- United States

- /

- Software

- /

- NasdaqCM:WULF

With A 37% Price Drop For TeraWulf Inc. (NASDAQ:WULF) You'll Still Get What You Pay For

The TeraWulf Inc. (NASDAQ:WULF) share price has fared very poorly over the last month, falling by a substantial 37%. Looking at the bigger picture, even after this poor month the stock is up 69% in the last year.

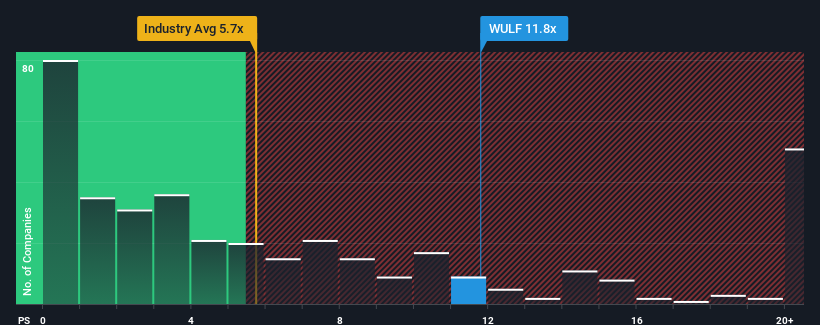

In spite of the heavy fall in price, TeraWulf's price-to-sales (or "P/S") ratio of 11.8x might still make it look like a strong sell right now compared to other companies in the Software industry in the United States, where around half of the companies have P/S ratios below 5.6x and even P/S below 2x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for TeraWulf

What Does TeraWulf's P/S Mean For Shareholders?

Recent times have been advantageous for TeraWulf as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on TeraWulf.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as TeraWulf's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 131% last year. Although, its longer-term performance hasn't been as strong with three-year revenue growth being relatively non-existent overall. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 60% per year over the next three years. With the industry only predicted to deliver 20% each year, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why TeraWulf's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

TeraWulf's shares may have suffered, but its P/S remains high. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into TeraWulf shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware TeraWulf is showing 3 warning signs in our investment analysis, and 2 of those don't sit too well with us.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if TeraWulf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:WULF

TeraWulf

Operates as a digital asset technology company in the United States.

Slight risk with limited growth.

Similar Companies

Market Insights

Community Narratives