- United States

- /

- IT

- /

- NYSE:ASGN

ASGN (ASGN) Valuation in Focus After Markets Rally on Fed Policy Shift Signals

Reviewed by Simply Wall St

ASGN (ASGN) just caught the attention of investors after Fed Chair Jerome Powell’s remarks at the Jackson Hole symposium sent a ripple across the markets. Powell signaled that a friendlier interest rate backdrop could be on the horizon, a shift that has investors reassessing companies across sectors. The result: ASGN’s stock joined a market-wide rally, benefiting from relief that rates may not stay as high or as long as initially feared.

This latest move comes at a challenging time for ASGN. The stock has struggled over the last year, with shares down 44%. Longer-term, the three-year picture shows a similar decline. While last week’s increase follows several initiatives such as ECS’ cloud-based Blue Dawn earning “awardable” status within the government’s AI procurement marketplace, the big driver now appears to be macro optimism rather than company-specific breakthroughs. It is a much-needed bounce for a stock that has spent the past twelve months losing momentum.

Now that the rally has arrived, investors are left wondering if this creates a real buying opportunity, or if markets are just adjusting to a new outlook without any fundamental re-rating for ASGN.

Most Popular Narrative: 5.8% Undervalued

According to community narrative, ASGN is viewed as undervalued and trading below analyst consensus estimates for its fair value. Optimism is grounded in its anticipated earnings and margin expansion.

Ongoing investments in cloud, AI, and cybersecurity solutions, supported by robust demand from both commercial and federal clients, are driving a growing pipeline of high-margin consulting contracts. This positions ASGN to benefit from clients' digital modernization roadmaps, which is likely to accelerate future revenue growth and improve overall net margins.

Curious about what’s fueling this bullish valuation? The focus is on forward-looking growth expectations and a leap in margins, rather than just a stock rebound. Interested in the details behind this narrative’s bold assumptions? Find out how evolving fundamentals and financial projections come together to support this valuation increase.

Result: Fair Value of $57.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent macroeconomic headwinds or weakness in commercial staffing could still challenge ASGN’s growth story and put analyst forecasts at risk.

Find out about the key risks to this ASGN narrative.Another View: DCF Model Weighs In

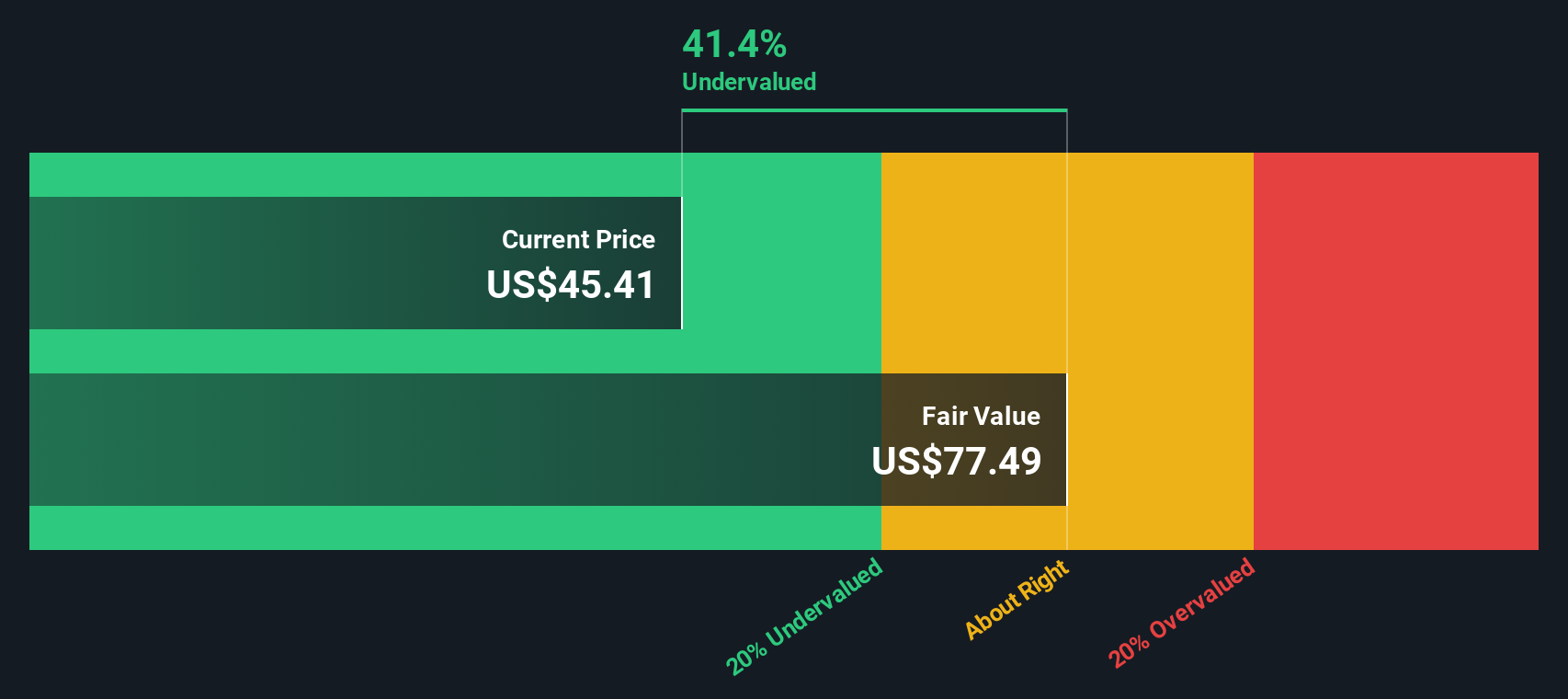

Taking a different approach, the SWS DCF model also suggests ASGN is undervalued. Instead of focusing on short-term sentiment, this model looks ahead to future cash flows. Does this second method reinforce confidence, or does it raise fresh questions for investors?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own ASGN Narrative

If you have a different perspective or want to dive deeper into the numbers, it’s easy to build your own story from the available data in just a few minutes. Simply do it your way.

A great starting point for your ASGN research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Great investors never settle for just one opportunity. If you want to find tomorrow’s winners ahead of the crowd, use the Simply Wall Street Screener to unlock new possibilities tailored to your interests. Check out these handpicked ideas designed to move your portfolio forward right now:

- Supercharge your passive income by tapping into a selection of companies with dividend stocks with yields > 3%. These offer yields over 3% to help grow your earnings steadily.

- Accelerate your edge in technology trends by scouting the most promising AI penny stocks. These are poised to lead the AI-driven transformation across industries.

- Secure value for your money by focusing on smart picks among undervalued stocks based on cash flows that show strong potential based on solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASGN

ASGN

Engages in the provision of information technology (IT) services and solutions in the technology, digital, and creative fields for commercial and government sectors in the United States, Canada, and Europe.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives