- United States

- /

- Software

- /

- NYSE:CRM

Salesforce (CRM) Partners With Sprout Social To Enhance Customer Engagement Across Platforms

Reviewed by Simply Wall St

Salesforce (CRM), a major player in customer relationship management, announced an expanded collaboration with Sprout Social, integrating social media channels directly into its platform to enhance customer engagement. Despite this promising development, Salesforce's stock experienced a 7% decline last week. This move diverges from the broader market trend, with major indexes like the Nasdaq Composite registering gains amid easing economic concerns. While the new partnership could potentially strengthen Salesforce's market position, other external factors may have exerted downward pressure on its share price during this period.

Buy, Hold or Sell Salesforce? View our complete analysis and fair value estimate and you decide.

The recent partnership between Salesforce and Sprout Social has the potential to significantly bolster Salesforce's platform by integrating social media capabilities, potentially enhancing its customer engagement offerings. This move aligns with Salesforce's broader strategy to expand its AI and data solutions, as outlined in the company's narrative surrounding Data Cloud and Agentforce initiatives. While these developments set the stage for potential revenue growth, concerns remain about competition, pricing model transitions, and external factors that could impede progress. Despite a 7% decline in the stock last week, Salesforce's total shareholder return was 30.13% over three years, indicating a positive momentum over the longer term.

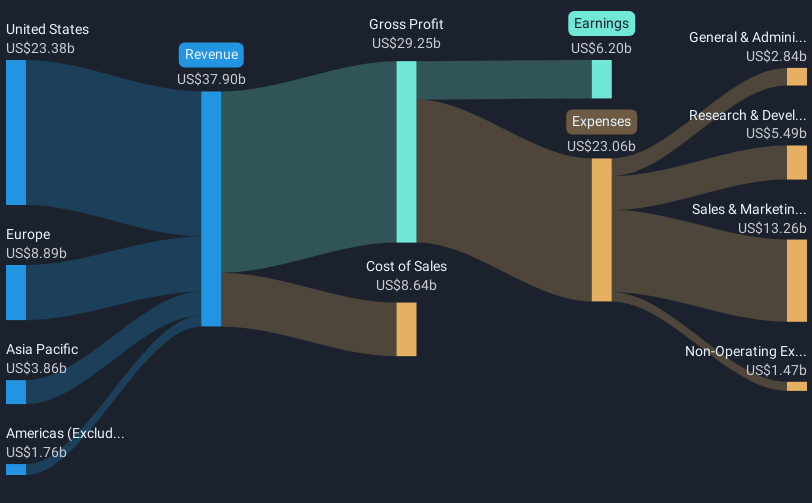

When contextualizing Salesforce's performance, it's important to note that although its stock underperformed the US software industry and broader market over the past year, the long-term growth reflects potential resilience. Moreover, Salesforce's revenue and earnings forecasts remain vital concerns, with analysts projecting a 9.6% annual revenue growth and expanding profit margins. Today's stock price of $240.88 shows about a 45% discount to the consensus price target of $349.41, suggesting room for growth according to analyst expectations. While the stock's dip might indicate market caution, Salesforce's strategic enhancements and evolving pricing models could influence its future market positioning and financial performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRM

Salesforce

Provides customer relationship management (CRM) technology that connects companies and customers together worldwide.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026