- United States

- /

- IT

- /

- NYSE:ACN

Accenture (ACN) Valuation Check After Expanding Anthropic Partnership and Scaling Enterprise AI Capabilities

Reviewed by Simply Wall St

Accenture (ACN) just doubled down on enterprise AI by expanding its partnership with Anthropic and creating a dedicated business group to train about 30,000 staff, a move squarely aimed at scaling clients beyond experimental pilots.

See our latest analysis for Accenture.

Those back to back deals with Anthropic, OpenAI and Snowflake help explain why Accenture’s 30 day share price return is 11.31%, even as its year to date share price return is still down 21.96%. This leaves long term total shareholder returns positive but modest, so momentum now looks to be rebuilding from a lower base.

If this AI push has your attention, it could be a good moment to see what else is emerging in the space by exploring high growth tech and AI stocks.

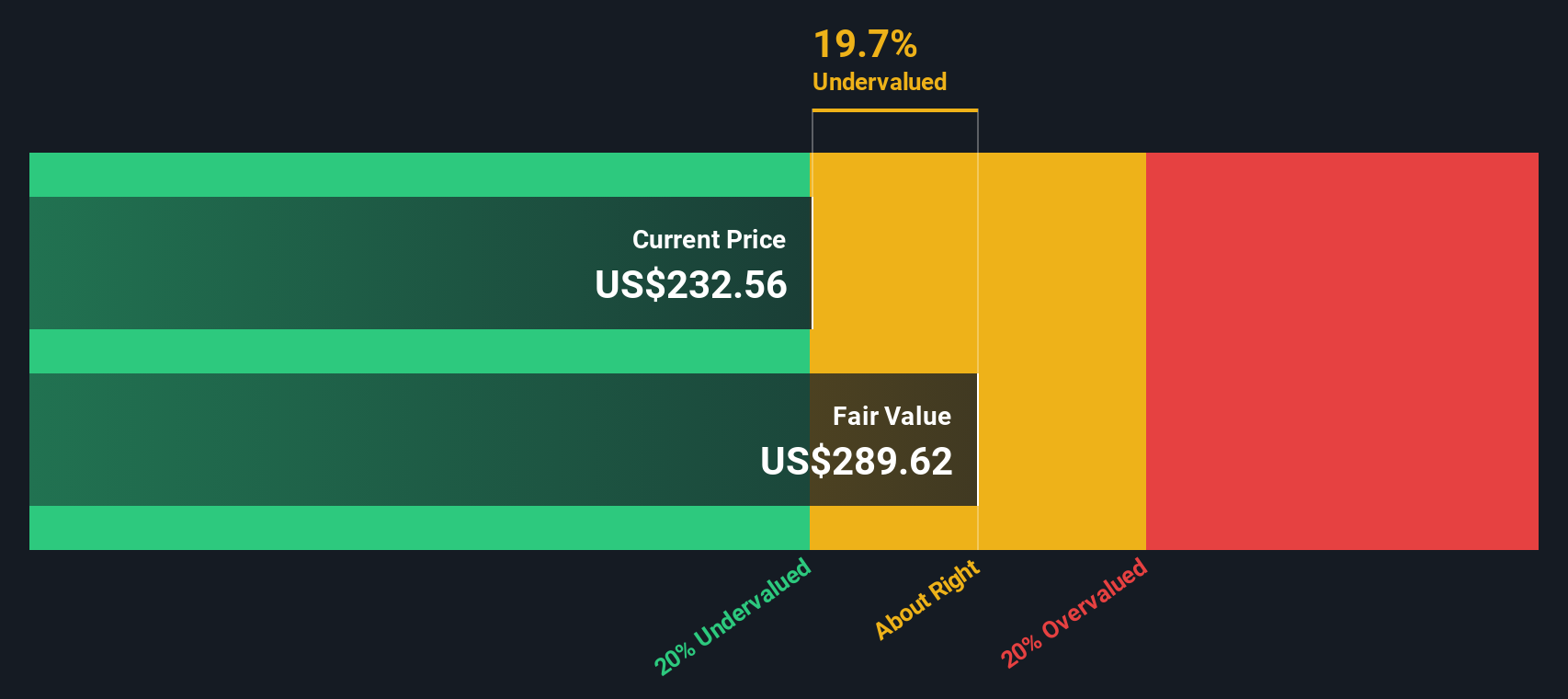

With revenue and earnings still growing, but the stock trading only slightly below analyst and intrinsic value estimates, the real question now is whether Accenture offers upside from here or if markets already price in its AI driven reinvention.

Most Popular Narrative Narrative: 34.5% Overvalued

According to FCruz, the narrative fair value for Accenture sits well below the last close of $272.22, framing the recent AI enthusiasm against more conservative long term assumptions.

Fundamental1) Valuation and Quality

Curious why a high quality, cash rich leader could still screen as expensive? The narrative leans on resilient margins, disciplined growth and a future earnings multiple that may surprise you. Want to see which profitability and growth levers carry the most weight in that fair value call? Read on to unpack the full playbook behind this valuation stance.

Result: Fair Value of $202.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained weakness in overall bookings or a sharper than expected slowdown in consulting spend could quickly challenge this overvalued narrative.

Find out about the key risks to this Accenture narrative.

Another Lens on Value

While the narrative fair value pins Accenture as 34.5% overvalued, our DCF model is more forgiving, putting fair value at roughly $276.79 versus the current $272.22, implying the shares are slightly undervalued. Is the truth somewhere between disciplined caution and quiet opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Accenture Narrative

If you see the story differently or want to stress test your own assumptions using the same data, you can build a custom view in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Accenture.

Ready for your next investment move?

Before you close this tab, lock in an edge by scanning fresh opportunities on Simply Wall Street that most investors are still overlooking.

- Target reliable income streams by checking out these 12 dividend stocks with yields > 3% that may help strengthen the foundation of your portfolio.

- Ride the next wave of innovation by zeroing in on these 26 AI penny stocks positioned at the heart of the AI transformation.

- Hunt for mispriced potential through these 907 undervalued stocks based on cash flows that could be trading below what their cash flows truly justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACN

Accenture

Provides strategy and consulting, industry X, song, and technology and operation services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet established dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026