- United States

- /

- Software

- /

- NYSE:CRM

Stable and Growing, but Insiders Aren't Buying It - Here are the Key Issues for Salesforce (NYSE:CRM) Investors

Key takeaways:

- Growth doesn't scale - expenses increased more than revenues.

- The company will likely continue to have stable income, but low margins.

- Top insiders sold shares this quarter

Salesforce (NYSE:CRM) jumped 13% at the market open after the company reported its quarterly results. Today, we will review the current performance of the stock, and take a look at some notable insider transactions from the past month.

Starting off with the Q1 highlights:

- Q1 revenue $7.4b up 24% y/y

- Q1 operating cash flow $3.68b up 21% y/y

- Current Remaining Performance Obligation of $21.5 Billion, up 21% y/y

- Net income of $20m, down 22.5x from $469m a year ago

See our latest analysis for Salesforce

Remaining Performance Obligations Recap

Remaining Performance Obligations (RPO) equals deferred revenue plus backlog. Essentially it's the revenue from subscriptions for which the company has long term deals with clients, and will (barring cancelations) be realized in the future.

Deferred revenue (or unearned revenue), represents revenue invoiced in advance. A "Backlog" is similar and represents future services that are already agreed upon, but have not been invoiced yet.

SaaS companies, with multi-year subscriptions from clients, can use the stability of the subscription to showcase how much they are going to make in the future - reflected in the RPO.

Performance and Outlook

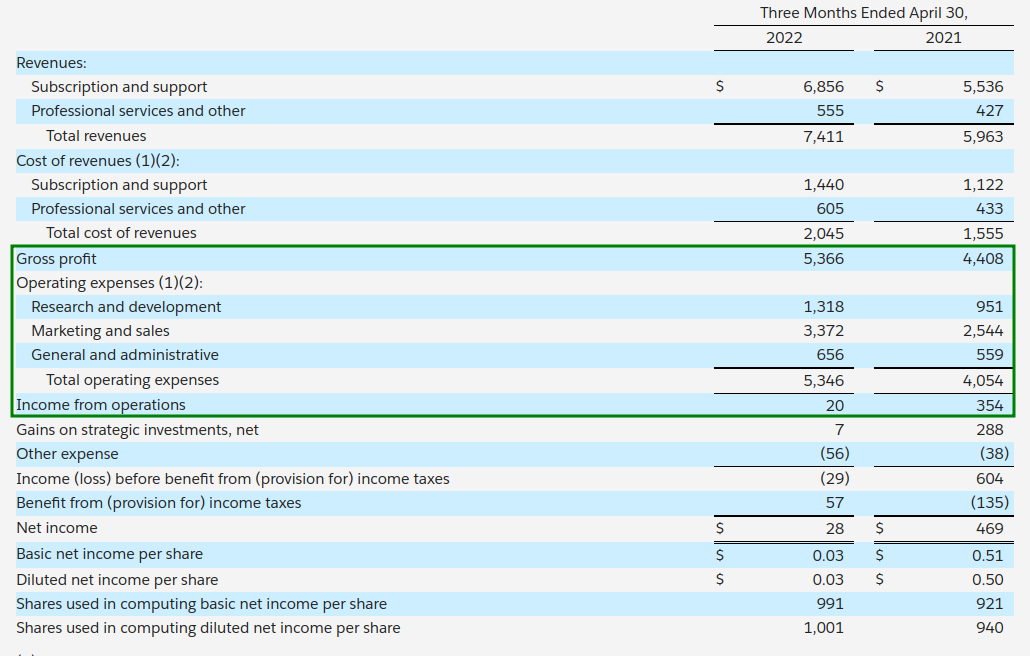

The company seems completely focused on growth, since it made only $20m in profit this quarter. While it may manage to continue market share expansion, some investors might be worried about the revenue to costs scaling. While revenue increased 24% y/y, total expenses (COGS + Operating exp) increased 31.2%.

This means that the company is not scaling well yet, as is it growing expenses more than revenues.

Most of the cost increase is found in total operating expenses, which grew 32%, while the highest growing sub-category was R&D with a growth of 38.5%.

In the table below, we can see how the company spends the majority of income:

Salesforce also posted future guidance:

- Q2 revenue growth 21%, an estimated $7.7b. Analysts estimate $7.77b

- Full year revenue growth of 20%, and estimated $31.7b. Analysts estimate $32b

Analysts are mostly agreeing with management on the future projections. It looks that there is still a lot of growth spending, and the company is not expected to make more than 3.8% EBIT margin for the current fiscal year.

The stock was trading around 6 times its sales before the report was published, and there may not be anything substantial to make investors increase these levels. Additionally, investors can consider the value of the company on a discounted cash flow basis, which currently seems to yield some estimated upside.

Besides earnings, there is one more thing that investors may want to look into before making a decision.

Insider Transactions

Looking at recent transactions, it seems that a good portion of the senior level insiders sold shares in the company this quarter.

When the messaging and the actions of management aren't aligned, shareholders may want to be more prudent when researching growth companies like CRM.

For Salesforce, it is even stranger that 6 of the top insiders sold a stake on the same date. Note that there are many Rule 10b5-1 transactions happening in Salesforce, but what we are showcasing seems to be independent of the planned transactions.

Conclusion

As many investors have repeated before, a good company is not necessarily a good investment.

Salesforce is undoubtedly great at creating value for stakeholders by providing an amazing product, but it falls behind on creating value for people that invest in the company.

The latest earnings reiterated the stability of growth for CRM, however the company is not scaling costs well and this makes the bottom line thin.

What is happening with insiders is also something to think about, as it would be great to see management aligned on the message with what they are doing behind the scenes.

If you want to explore more, then you will not want to miss this free list of growing companies that insiders are buying.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:CRM

Salesforce

Provides customer relationship management (CRM) technology that connects companies and customers together worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives