- United States

- /

- Software

- /

- NYSE:CRM

Is Salesforce Now Attractively Priced After This Year’s 27.8% Share Price Slide?

Reviewed by Bailey Pemberton

- Wondering if Salesforce is finally trading at a price that makes sense, or if the market is still overreacting to the recent tech shake up? In this article we unpack what the current share price really implies about future growth and risk.

- Salesforce has been on a bit of a rollercoaster, with the stock up 4.6% over the last week but still down 8.7% over 30 days, and sitting about 27.8% lower year to date and 34.7% below where it was a year ago. Zooming out, the 3 year return is 84.9%, and 9.4% over 5 years.

- Recently, investors have been reacting to a mix of headlines around big tech regulation, changing enterprise software budgets and shifting expectations for cloud growth, all of which have contributed to Salesforce's volatility. At the same time, ongoing product innovation in AI powered CRM tools and strategic partnerships with other cloud platforms have kept Salesforce in the conversation as a long term category leader.

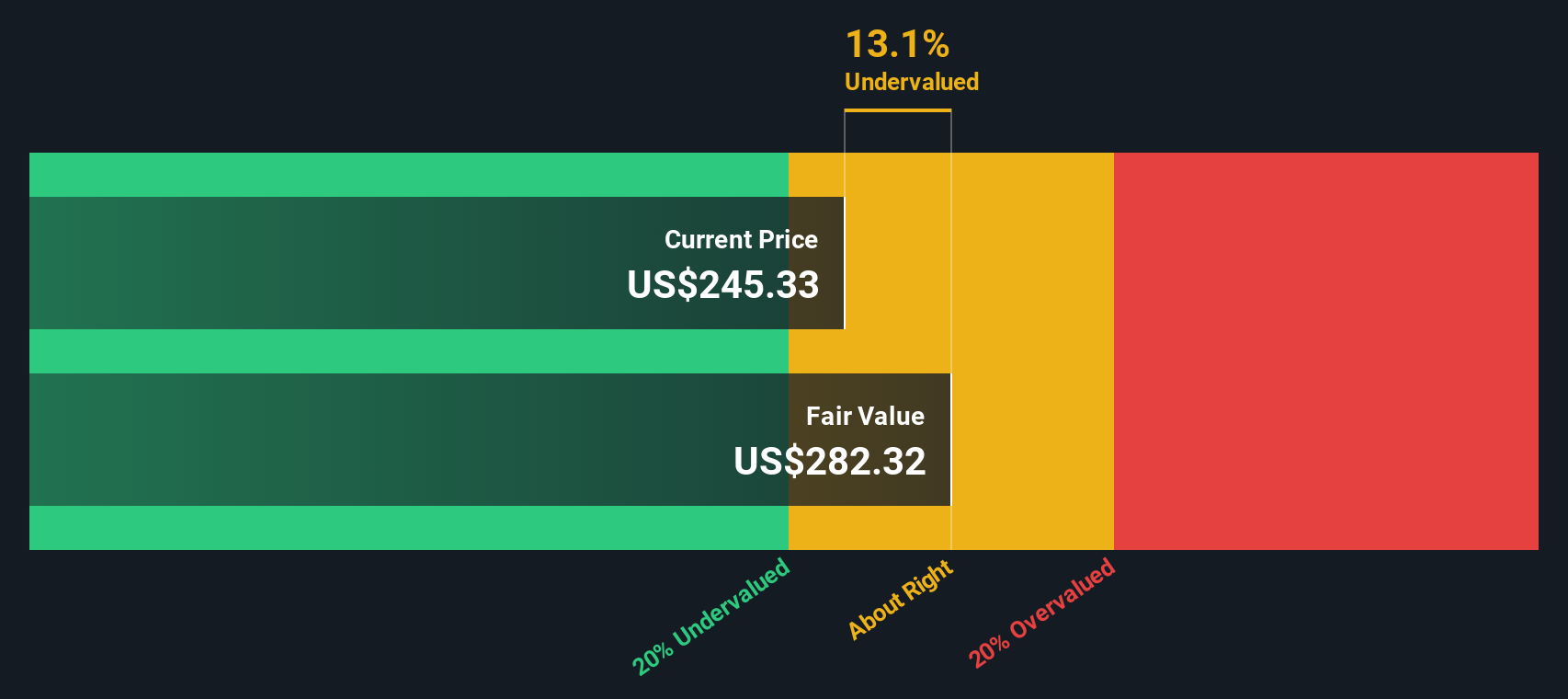

- On our framework, Salesforce currently scores a 4/6 valuation check, suggesting it screens as undervalued on most but not all of the metrics we track. In the next sections we walk through those different valuation approaches, and then finish with a more holistic way to think about what Salesforce may be worth.

Find out why Salesforce's -34.7% return over the last year is lagging behind its peers.

Approach 1: Salesforce Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting its future cash flows and then discounting those back to the present. For Salesforce, we start with last twelve months free cash flow of roughly $12.4 billion, and use analyst forecasts for the next few years, with Simply Wall St extending those trends further out.

