- United States

- /

- Software

- /

- NYSE:BOX

Assessing Box’s Valuation Amid AI Push and Recent Share Price Pullback

Reviewed by Bailey Pemberton

- Investors may be wondering whether Box is quietly turning into a value opportunity, or whether the market is right to be cautious about the stock at current levels.

- Despite drifting lower recently, with the share price down 5.6% over the last week, 4.9% over the past month and 3.0% year to date, long-term holders are still sitting on a 61.2% gain over five years.

- Recent attention on Box has focused on how its content management platform is adapting to the AI era and developing deeper integrations with major ecosystem partners. This has reshaped expectations around its long-term growth runway. At the same time, debates about competition and the pace of enterprise cloud spending are influencing how investors consider both potential upside and risk.

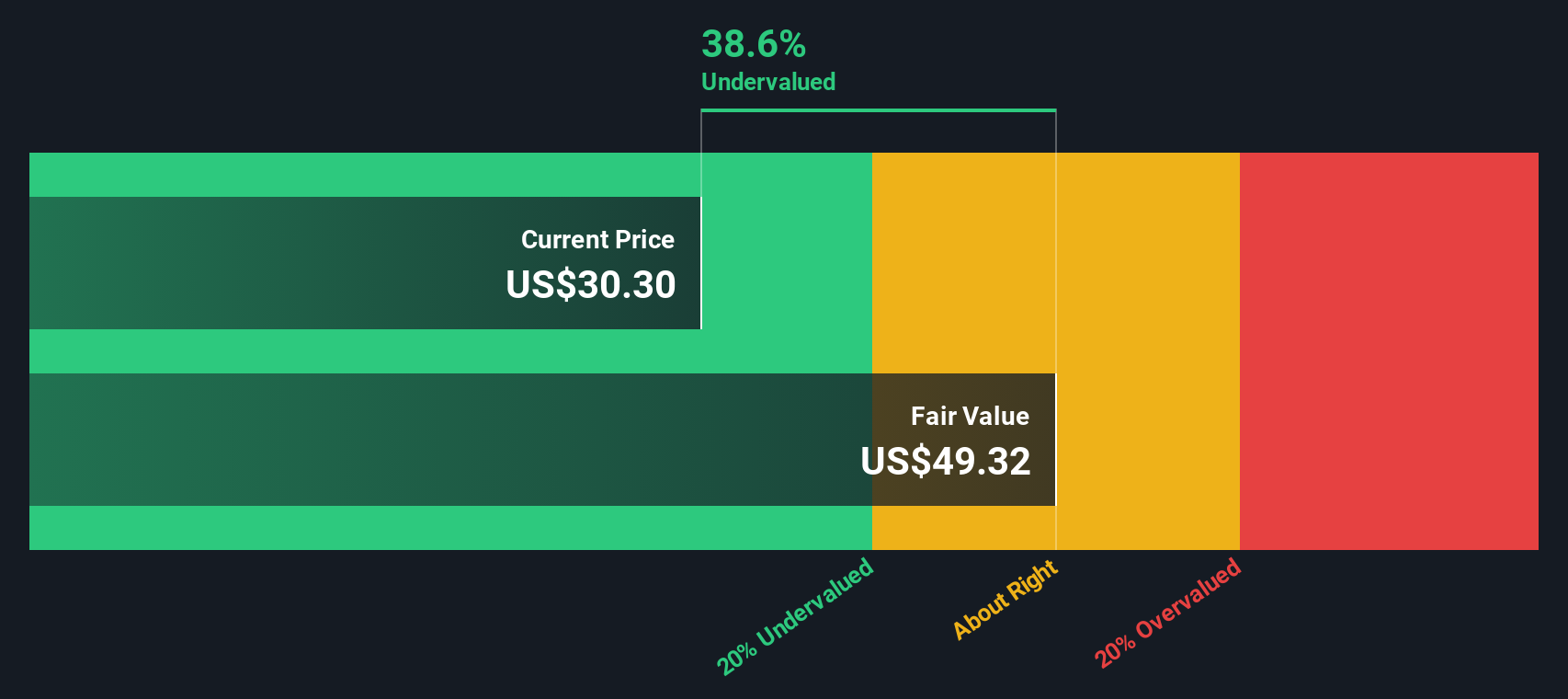

- Right now, Box scores a 4/6 valuation check, suggesting it screens as undervalued on most, but not all, of our metrics. We will unpack those different valuation approaches shortly, before finishing with a more holistic way to think about what Box may be worth.

Find out why Box's -5.8% return over the last year is lagging behind its peers.

Approach 1: Box Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes Box’s expected future cash flows, then discounts them back to today’s dollars to estimate what the business is worth now. For Box, the latest twelve month free cash flow stands at about $316.8 million, and analysts expect this to continue growing as the company scales its content cloud and AI offerings.

Simply Wall St uses a 2 Stage Free Cash Flow to Equity approach, combining analyst forecasts for the next several years with longer term projections that are extrapolated beyond that period. Under this framework, Box’s free cash flow is projected to rise to roughly $529.5 million by 2035, with the interim years stepping up gradually from the current level.

