- United States

- /

- Software

- /

- NYSE:CRM

Salesforce (NYSE:CRM) Declares Quarterly Dividend of US$0.42 Per Share

Reviewed by Simply Wall St

Salesforce (NYSE:CRM) recently affirmed a quarterly cash dividend of $0.42 per share, payable in July 2025. Over the last week, Salesforce's share price remained flat, mirroring the overall market's stable performance despite the broader market experiencing gains, particularly in tech stocks. The market showed resilience with the S&P 500 reaching 6,000 points, bolstered by solid economic data such as the May jobs report. Salesforce's dividend announcement aligns with these broader market sentiments but didn't significantly influence its stock price, reflecting the prevailing investor confidence in robust economic conditions.

We've discovered 1 warning sign for Salesforce that you should be aware of before investing here.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent dividend announcement by Salesforce anchors its long-term strategy to retain investor confidence, reflecting robust economic expectations. Over five years, Salesforce's total return—including share price and dividends—was 56.38%, offering a valuable context to its stable performance over the last week. While the company's share price mirrored a flat overall market recently, it indicates that investors may have already priced in the anticipated market resilience and economic growth. Salesforce's shares did underperform the broader US Software industry over the past year, which experienced a higher return of 21.9% compared to the market's 11%.

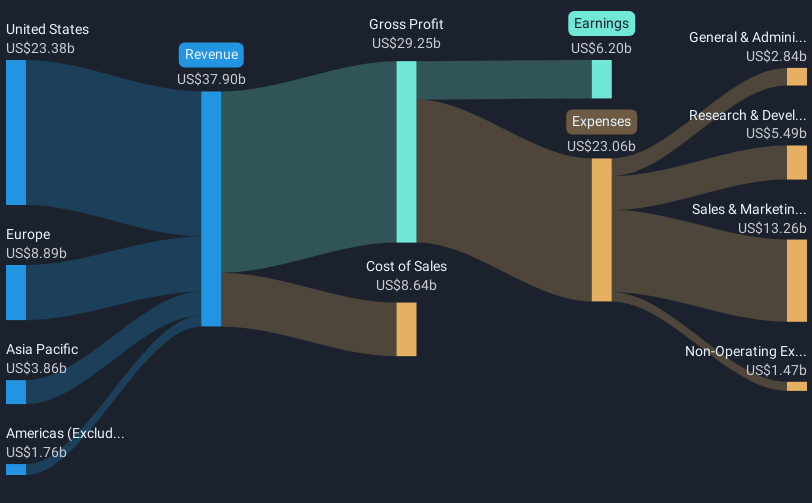

The dividend news alone may not significantly shift revenue and earnings forecasts but underscores the company's commitment to shareholders amidst economic optimism. Analysts forecast Salesforce's revenue to grow by 9% annually over the next three years, with earnings projected to reach US$9.9 billion by 2028. The share price reveals a 32.6% discount compared to the consensus price target of US$354.14, suggesting potential for appreciation if these forecasts are realized. The company's strengthening of AI and data initiatives through investments like Agentforce and Data Cloud may provide further revenue streams, potentially impacting long-term share performance positively. However, risks such as pricing model transitions and external competition remain considerations for Salesforce's future growth trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRM

Salesforce

Provides customer relationship management technology that connects companies and customers together worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)