On this basis, Salesforce’s free cash flow is projected to rise to around $20.3 billion by 2030, with growth slowing gradually over time as the business matures. All of these future cash flows are converted into today’s dollars using a required rate of return, and then summed to arrive at an estimated intrinsic value per share.

This 2 Stage Free Cash Flow to Equity model produces a fair value estimate of about $371 per share, which implies the stock is trading at roughly a 35.7% discount. In other words, the cash flow outlook currently justifies a materially higher price than where the market is valuing Salesforce.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Salesforce is undervalued by 35.7%. Track this in your watchlist or portfolio, or discover 915 more undervalued stocks based on cash flows.

Approach 2: Salesforce Price vs Earnings

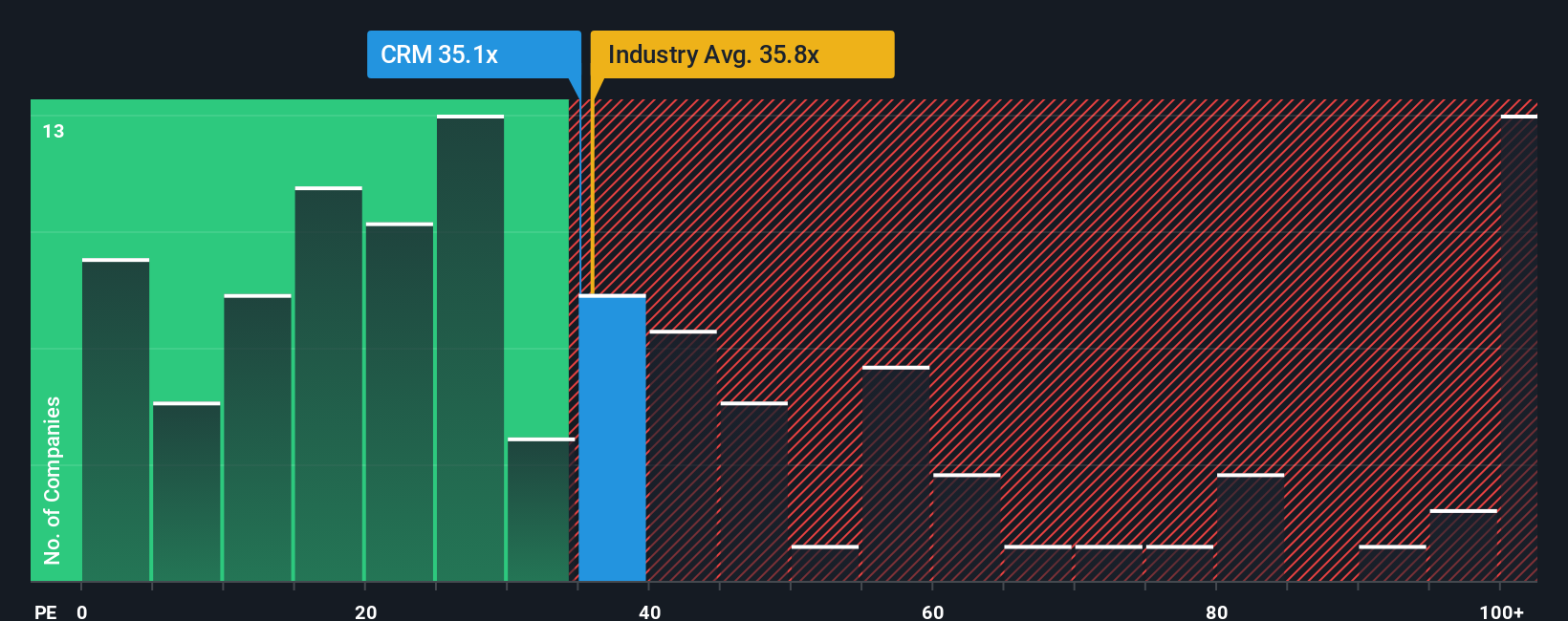

For profitable companies like Salesforce, the price to earnings, or PE, ratio is a useful shorthand for how much investors are willing to pay today for each dollar of current earnings. It naturally captures expectations for future growth and the perceived risk of those earnings, so faster growing, lower risk businesses usually justify a higher PE multiple.

What counts as a normal or fair PE therefore depends on how quickly earnings are expected to compound and how stable they are. Salesforce currently trades on a PE of about 34.1x, which is slightly above the broader Software industry average of roughly 31.7x, but well below the peer group average of around 56.6x. This implies the market is applying a discount to more aggressively valued software names.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what PE multiple Salesforce should trade on, given its earnings growth outlook, margins, risk profile, industry and market cap. For Salesforce, this Fair Ratio comes out at about 41.1x. This suggests the stock trades at a meaningful discount to where it might sit if priced purely on those fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Salesforce Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Salesforce’s story to a concrete financial forecast and a Fair Value estimate that you can compare to today’s share price.

