- United States

- /

- Software

- /

- NasdaqGS:ZS

Exploring 3 High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

The U.S. stock market recently experienced a rebound, with major indices such as the Nasdaq, Dow Jones Industrial Average, and S&P 500 closing higher amid a recovery from a tech sector downturn and ongoing economic uncertainty due to the government shutdown. In this environment, high growth tech stocks can be particularly appealing for investors seeking potential returns in sectors driven by innovation and strong demand trends like AI; however, selecting promising stocks requires careful consideration of company fundamentals and market positioning.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Exelixis | 11.10% | 22.30% | ★★★★★☆ |

| Palantir Technologies | 26.74% | 29.17% | ★★★★★★ |

| Workday | 11.19% | 32.07% | ★★★★★☆ |

| Praxis Precision Medicines | 70.78% | 67.85% | ★★★★★★ |

| RenovoRx | 65.52% | 68.63% | ★★★★★☆ |

| Circle Internet Group | 27.53% | 82.41% | ★★★★★☆ |

| OS Therapies | 56.64% | 68.61% | ★★★★★☆ |

| Gorilla Technology Group | 32.75% | 122.61% | ★★★★★☆ |

| Aldeyra Therapeutics | 42.92% | 73.80% | ★★★★★☆ |

| Zscaler | 15.72% | 40.94% | ★★★★★☆ |

Click here to see the full list of 79 stocks from our US High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

CareDx (CDNA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CareDx, Inc. focuses on creating and marketing diagnostic solutions for transplant patients and caregivers globally, with a market cap of $772.86 million.

Operations: The company generates revenue through the development and commercialization of diagnostic solutions specifically designed for transplant patients, catering to both domestic and international markets.

CareDx, a player in the transplantation diagnostics market, has shown resilience and innovation with its latest financials revealing a significant turnaround. From a net loss of $10.64 million to a net income of $1.68 million this quarter, alongside revenue jumping from $82.88 million to $100.06 million year-over-year, the company's recovery is notable. This performance aligns with their raised full-year revenue forecast now set between $372 million and $376 million, reflecting confidence in continued growth driven by advancements like the SHORE study for heart transplant surveillance and new leadership under Dr. Jeffrey Teuteberg as CMO—further cementing its foothold in high-stakes medical technology sectors.

- Navigate through the intricacies of CareDx with our comprehensive health report here.

Gain insights into CareDx's historical performance by reviewing our past performance report.

Advanced Energy Industries (AEIS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Advanced Energy Industries, Inc. specializes in precision power conversion, measurement, and control solutions globally with a market cap of $7.34 billion.

Operations: Advanced Energy Industries focuses on delivering precision power conversion, measurement, and control solutions across various global markets. The company operates with a market capitalization of approximately $7.34 billion.

Despite a challenging year with a one-off loss of $42.4 million, Advanced Energy Industries (AE) has demonstrated resilience and strategic foresight in its operations. The company reported substantial growth in its third-quarter revenue, reaching $463.3 million, up from $374.2 million the previous year, reflecting a robust increase of nearly 24%. This performance is underpinned by AE's significant commitment to R&D, crucial for maintaining technological leadership in the precision power conversion sector. Looking ahead, AE's guidance for the fourth quarter anticipates earnings per share between $0.87 and $1.37 and revenue projections around $470 million, indicating confidence in sustained operational efficiency and market demand.

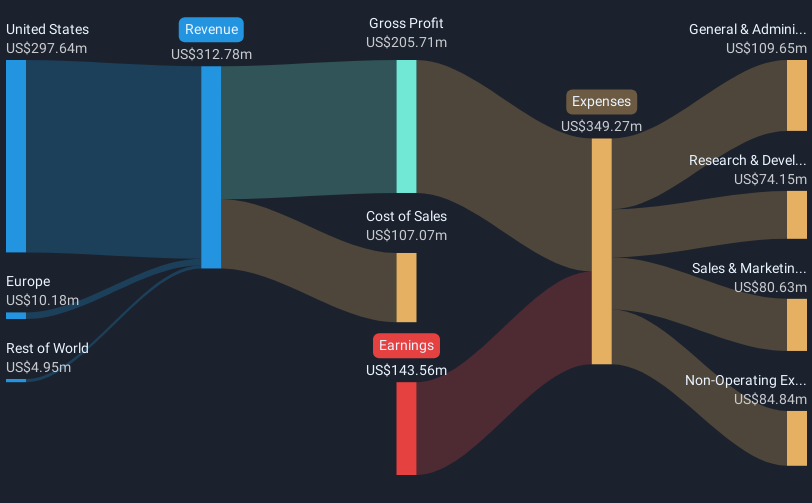

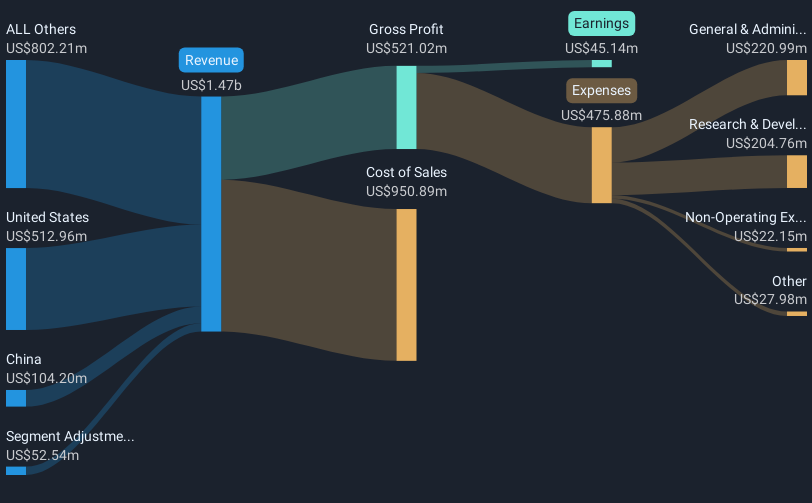

Zscaler (ZS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zscaler, Inc. is a global cloud security company with a market capitalization of $51.97 billion.

Operations: The company generates revenue primarily from the sale of subscription services to its cloud platform and related support services, amounting to $2.67 billion.

Zscaler's recent unveiling of enhanced Zscaler Digital Experience (ZDX) capabilities marks a significant step in addressing the costly challenge of digital downtime, which is estimated to cost businesses $400 billion annually. By integrating advanced telemetry across devices, networks, and applications, ZDX reduces detection times by 98% and issue resolution from days to minutes. This innovation not only boosts productivity but also aligns with the growing necessity for Zero Trust architectures in cybersecurity—critical as enterprises increasingly depend on robust digital infrastructures. Moreover, the strategic expansion with HCLTech leverages AI for network transformation and heightens zero-trust security efficacy, positioning Zscaler at the forefront of enterprise resilience initiatives.

- Click here and access our complete health analysis report to understand the dynamics of Zscaler.

Review our historical performance report to gain insights into Zscaler's's past performance.

Key Takeaways

- Take a closer look at our US High Growth Tech and AI Stocks list of 79 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zscaler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZS

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives