- United States

- /

- Software

- /

- NYSE:CRM

Salesforce (NYSE:CRM) Expands AI Capabilities With Deloitte Partnership, Shares Up 2%

Reviewed by Simply Wall St

Deloitte and Salesforce (NYSE:CRM) have recently strengthened their strategic partnership to deliver innovative AI-driven solutions, which has positioned Salesforce to enhance its market presence significantly. This collaboration aligns with the broader market trends where mega-cap tech stocks are rising amidst a rebound rally, as seen in the slight gains of the S&P 500 and Nasdaq. Moreover, the integration of Salesforce’s Agentforce into Maximus's Total Experience Management solution underscores the company's commitment to enhancing customer experience across sectors. Such developments have supported a 1.86% increase in Salesforce's share price over the last week, indicating positive market sentiment.

Buy, Hold or Sell Salesforce? View our complete analysis and fair value estimate and you decide.

The last five years have seen Salesforce's shares achieve a total return of 91.90%. Key to this has been the company's continuous innovation and expansion in AI and data solutions. For instance, Salesforce's investments in Agentforce and Data Cloud, launched in the years leading up to today, are anticipated to drive revenue growth by enhancing operational efficiency and customer success. The shift to a consumption-based pricing model reflects its adaptability to industry trends.

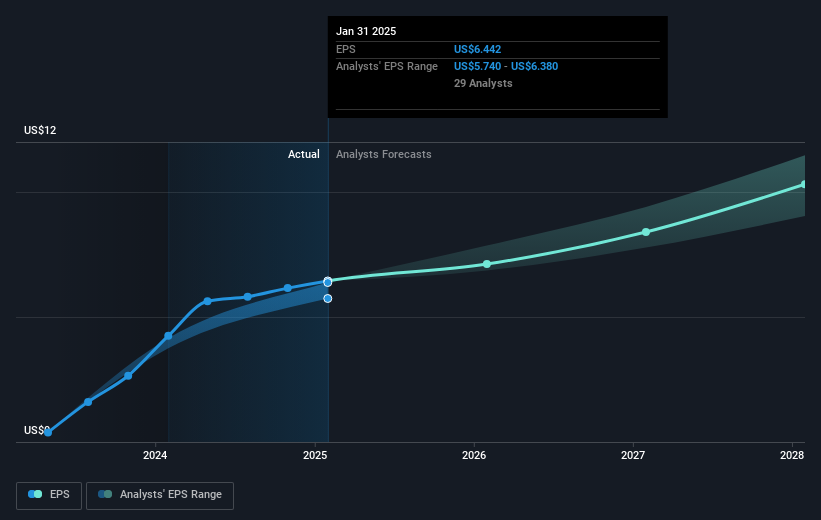

Salesforce has also focused on strategic partnerships, notably with major tech companies like AWS, Alibaba, and Google. These alliances are aimed at deploying Salesforce's offerings more cost-effectively. Moreover, the company's strong financial performance, as evidenced by increased revenue and net income in Q4 2025, underpins its long-term success. Despite a recent underperformance against the US Software industry over a one-year period, these strategic initiatives and robust earnings growth have played crucial roles in Salesforce's substantial five-year returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRM

Salesforce

Provides customer relationship management (CRM) technology that connects companies and customers together worldwide.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives