- United States

- /

- IT

- /

- NYSE:ACN

Accenture (NYSE:ACN) Announces US$1.48 Dividend, Buyback Update Despite 5% Share Price Dip

Reviewed by Simply Wall St

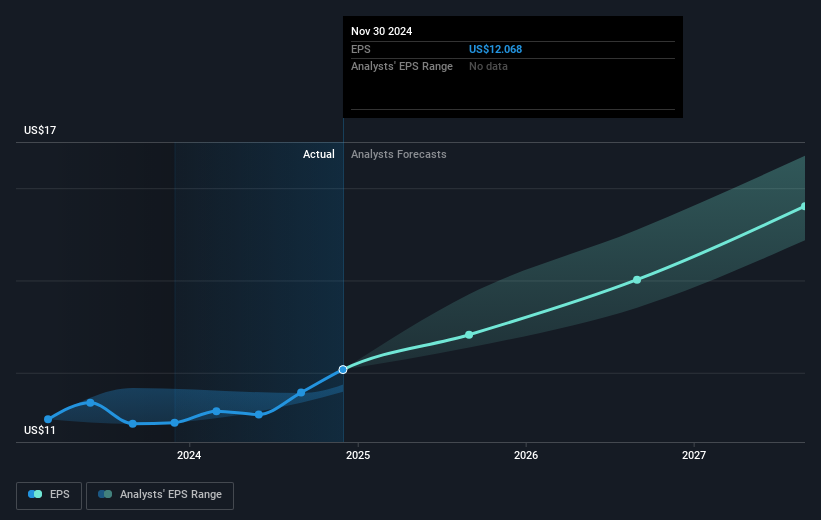

Accenture (NYSE:ACN) recently declared a substantial 15% increase in its quarterly dividend to $1.48 per share, alongside reporting robust second-quarter earnings with sales rising to $16.7 billion and net income increasing year-over-year. Despite these positive developments, the company's shares registered a 5.1% drop over the last week. This decline comes amid a broader market recovering from losses, as the S&P 500 attempts to break a four-week losing streak and economic uncertainties persist. Accenture's stock performance may reflect investor caution as market trends adjust, despite its strong financial reporting and shareholder-focused initiatives.

Buy, Hold or Sell Accenture? View our complete analysis and fair value estimate and you decide.

Accenture's shares have shown a total return of 89.08% over the past five years, reflecting consistent growth and investment initiatives. The last five years have seen Accenture significantly expand its AI capabilities through investments like the AI Refinery platform and a dedicated AI workforce. Additionally, strategic acquisitions totaling US$242 million in the latest quarter underline its focus on digital transformation services, enhancing both market share and operational efficiency.

Furthermore, a strong focus on returning value to shareholders is evident through its comprehensive share buyback program, with over 514 million shares repurchased for US$43 billion since 2001. Earnings growth, partly driven by robust client partnerships such as those with Verizon Business and HPE, contrasts with uneven geographic performance and competitive pricing pressures. This backdrop of strategic investment and financial performance has positioned Accenture as a prominent player in its industry, despite the company's underperformance against both the US market and IT industry over the past year.

Dive into the specifics of Accenture here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACN

Accenture

Provides strategy and consulting, industry X, song, and technology and operation services in North America, Europe, the Middle East, Africa, and internationally.

Outstanding track record, undervalued and pays a dividend.