- United States

- /

- IT

- /

- NYSE:BBAI

BigBear.ai Holdings (NYSE:BBAI) Soars 192% In Last Quarter

Reviewed by Simply Wall St

BigBear.ai Holdings (NYSE:BBAI) reported a notable price surge of 192% in the last quarter, drawing attention following recent strategic efforts. A key event was the deployment of its biometric software across major international airports, enhancing passenger processing, which aligns with the company's mission to advance technological solutions. Additionally, the partnership with Analogic to improve airport security operations reflects BigBear.ai's push into AI-driven enhancements. In contrast to broader markets, which remained mostly flat, the company’s integration capabilities and strategic collaborations potentially added weight to its significant outperformance compared to general market upward trends.

The deployment of BigBear.ai's biometric software in international airports and its collaboration with Analogic could significantly impact the company's narrative around international expansion and regional partnerships. These developments may bolster BigBear.ai’s revenue potential through increased market presence and the conversion of successful pilots into lasting programs. The focus on AI-driven solutions, particularly for defense and security sectors, aligns with efforts to boost sustained growth and improve margins. The news adds reinforcement to forecasts of revenue growth, positioning the company to capitalize on rising federal spending and shifting procurement practices.

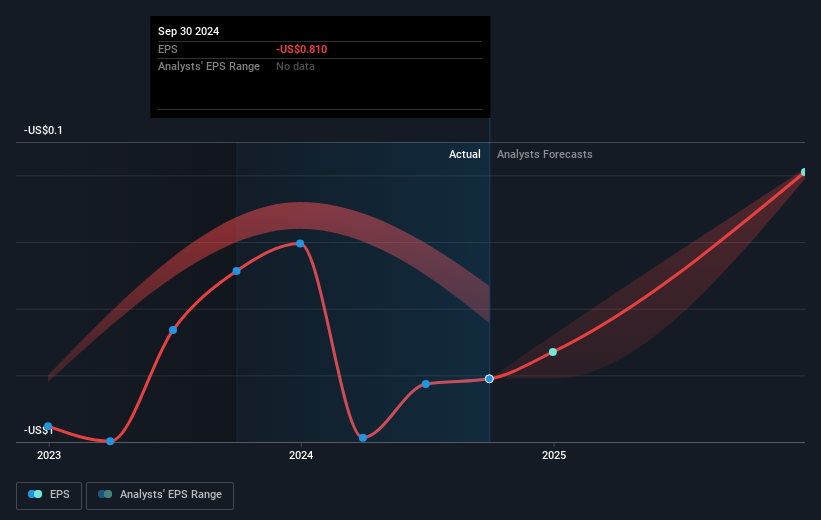

Over the past year, BigBear.ai Holdings achieved an impressive total shareholder return of 425.68%, reflecting a substantial performance compared to both broader market trends, which showed a 12.5% return, and the US IT industry, which returned 35.2%. This substantial gain highlights the company's ability to significantly exceed both market and industry benchmarks. Despite recent price surge, the current share price of US$4.05 represents a 16.2% discount to the consensus analyst price target of US$4.83, reflecting differing expectations about future growth and profitability.

The company’s revenue variability and high R&D costs remain challenges, yet the recent advancements and strategic partnerships suggest a potential for improved forecasts. Analysts expect revenues to grow 9% annually over the next three years, although profitability remains elusive. Shareholder expectations are tempered by these realities, as ongoing government delays and investment needs could impact net margins. These elements combine, posing opportunities and risks that investors should weigh, especially in light of fluctuating earnings potential and price target variances.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BigBear.ai Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBAI

BigBear.ai Holdings

Provides artificial intelligence-powered decision intelligence solutions.

Flawless balance sheet slight.

Market Insights

Community Narratives