- United States

- /

- IT

- /

- NYSE:BBAI

BigBear.ai (BBAI): Assessing Valuation Following Malaysia Aerospace Partnership and Ask Sage Acquisition

Reviewed by Simply Wall St

BigBear.ai Holdings (BBAI) caught fresh investor attention after announcing a strategic memorandum of understanding to advance technologies in Malaysia's Pahang Aerospace City. The company also announced its acquisition of Ask Sage for broader defense and AI market reach.

See our latest analysis for BigBear.ai Holdings.

Momentum has certainly picked up for BigBear.ai Holdings as its recent partnership in Malaysia and the Ask Sage acquisition fueled a wave of optimism, pushing the year-to-date share price return to 46.47%. Over the longer term, the company’s three-year total shareholder return of 531.29% highlights just how much faith investors are placing in its evolving role at the intersection of AI and defense.

If you want to see how other aerospace and defense innovators are making moves, this is the perfect moment to discover See the full list for free.

With shares rallying sharply and major acquisitions fresh in the spotlight, the question now is whether BigBear.ai Holdings is presenting an overlooked value or if the market has already factored in all its growth potential.

Most Popular Narrative: 9.7% Undervalued

BigBear.ai Holdings closed at $6.02, while the most-followed narrative sees a fair value over $6.60. This gap provides an opportunity to take a closer look at what is driving analysts’ optimism beyond the recent price surge.

BigBear.ai plans to expand internationally by converting successful pilots into enduring programs and building regional partnerships with leading companies, potentially increasing revenue and global market presence. The company is focused on business alliances and strategic acquisitions, which could drive faster innovation and open new revenue streams by accessing additional markets and technologies.

Earnings projections, margin assumptions, and growth rates that would surprise most investors all contribute to the fair value estimate. Analyst assumptions and long-term revenue targets play a key role in this narrative. Interested in what makes this outlook so optimistic?

Result: Fair Value of $6.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, government funding delays and ongoing R&D investments could disrupt growth forecasts and negatively impact BigBear.ai Holdings' profitability outlook.

Find out about the key risks to this BigBear.ai Holdings narrative.

Another View: Price Ratios Raise Caution

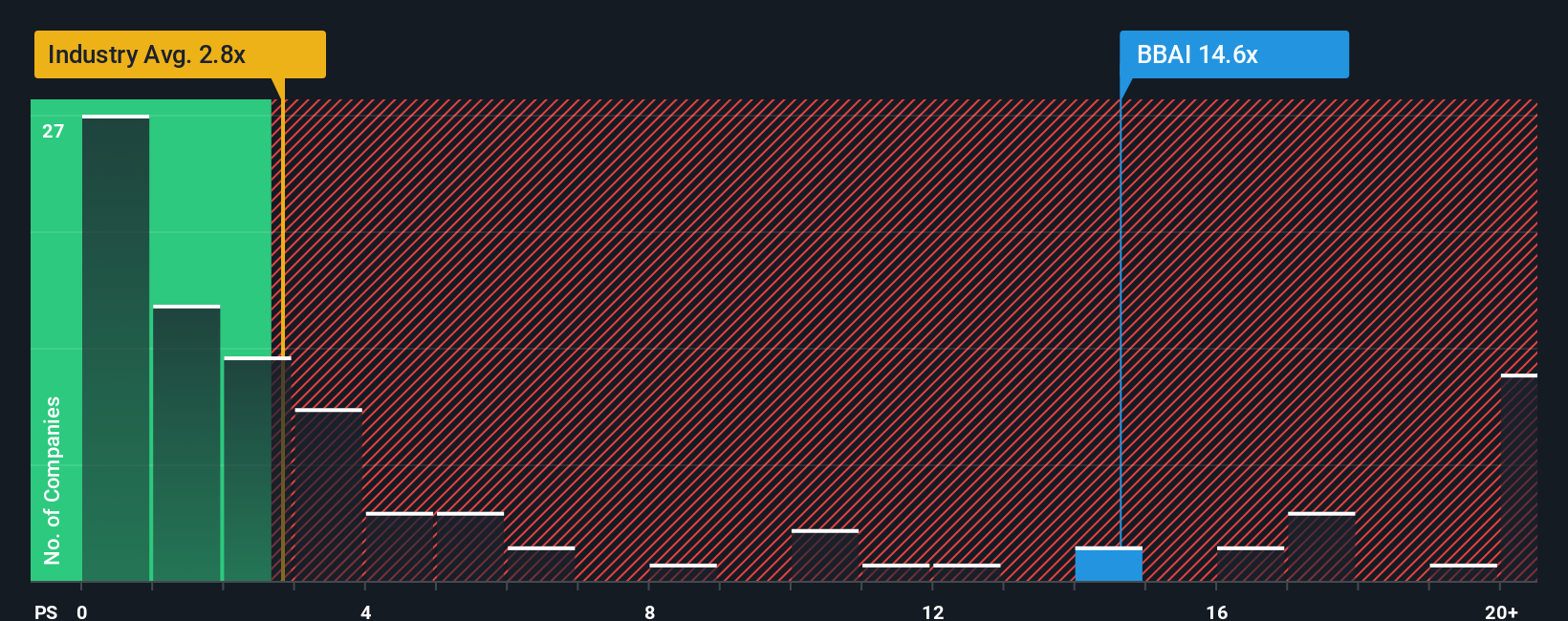

While fair value estimates signal BigBear.ai Holdings might be undervalued, looking through the lens of price-to-sales ratios tells a more expensive story. The company trades at 18.2 times sales, which is far above the industry average of 2.6x and its fair ratio of 3.3x. This could mean investors are taking on more risk by paying a premium for future growth that is not guaranteed. Is this optimism justified, or are expectations outpacing reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BigBear.ai Holdings Narrative

Readers who want to dig deeper, question the consensus, or personalize their research can easily craft their own narrative in just a few minutes, so why not Do it your way?

A great starting point for your BigBear.ai Holdings research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the crowd by finding stocks that could help you reach your financial goals faster. Unique opportunities are waiting if you know where to look.

- Uncover untapped opportunities with these 928 undervalued stocks based on cash flows, designed to highlight companies trading below their intrinsic value and positioned for growth.

- Boost your income potential by checking out these 15 dividend stocks with yields > 3%, filled with stocks offering attractive yields above 3%.

- Seize the innovation edge and spot tomorrow's leaders by reviewing these 25 AI penny stocks, focusing on companies advancing artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BigBear.ai Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBAI

BigBear.ai Holdings

Provides artificial intelligence-powered decision intelligence solutions.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.