A Narrative is the story behind your numbers, where you spell out how you think Salesforce’s revenue, earnings and margins will evolve, and then turn that view into a structured forecast and an implied Fair Value.

On Simply Wall St’s Community page, used by millions of investors, you can quickly build or follow Narratives that show how a particular storyline, such as Salesforce winning the “AI CRM” race or facing slower enterprise adoption, translates into future cash flows and a target valuation.

Because Narratives sit on live data, they automatically update when new information like earnings, acquisitions or macro news hits, helping you assess how Fair Value moves relative to the current share price as conditions change.

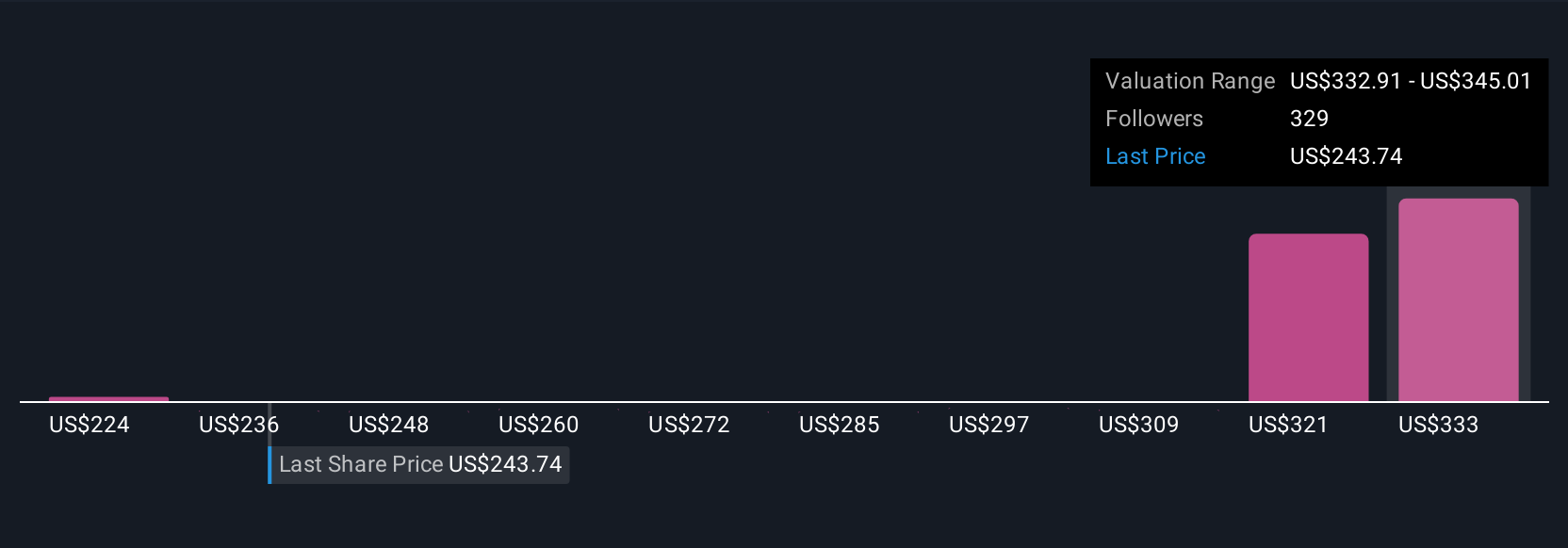

For example, one Salesforce Narrative on the platform values CRM at around $224 per share with more conservative growth and margins, while another more optimistic Narrative, assuming faster AI driven expansion and higher profitability, points to Fair Value closer to $331. This illustrates how different but clearly defined perspectives lead to different, yet transparent, price targets.

For Salesforce, however, we'll make it really easy for you with previews of two leading Salesforce Narratives:

Fair value: $330.59 per share

Implied undervaluation vs current price: 27.8%

Forecast revenue growth: 9.47%

- AI driven automation and Data Cloud adoption are lifting average contract values, supporting faster, more durable revenue and margin growth.

- Expanding into mid market and SMB customers, alongside disciplined cost control and buybacks, is broadening the customer base while scaling profitability.

- Key risks include intensifying competition from hyperscalers, tighter data regulation, and integration challenges from acquisitions that could weigh on growth and margins.

Fair value: $223.99 per share

Implied overvaluation vs current price: 6.6%

Forecast revenue growth: 13.0%

- Sees Salesforce as a mature leader whose growth is increasingly constrained by a saturated enterprise market and heavy reliance on large customers.

- Expects AI and acquisitions to support growth but believes margin expansion and free cash flow are at risk from rising competition, pricing pressure, and renewed deal activity.

- Assumes a much lower long term PE multiple as the market normalizes expectations, leaving less upside from today’s price if growth or profitability disappoint.

Do you think there's more to the story for Salesforce? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRM

Salesforce

Provides customer relationship management (CRM) technology that connects companies and customers together worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026