- United States

- /

- Software

- /

- NYSE:CRM

Salesforce (NYSE:CRM) Launches Agentforce 2dx With Enhanced AI Automation Tools And Developer Support

Reviewed by Simply Wall St

Last week, Salesforce (NYSE:CRM) launched its Agentforce 2dx, an enhanced digital labor platform aimed at integrating autonomous AI agents into workflows. Despite these product innovations, Salesforce’s stock price declined by 5% over the same period. Market conditions contributed to this decline as tech stocks were broadly affected by tariff concerns, with U.S. stock indices like the Nasdaq Composite and S&P 500 seeing 1.1% and 0.9% declines, respectively. The overall market was pressured by tariff uncertainties and a weakening economic sentiment. Additionally, disappointing outlooks from peers like Marvell Technology sparked sell-offs in tech, further impacting Salesforce. While the company’s advancements in AI and digital labor hold promise, the external macroeconomic pressures associated with tariffs played a more immediate role in influencing its share price performance.

Get an in-depth perspective on Salesforce's performance by reading our analysis here.

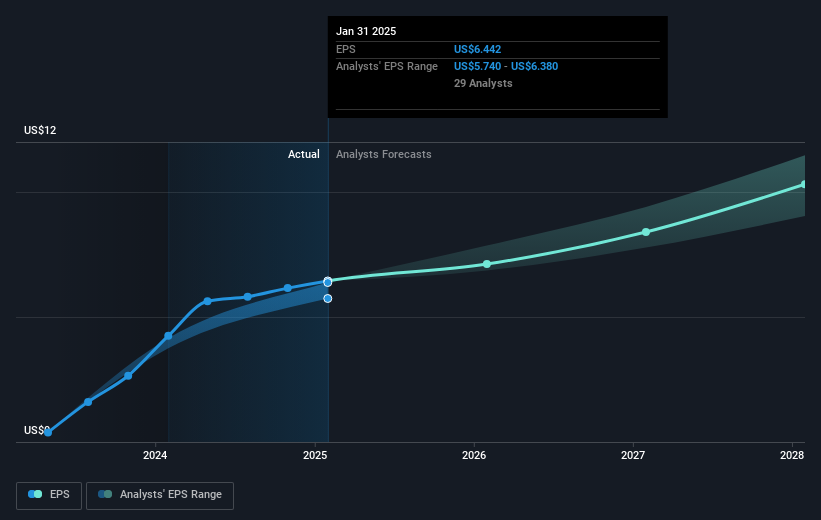

Over the past five years, Salesforce's total shareholder return, including share price and dividends, was 89.95%. During this period, the company experienced substantial earnings growth, with a 27.4% annual increase. This level of growth was significantly higher than the 49.8% increase seen in the most recent year, underscoring a strong earnings trajectory. Key innovations, such as the introduction of the AI-powered Agentforce platform, have bolstered Salesforce's reputation as a leader in digital transformation, allowing it to capitalize on the growing demand for AI-driven solutions.

In alignment with its growth strategy, Salesforce has expanded through collaborations, such as its extended partnership with Google to develop customized AI solutions. However, while Salesforce's earnings growth outpaced the software industry recently, its share performance over the past year has lagged behind both the broader US market, which returned 14%, and the software industry, which saw an 8% rise. Despite these market pressures, the long-term growth and innovation-focused initiatives underscore the company's strong performance over the last five years.

- Learn how Salesforce's intrinsic value compares to its market price with our detailed valuation report.

- Analyze the downside risks for Salesforce and understand their potential impact—click to learn more.

- Already own Salesforce? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRM

Salesforce

Provides customer relationship management (CRM) technology that connects companies and customers together worldwide.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives