- United States

- /

- Software

- /

- NYSE:QTWO

High Growth Tech Stocks in US with Promising Potential

Reviewed by Simply Wall St

With the S&P 500 reaching 6,000 for the first time since February and a solid May jobs report bolstering market confidence, U.S. stock indexes are poised for gains as investor concerns about tariffs ease. In this vibrant economic landscape, identifying high growth tech stocks with promising potential involves looking at companies that can leverage strong corporate earnings and favorable market conditions to drive innovation and expansion in the technology sector.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.38% | 39.09% | ★★★★★★ |

| Mereo BioPharma Group | 53.63% | 66.57% | ★★★★★★ |

| Ardelyx | 20.78% | 59.46% | ★★★★★★ |

| Travere Therapeutics | 26.41% | 64.47% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.28% | 60.66% | ★★★★★★ |

| Alkami Technology | 20.54% | 76.67% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.64% | 61.12% | ★★★★★★ |

| Ascendis Pharma | 35.15% | 60.20% | ★★★★★★ |

| Lumentum Holdings | 22.53% | 112.10% | ★★★★★★ |

Click here to see the full list of 226 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

BILL Holdings (BILL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BILL Holdings, Inc. offers a financial operations platform catering to small and midsize businesses globally, with a market capitalization of approximately $4.70 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to $1.42 billion.

BILL Holdings has demonstrated a robust trajectory in its financial and operational strategies, notably with the recent executive team expansion to bolster its growth and leadership in the tech sector. The company's strategic maneuvers, including securing a $300 million credit facility for enhanced financial flexibility and the integration of new online bill payment solutions through its partnership with Xero, underscore its innovative approach to streamlining financial operations for small businesses. Moreover, BILL's commitment to R&D is evident from its annual expenditure growth rate of 15%, aligning with revenue increases and ensuring continuous improvement in service offerings. This strategy not only enhances client engagement by simplifying payment processes but also positions BILL effectively for sustained growth in a competitive landscape.

- Unlock comprehensive insights into our analysis of BILL Holdings stock in this health report.

Examine BILL Holdings' past performance report to understand how it has performed in the past.

DoubleVerify Holdings (DV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DoubleVerify Holdings, Inc. offers media effectiveness platforms globally, with a market capitalization of approximately $2.39 billion.

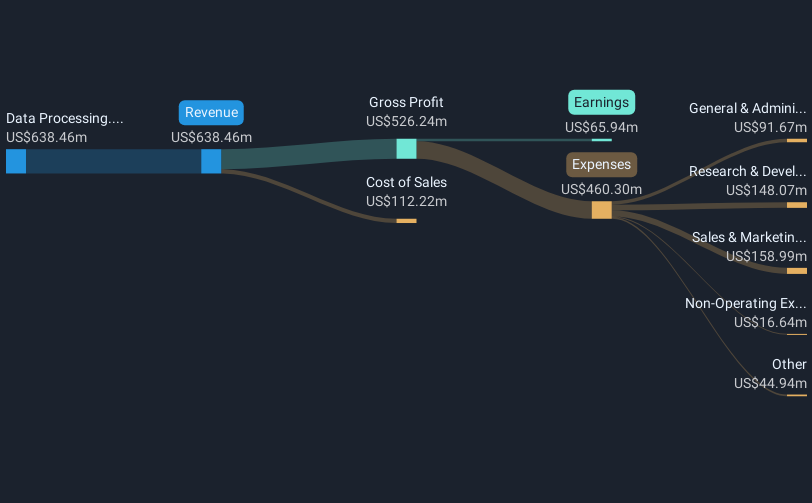

Operations: DoubleVerify generates revenue primarily from its data processing segment, which accounts for $681.13 million. The company's focus is on providing media effectiveness solutions both in the U.S. and internationally.

DoubleVerify Holdings is navigating a dynamic tech landscape with its innovative digital media measurement and analytics solutions. The company's recent partnership with Impact Plus, focusing on emissions measurement for digital campaigns, underscores its commitment to sustainability in advertising technologies. Despite facing challenges such as a significant lawsuit alleging overbilling and technological limitations on closed platforms, DoubleVerify has maintained a revenue growth forecast of 10% annually. Moreover, the firm's strategic board appointments and product enhancements like AI-powered controls for Google’s Search Partner Network highlight its proactive approach in adapting to industry shifts and enhancing client offerings.

- Delve into the full analysis health report here for a deeper understanding of DoubleVerify Holdings.

Assess DoubleVerify Holdings' past performance with our detailed historical performance reports.

Q2 Holdings (QTWO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Q2 Holdings, Inc. offers digital solutions tailored for financial institutions, FinTechs, and alternative finance companies in the United States with a market capitalization of $5.58 billion.

Operations: The company generates revenue primarily through the sale, implementation, and support of its digital solutions, amounting to $720.69 million. It focuses on serving financial institutions, FinTechs, and alternative finance companies in the U.S., with a market cap of $5.58 billion.

Q2 Holdings is distinguishing itself in the fintech sector with strategic innovations aimed at integrating banking services directly into ERP systems, a move underscored by their recent launch of Direct ERP. This solution not only streamlines financial processes but also enhances transparency and efficiency, addressing a significant market need as evidenced by Datos Insights revealing that 91% of North American businesses prioritize such integrations. Financially, Q2 has shown resilience with a notable turnaround in its first quarter earnings for 2025, reporting net income of $4.75 million compared to a net loss the previous year and projecting robust revenue growth between 10% to 13% for Q2. These developments suggest that Q2 Holdings is adeptly navigating its market challenges while capitalizing on emerging business opportunities within digital banking solutions.

- Dive into the specifics of Q2 Holdings here with our thorough health report.

Explore historical data to track Q2 Holdings' performance over time in our Past section.

Make It Happen

- Get an in-depth perspective on all 226 US High Growth Tech and AI Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Q2 Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QTWO

Q2 Holdings

Provides digital solutions to financial institutions, financial technology companies, FinTechs, and alternative finance companies (Alt-FIs) in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives