- United States

- /

- IT

- /

- NYSE:BBAI

After Leaping 38% BigBear.ai Holdings, Inc. (NYSE:BBAI) Shares Are Not Flying Under The Radar

The BigBear.ai Holdings, Inc. (NYSE:BBAI) share price has done very well over the last month, posting an excellent gain of 38%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 15% in the last twelve months.

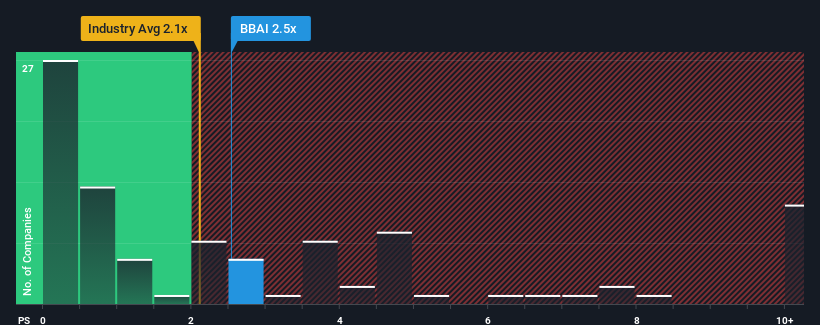

Even after such a large jump in price, there still wouldn't be many who think BigBear.ai Holdings' price-to-sales (or "P/S") ratio of 2.5x is worth a mention when the median P/S in the United States' IT industry is similar at about 2.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for BigBear.ai Holdings

What Does BigBear.ai Holdings' P/S Mean For Shareholders?

Recent times haven't been great for BigBear.ai Holdings as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on BigBear.ai Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like BigBear.ai Holdings' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 4.6% gain to the company's revenues. Pleasingly, revenue has also lifted 70% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 12% per year as estimated by the six analysts watching the company. With the industry predicted to deliver 13% growth per annum, the company is positioned for a comparable revenue result.

In light of this, it's understandable that BigBear.ai Holdings' P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does BigBear.ai Holdings' P/S Mean For Investors?

BigBear.ai Holdings appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that BigBear.ai Holdings maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Plus, you should also learn about these 5 warning signs we've spotted with BigBear.ai Holdings.

If these risks are making you reconsider your opinion on BigBear.ai Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if BigBear.ai Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BBAI

BigBear.ai Holdings

Provides artificial intelligence-powered decision intelligence solutions.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.