- United States

- /

- IT

- /

- NYSE:ACN

Accenture (ACN): Reassessing Valuation After a 10% Monthly Share Price Rebound

Reviewed by Simply Wall St

Accenture (ACN) has quietly put together a steady rebound, with the stock up about 10% over the past month after a weak year to date. That move has investors revisiting its long term setup.

See our latest analysis for Accenture.

That recent pop in the share price, with a 7 day share price return of about 10 percent and a 30 day share price return close to 10 percent as well, has come after a tough stretch where year to date share price returns and 1 year total shareholder returns are still firmly negative. However, the 5 year total shareholder return shows Accenture has ultimately rewarded patient holders over a longer horizon, suggesting momentum may be turning rather than starting from scratch at this latest share price of $272.85.

If Accenture's rebound has you rethinking where the real opportunities are in tech, this could be a smart moment to explore high growth tech and AI stocks for more potential ideas.

With shares now hovering just below Wall Street’s targets after a sharp bounce, the key question is whether Accenture is still trading at a discount to its long term potential, or if the market is already pricing in the next leg of growth.

Most Popular Narrative Narrative: 34.8% Overvalued

According to FCruz, the narrative fair value for Accenture sits well below the recent 272.85 dollar close, framing a sizable valuation gap that hinges on execution.

Read‑through: After a sector de‑rating, ACN trades around its long‑run average multiple with superior profitability and returns on capital for a services name.

Curious why a high quality, cash rich leader could still screen expensive? The answer hides in its margin roadmap and a punchy future earnings multiple. Want to see which growth levers and profitability targets drive that bold fair value cut, and how long they are expected to hold up? The full narrative lays out the entire playbook.

Result: Fair Value of $202.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained weakness in overall bookings and prolonged consulting decision delays could undermine the margin story and keep the stock’s premium hard to justify.

Find out about the key risks to this Accenture narrative.

Another Take Using Market Multiples

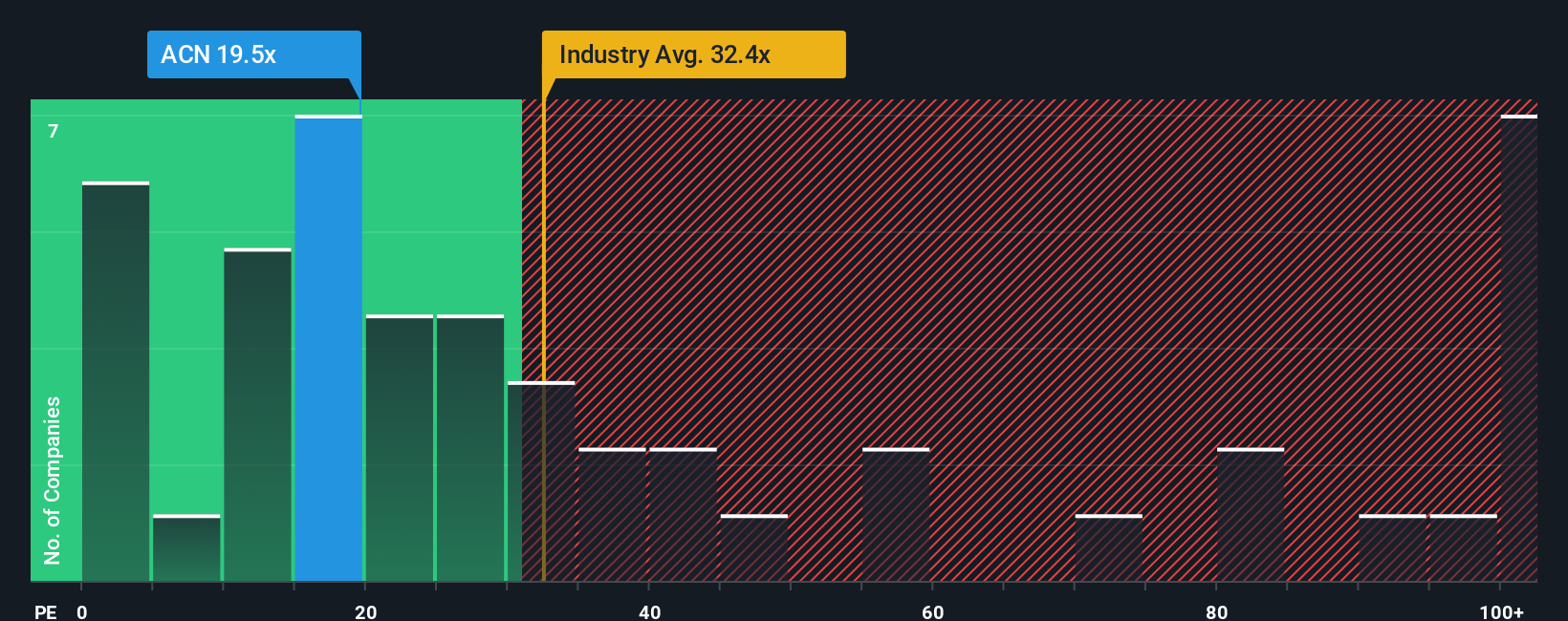

While the narrative fair value pegs Accenture as heavily overvalued, our ratio based view sends a different signal. At about 22 times earnings, the stock trades cheaper than both US IT peers on roughly 29.7 times and its own fair ratio of 36.6 times, which hints that execution risk might already be partly priced in. Could the downside already be more limited than the narrative suggests?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Accenture Narrative

If you see the story differently or want to test your own assumptions directly against the numbers, you can build a full view faster than you think: Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Accenture.

Ready for more investment ideas beyond Accenture?

If you only stop at Accenture, you risk missing out on other compelling setups. Use the Simply Wall St Screener to pinpoint your next edge.

- Capture mispriced opportunities by targeting these 920 undervalued stocks based on cash flows where strong cash flows meet prices that have not yet caught up.

- Ride powerful innovation trends by focusing on these 25 AI penny stocks, tapping companies at the heart of real world AI adoption.

- Lock in dependable income potential with these 14 dividend stocks with yields > 3%, zeroing in on yields above 3 percent backed by solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACN

Accenture

Provides strategy and consulting, industry X, song, and technology and operation services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet established dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026