- United States

- /

- Software

- /

- NasdaqGS:ZS

Will Zscaler’s (ZS) Push into Healthcare Zero Trust Redefine Its Competitive Edge?

Reviewed by Sasha Jovanovic

- The Alliance for Smart Healthcare Excellence recently announced that Zscaler, Inc. will sponsor the development of the Zero Trust Maturation Model (ZTMM), a framework designed to help healthcare organizations strengthen their defenses against growing cyber threats.

- This initiative positions Zscaler at the forefront of addressing digital risk and cybersecurity maturity in the rapidly evolving healthcare sector.

- We'll take a look at how Zscaler's role in advancing Zero Trust frameworks could influence its long-term industry leadership and growth opportunities.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 33 companies in the world exploring or producing it. Find the list for free.

Zscaler Investment Narrative Recap

To be confident as a Zscaler shareholder, you need to believe that the shift to zero trust security as a core requirement, especially in critical industries like healthcare, will keep the company ahead of evolving cybersecurity risks and help it win key enterprise accounts. Zscaler's new sponsorship of the Zero Trust Maturation Model highlights its commitment to industry-wide standards, but this move does not materially change the near-term catalysts or the biggest risk: intensifying competition from public cloud providers and established cybersecurity vendors.

Among recent updates, Zscaler's AI-driven security enhancements from June 2025 stand out as particularly relevant, as protecting smart healthcare technology requires advanced solutions capable of handling the surge in AI and IoT threats. Continued innovation in AI security remains a catalyst, supporting Zscaler’s ability to serve increasingly complex digital environments and address emerging client needs.

In contrast, investors should also be aware that the rise of bundled security offerings by cloud giants could...

Read the full narrative on Zscaler (it's free!)

Zscaler's outlook anticipates $4.7 billion in revenue and $139.8 million in earnings by 2028. This scenario requires annual revenue growth of 20.5% and an increase in earnings of $181.3 million from the current -$41.5 million.

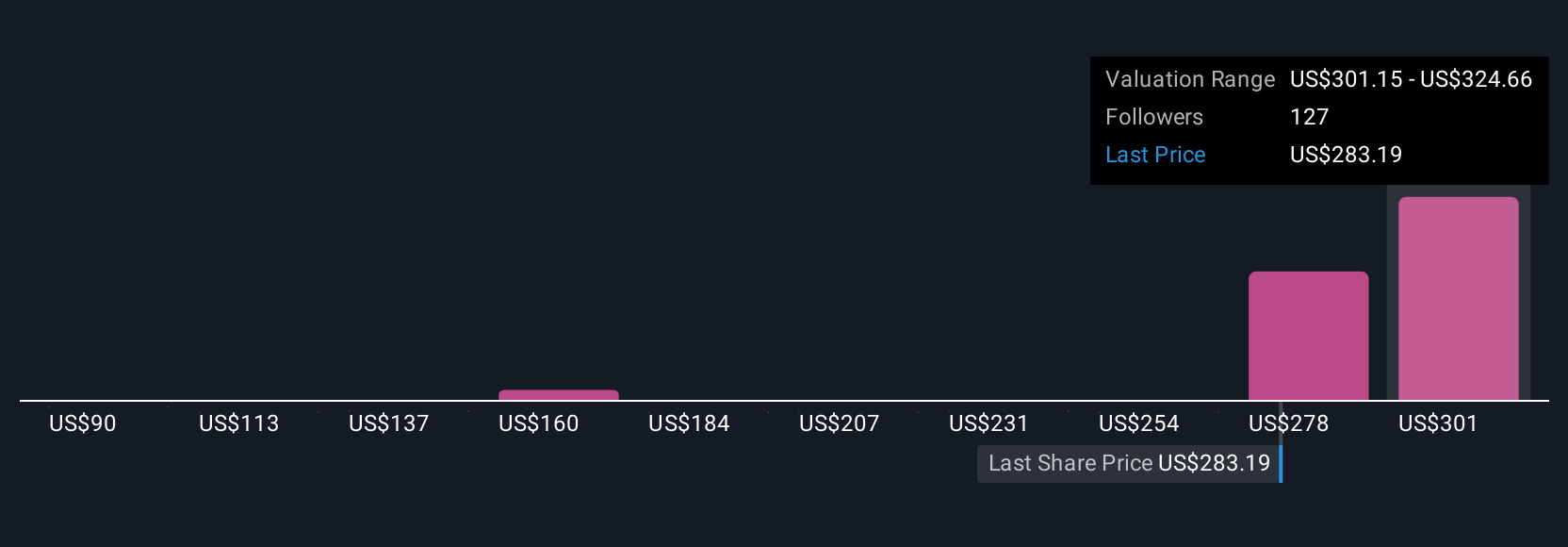

Uncover how Zscaler's forecasts yield a $324.66 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members produced nine fair value estimates for Zscaler between US$89.53 and US$324.66, reflecting a broad mix of outlooks. As you consider these varied opinions, remember that intensifying competition from public cloud providers could reshape growth opportunities, making it essential to weigh multiple perspectives.

Explore 9 other fair value estimates on Zscaler - why the stock might be worth as much as 6% more than the current price!

Build Your Own Zscaler Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zscaler research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Zscaler research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zscaler's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zscaler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZS

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives