- United States

- /

- IT

- /

- NYSE:BBAI

Will BigBear.ai (BBAI) and Tsecond’s Edge AI Deal Reshape Its Defense Market Positioning?

Reviewed by Sasha Jovanovic

- On October 13, 2025, BigBear.ai announced a partnership with Tsecond Inc. to deliver AI-enabled edge infrastructure for mission-critical U.S. national security operations by integrating their ConductorOS and Tsecond’s BRYCK platform.

- This collaboration addresses the need to rapidly deploy and manage AI solutions in disconnected tactical settings, supporting faster and more reliable decision-making for defense teams at the edge.

- We'll discuss how this AI-focused partnership could reinforce BigBear.ai’s positioning in key defense and national security markets.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

BigBear.ai Holdings Investment Narrative Recap

Shareholders in BigBear.ai need to believe in the company's ability to gain traction in the AI-driven defense and security market despite continued net losses and revenue variability. The recent partnership with Tsecond Inc. could improve project delivery and customer reach in mission-critical settings, but does not appear to materially shift the most important catalysts or near-term risks, such as large, lumpy government contract awards and potential funding delays.

Among recent updates, the proposed increase in authorized shares to 1,000,000,000 stands out, especially as the company continues to fund growth. While this could support further expansion and capital needs, it raises additional questions for shareholders within the context of possible dilution, especially when linked to ongoing revenue and earnings challenges.

On the other hand, investors should keep in mind the ongoing risk that...

Read the full narrative on BigBear.ai Holdings (it's free!)

BigBear.ai Holdings' outlook anticipates $162.2 million in revenue and $10.3 million in earnings by 2028. This assumes annual revenue growth of 2.1% and a $454.2 million increase in earnings from the current -$443.9 million.

Uncover how BigBear.ai Holdings' forecasts yield a $5.83 fair value, a 22% downside to its current price.

Exploring Other Perspectives

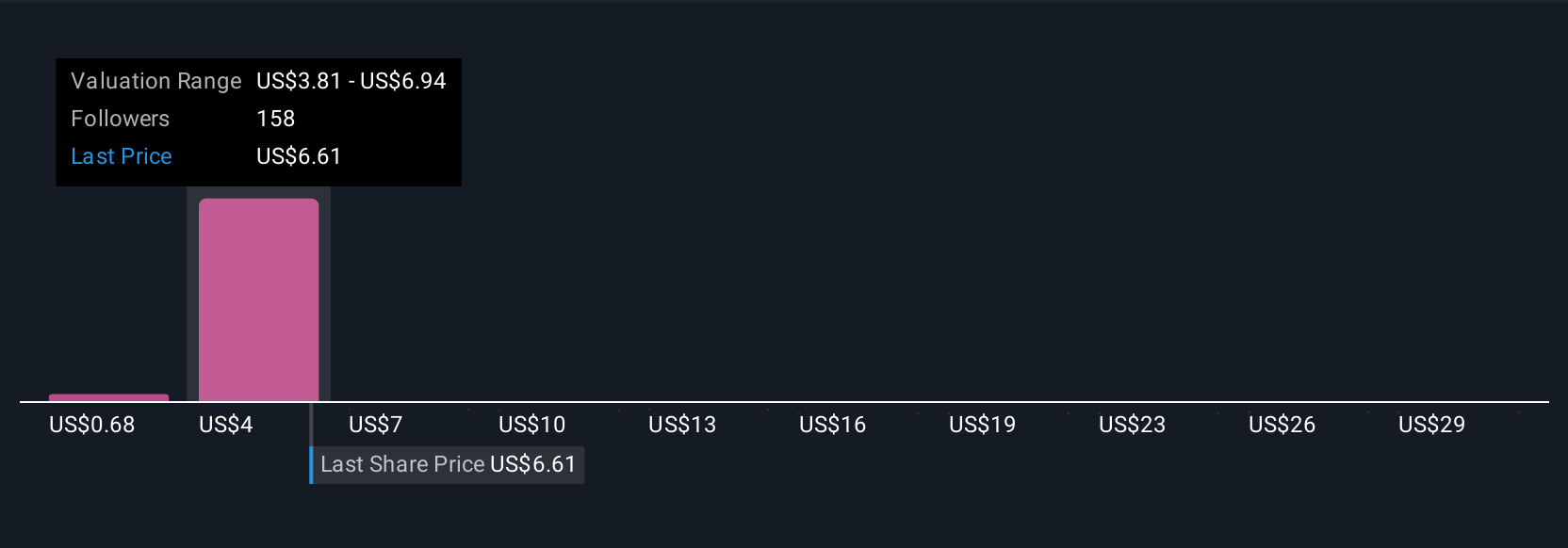

Thirty-five private investors in the Simply Wall St Community set fair values for BigBear.ai from US$0.67 to US$15.91 per share. Given large revenue swings and share dilution risks, your outlook could differ widely from consensus, see how your view fits with others.

Explore 35 other fair value estimates on BigBear.ai Holdings - why the stock might be worth less than half the current price!

Build Your Own BigBear.ai Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BigBear.ai Holdings research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free BigBear.ai Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BigBear.ai Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BigBear.ai Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBAI

BigBear.ai Holdings

Provides artificial intelligence-powered decision intelligence solutions.

Flawless balance sheet with low risk.

Market Insights

Community Narratives