- United States

- /

- IT

- /

- NYSE:ACN

How Investors Are Reacting To Accenture (ACN) Dividend Hike and Revenue Growth Guidance

Reviewed by Sasha Jovanovic

- Accenture recently announced a series of business updates, including year-over-year revenue growth to US$17.60 billion for the fourth quarter and a quarterly dividend increase to US$1.63 per share.

- An important insight is that the company’s commitment to higher dividends and confirmed guidance for continued earnings growth signals management’s confidence in Accenture’s cash flow and long-term prospects despite recent profit pressure.

- We’ll examine how the stronger dividend and revenue guidance shape Accenture’s outlook, with a focus on shareholder value.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Accenture Investment Narrative Recap

To be a shareholder in Accenture, you need to believe in the company’s ability to convert large-scale transformation and AI investments into consistent, long-term value for both clients and shareholders. The recent executive appointments in Reinvention Services and leadership shifts are unlikely to materially impact the most important short-term catalyst, which remains the ramp-up of generative AI-driven solutions, or shift the biggest risk, which is continued uncertainty in the federal business and pressure on operating margins.

Of the recent announcements, the appointment of Shaheen Sayed as Chief Commercial Officer of Reinvention Services is most relevant. Her role focuses on integrating AI-enabled solutions across operations, directly supporting Accenture’s critical growth catalyst: delivering measurable value from AI initiatives. This underscores management’s commitment to capitalize on AI-driven transformations for revenue growth, even as federal revenue and margin pressures persist.

But contrary to the positive momentum from leadership changes, investors should also be aware of ongoing risks in federal contract performance and margin pressure that could affect future results...

Read the full narrative on Accenture (it's free!)

Accenture's narrative projects $81.5 billion revenue and $10.0 billion earnings by 2028. This requires 6.0% yearly revenue growth and a $2.1 billion earnings increase from $7.9 billion today.

Uncover how Accenture's forecasts yield a $278.32 fair value, a 12% upside to its current price.

Exploring Other Perspectives

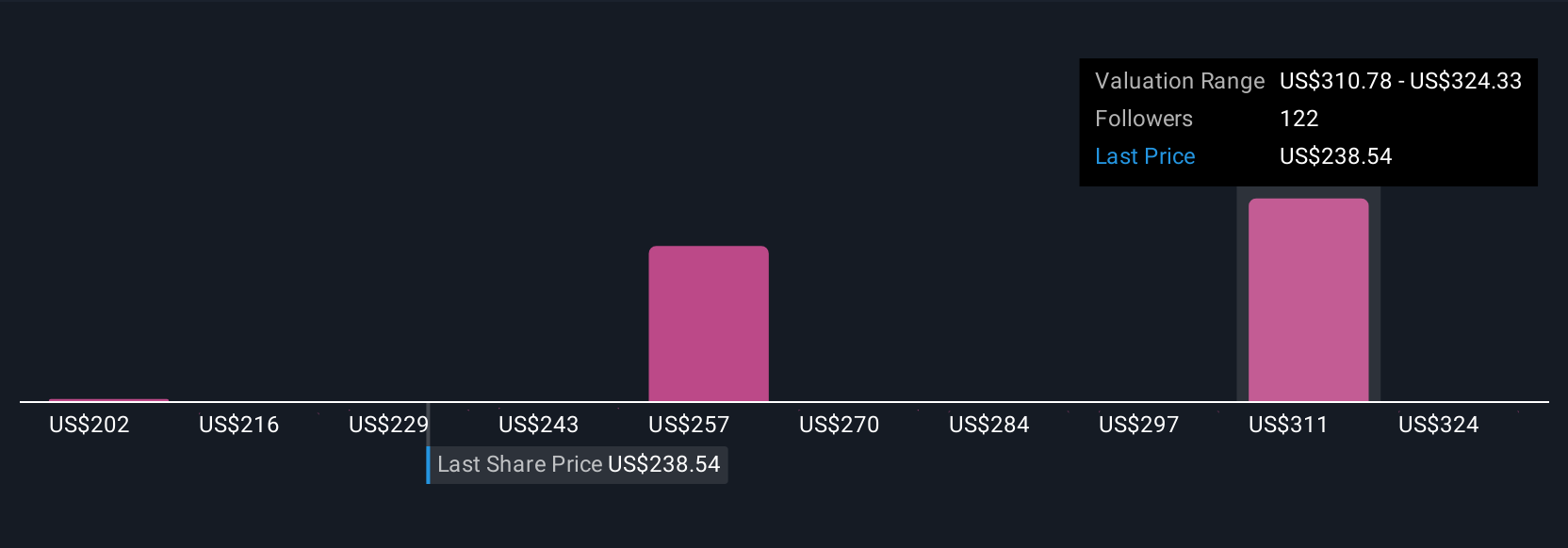

Fifteen members of the Simply Wall St Community offered fair value estimates for Accenture ranging from US$202.38 to US$337.88 per share. While some foresee significant upside, many remain focused on the uncertain trajectory of federal revenue and margin trends that may shape Accenture’s results over the coming quarters; see how your views compare.

Explore 15 other fair value estimates on Accenture - why the stock might be worth 18% less than the current price!

Build Your Own Accenture Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Accenture research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Accenture research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Accenture's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACN

Accenture

Provides strategy and consulting, industry X, song, and technology and operation services in North America, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives