- United States

- /

- Software

- /

- NYSE:BILL

How Investors May Respond To BILL Holdings (BILL) Amid Starboard Activism and Cash Account Launch

Reviewed by Sasha Jovanovic

- In late September 2025, activist hedge fund Starboard Value disclosed an 8.5% stake in BILL Holdings and called for changes to the company’s board, while BILL launched the BILL Cash Account, a high-yield, fee-free account aimed at streamlining cash management for SMBs.

- This combination of shareholder activism and product innovation highlights rising pressure and opportunity for BILL Holdings to accelerate operational improvements and meet evolving SMB needs.

- We will examine how Starboard Value’s board campaign and the BILL Cash Account launch reshape the company’s investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

BILL Holdings Investment Narrative Recap

To own BILL Holdings, investors need to believe in the company’s ability to drive sustainable growth from the ongoing digital transformation of SMB financial operations, bolstered by continuous product development and platform enhancements. The recent Starboard Value activism and the launch of the BILL Cash Account add urgency and visibility, but do not materially change the primary short-term catalyst, which is delivering stronger revenue growth and improved profitability, or the biggest risk, which remains competitive pressures from larger fintech peers.

Of the recent announcements, the launch of the BILL Cash Account stands out as directly relevant. By introducing a high-yield, fee-free cash management product with robust FDIC insurance and embedded payments functionality, BILL is addressing SMB core needs and aiming to boost customer retention and average revenue per user, two vital levers for growth in a crowded market.

However, with increased attention comes the challenge of defending market share and pricing power as larger competitors eye similar opportunities, so investors should also consider...

Read the full narrative on BILL Holdings (it's free!)

BILL Holdings' narrative projects $2.1 billion in revenue and $94.8 million in earnings by 2028. This requires 13.2% yearly revenue growth and a $71 million increase in earnings from the current $23.8 million.

Uncover how BILL Holdings' forecasts yield a $60.10 fair value, a 13% upside to its current price.

Exploring Other Perspectives

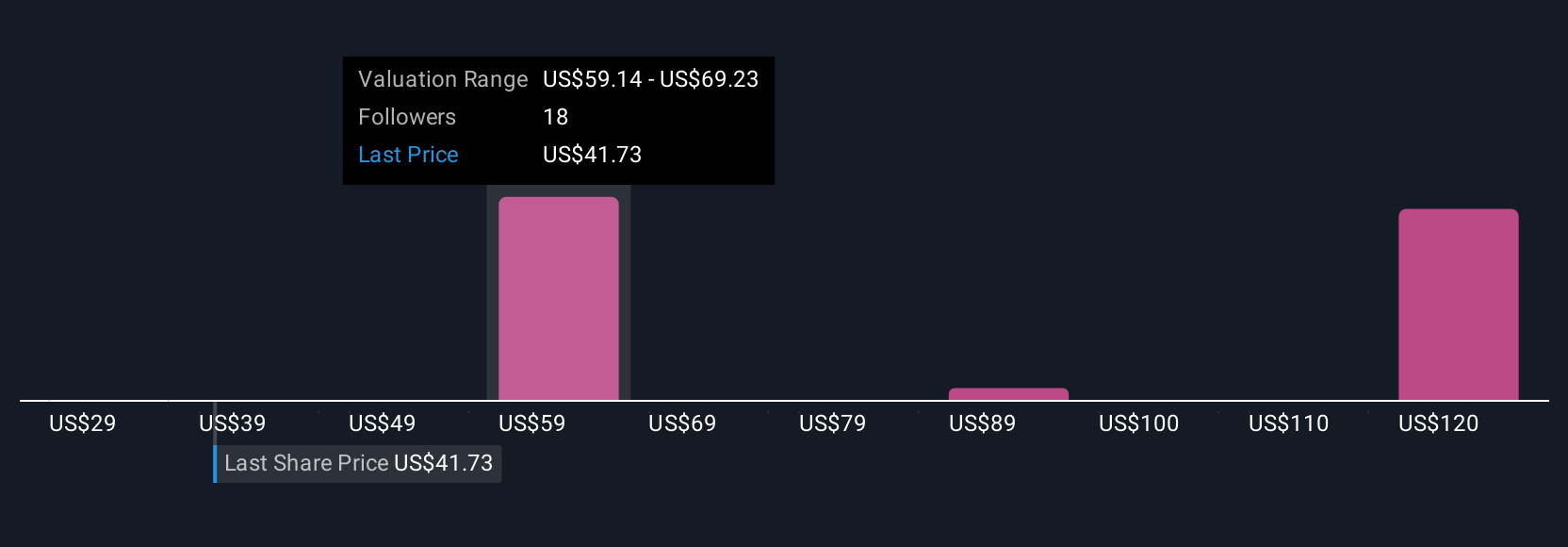

Four fair value estimates from the Simply Wall St Community span from US$60.10 to US$92.40, reflecting broad views on BILL Holdings’ potential. Many see increased competition as a persistent risk, leading to ongoing debate about the company’s margin outlook and future growth.

Explore 4 other fair value estimates on BILL Holdings - why the stock might be worth as much as 73% more than the current price!

Build Your Own BILL Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BILL Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BILL Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BILL Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 33 companies in the world exploring or producing it. Find the list for free.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BILL Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BILL

BILL Holdings

Provides financial operations platform for small and midsize businesses worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives