- United States

- /

- Software

- /

- NYSE:CMCM

We Think Cheetah Mobile (NYSE:CMCM) Needs To Drive Business Growth Carefully

Just because a business does not make any money, does not mean that the stock will go down. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So, the natural question for Cheetah Mobile (NYSE:CMCM) shareholders is whether they should be concerned by its rate of cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for Cheetah Mobile

How Long Is Cheetah Mobile's Cash Runway?

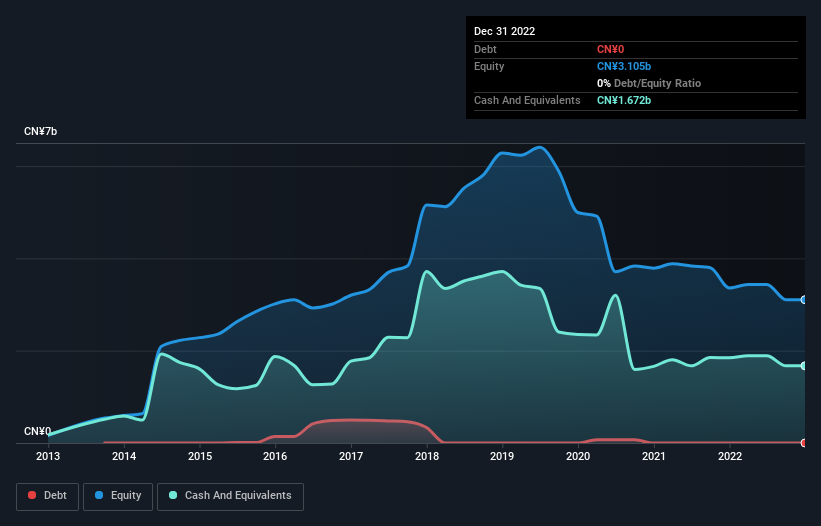

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. When Cheetah Mobile last reported its balance sheet in December 2022, it had zero debt and cash worth CN¥1.7b. Looking at the last year, the company burnt through CN¥431m. So it had a cash runway of about 3.9 years from December 2022. A runway of this length affords the company the time and space it needs to develop the business. Depicted below, you can see how its cash holdings have changed over time.

Is Cheetah Mobile's Revenue Growing?

We're hesitant to extrapolate on the recent trend to assess its cash burn, because Cheetah Mobile actually had positive free cash flow last year, so operating revenue growth is probably our best bet to measure, right now. While it's not that amazing, we still think that the 6.7% increase in revenue from operations was a positive. In reality, this article only makes a short study of the company's growth data. This graph of historic earnings and revenue shows how Cheetah Mobile is building its business over time.

How Hard Would It Be For Cheetah Mobile To Raise More Cash For Growth?

Notwithstanding Cheetah Mobile's revenue growth, it is still important to consider how it could raise more money, if it needs to. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of CN¥473m, Cheetah Mobile's CN¥431m in cash burn equates to about 91% of its market value. That suggests the company may have some funding difficulties, and we'd be very wary of the stock.

So, Should We Worry About Cheetah Mobile's Cash Burn?

Even though its cash burn relative to its market cap makes us a little nervous, we are compelled to mention that we thought Cheetah Mobile's cash runway was relatively promising. We don't think its cash burn is particularly problematic, but after considering the range of factors in this article, we do think shareholders should be monitoring how it changes over time. On another note, Cheetah Mobile has 3 warning signs (and 1 which is potentially serious) we think you should know about.

Of course Cheetah Mobile may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CMCM

Cheetah Mobile

Provides internet services, artificial intelligence (AI), and other services in the People’s Republic of China, Hong Kong, Japan, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.