David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that BILL Holdings, Inc. (NYSE:BILL) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for BILL Holdings

What Is BILL Holdings's Debt?

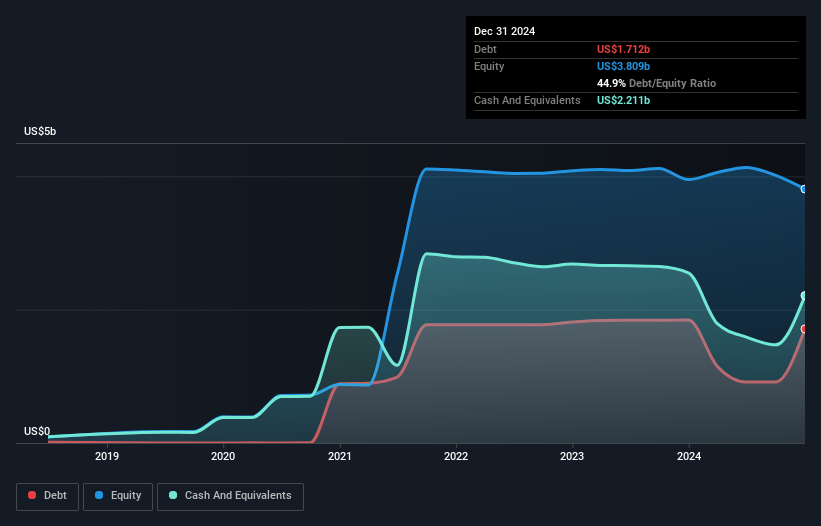

The image below, which you can click on for greater detail, shows that BILL Holdings had debt of US$1.71b at the end of December 2024, a reduction from US$1.84b over a year. However, it does have US$2.21b in cash offsetting this, leading to net cash of US$499.1m.

A Look At BILL Holdings' Liabilities

We can see from the most recent balance sheet that BILL Holdings had liabilities of US$4.12b falling due within a year, and liabilities of US$1.74b due beyond that. On the other hand, it had cash of US$2.21b and US$677.3m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$2.98b.

This deficit is considerable relative to its market capitalization of US$4.82b, so it does suggest shareholders should keep an eye on BILL Holdings' use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry. Despite its noteworthy liabilities, BILL Holdings boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if BILL Holdings can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, BILL Holdings reported revenue of US$1.4b, which is a gain of 16%, although it did not report any earnings before interest and tax. We usually like to see faster growth from unprofitable companies, but each to their own.

So How Risky Is BILL Holdings?

Although BILL Holdings had an earnings before interest and tax (EBIT) loss over the last twelve months, it made a statutory profit of US$82m. So taking that on face value, and considering the cash, we don't think its very risky in the near term. Until we see some positive EBIT, we're a bit cautious of the stock, not least because of the rather modest revenue growth. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for BILL Holdings (1 is significant) you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if BILL Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BILL

BILL Holdings

Provides financial operations platform for small and midsize businesses worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success