When these projected cash flows are discounted back to the present, the model arrives at an intrinsic value of about $47.33 per share. Compared with the current market price, this implies the stock trades at a 35.8% discount to its estimated fair value, which indicates that investors may not be fully pricing in Box’s future cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Box is undervalued by 35.8%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: Box Price vs Earnings

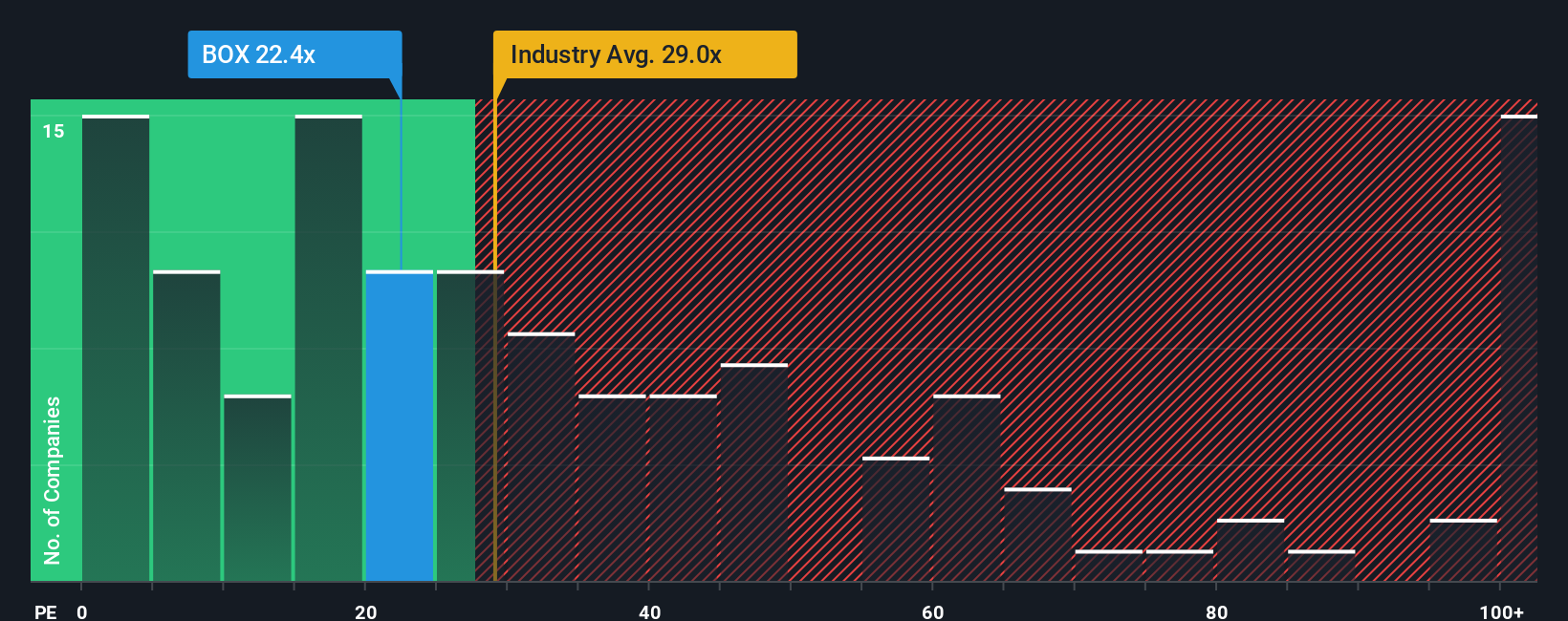

For profitable software companies like Box, the price to earnings (PE) ratio is a useful way to gauge how much investors are paying for each dollar of current profit. Higher growth and lower risk typically justify a higher PE, while slower growth, thinner margins or elevated uncertainty call for a lower, more conservative multiple.

Box currently trades on a PE of about 23.3x, which sits below both the broader software industry average of roughly 32.7x and the peer group average near 67.6x. At first glance, that discount suggests the market is more cautious about Box’s earnings durability or growth profile than it is for many other software names.

Simply Wall St’s Fair Ratio framework refines this comparison by estimating what PE multiple Box should command given its specific earnings growth outlook, profit margins, industry, market cap and risk profile. For Box, this Fair Ratio is 18.4x, which points to a valuation that is somewhat richer than those fundamentals alone would justify. Because the Fair Ratio is tailored to the company, it offers a more nuanced signal than broad peer or industry comparisons.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Box Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that lets you write the story behind your numbers by linking your view of a company’s competitive position, growth drivers and risks to concrete forecasts for future revenue, earnings and margins. These then roll up into a personal fair value you can compare with the current share price to decide whether to buy, hold or sell. Your Narrative automatically refreshes as new information like earnings or partnership news arrives. For Box, for example, a bullish investor might build a Narrative around its expanding AI partnerships and assign a fair value closer to the high analyst target of 45 dollars. A more cautious investor who worries about hyperscaler competition and margin pressure might set a fair value nearer the low target of 26 dollars. By seeing these different Narratives side by side, you can quickly understand not just what other investors think Box is worth, but why they think that way and how their assumptions differ from your own.

Do you think there's more to the story for Box? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Box might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BOX

Box

Provides a cloud content management platform that enables organizations of various sizes to manage and share their content from anywhere on any device in the United States and Japan.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026