However, can any model fully capture changing business risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Clearwater Analytics Holdings Narrative

If you see things differently or want to take a hands-on look at the numbers, you can build your own view in just a few minutes. Do it your way

A great starting point for your Clearwater Analytics Holdings research is our analysis highlighting 5 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want to uncover fresh market opportunities beyond Clearwater Analytics Holdings, now is the perfect time to act. Let your investment strategy lead you into untapped potential with these exciting themes on Simply Wall Street’s Screener:

- Unlock potential with healthcare AI stocks to spot pioneers reshaping patient care using advanced medical analytics and artificial intelligence.

- Tap into steady income streams with dividend stocks with yields > 3%, focusing on companies recognized for reliable dividend yields above 3%.

- Get ahead of the curve by seeking value through undervalued stocks based on cash flows, targeting stocks with strong cash flow fundamentals that are priced below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:CWAN

Clearwater Analytics Holdings

Develops and provides a Software-as-a-Service (SaaS) solution for automated investment data aggregation, reconciliation, accounting, and reporting services to insurers, investment managers, corporations, institutional investors, and government entities in the United States and internationally.

Very undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives