- United States

- /

- Specialty Stores

- /

- NYSE:RH

Insider-Favored Growth Stocks To Watch In November 2025

Reviewed by Simply Wall St

As the U.S. stock market kicks off a holiday-shortened week with notable gains across major indexes, investors are increasingly optimistic about a potential interest rate cut by the Federal Reserve in December. Amid this backdrop, growth companies with high insider ownership are garnering attention as they often signal strong confidence from those closest to the business, making them intriguing options for those looking to navigate current market conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 14.0% | 50.7% |

| StubHub Holdings (STUB) | 23.3% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 26.3% | 114.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| FTC Solar (FTCI) | 22.6% | 78.8% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.2% |

| Astera Labs (ALAB) | 11.9% | 29.1% |

| AppLovin (APP) | 27.5% | 26.4% |

Underneath we present a selection of stocks filtered out by our screen.

TeraWulf (WULF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TeraWulf Inc. is a digital asset technology company operating in the United States with a market cap of $4.73 billion.

Operations: TeraWulf Inc. generates its revenue through digital asset technology operations in the United States.

Insider Ownership: 14.4%

TeraWulf is experiencing significant revenue growth, with a forecast of 49% annually, surpassing the US market average. Despite high insider ownership, recent months have seen substantial insider selling. The company reported a net loss of US$455.05 million for Q3 2025 but is expected to become profitable within three years. A strategic joint venture with Fluidstack aims to generate US$9.5 billion in contracted revenue over 25 years, enhancing its growth prospects despite financial volatility and limited cash runway.

- Click here to discover the nuances of TeraWulf with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of TeraWulf shares in the market.

Klaviyo (KVYO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Klaviyo, Inc. is a technology company that offers a software-as-a-service platform globally, with a market cap of approximately $8.35 billion.

Operations: The company generates revenue primarily from its Internet Software segment, which accounted for $1.15 billion.

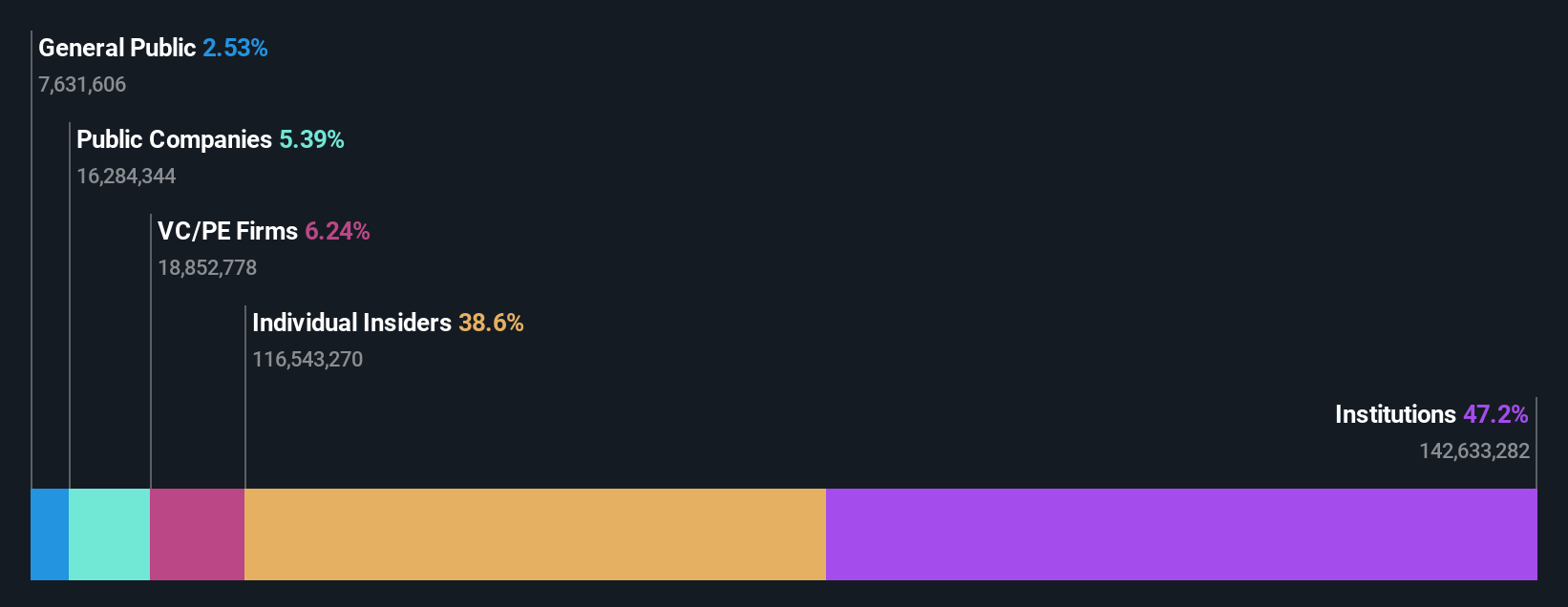

Insider Ownership: 38.6%

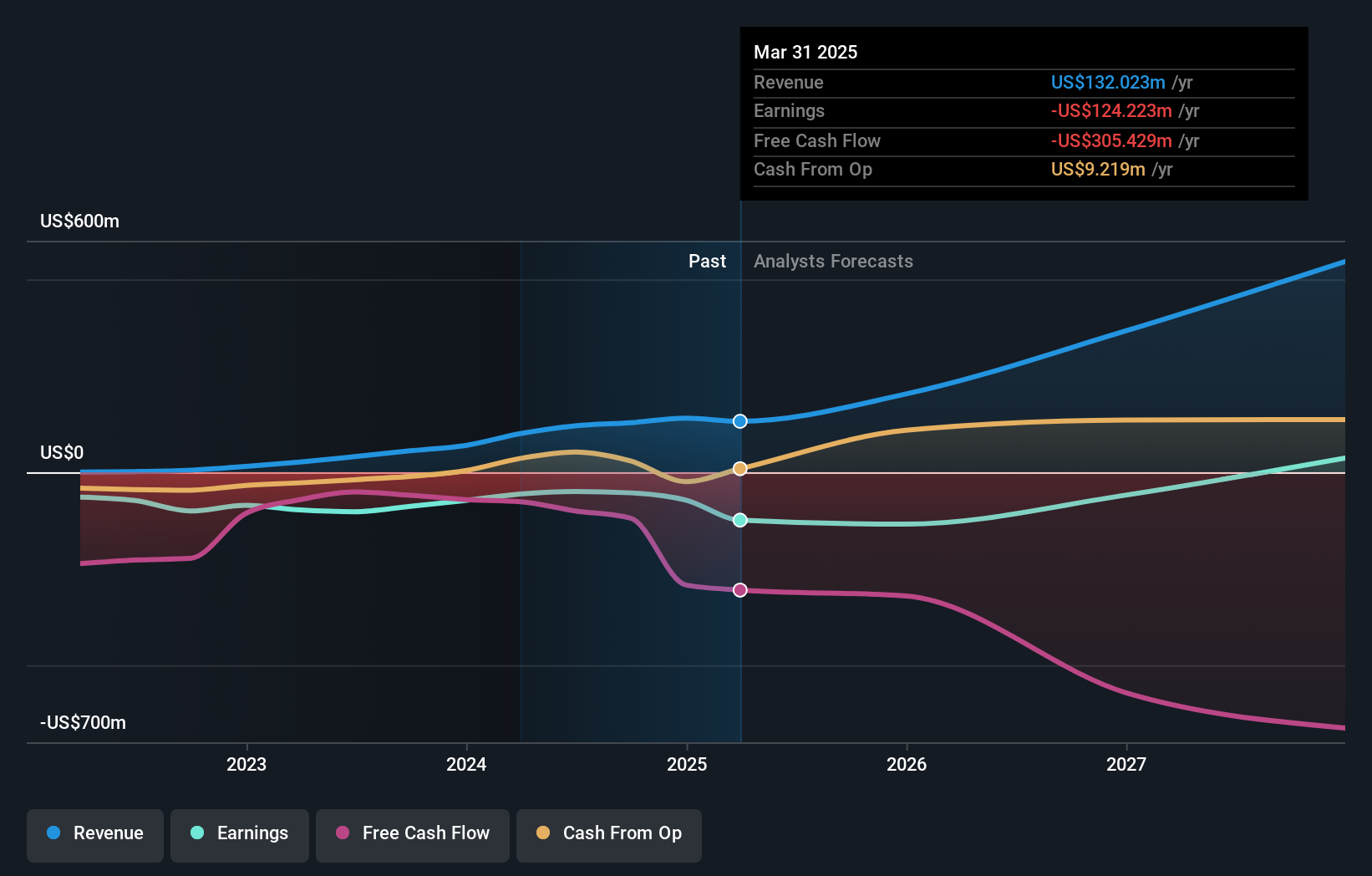

Klaviyo is forecast to become profitable in three years, with revenue growth of 17.5% per year, outpacing the US market. Recent earnings showed Q3 sales of US$310.88 million, up from US$235.09 million a year ago, though net loss remains at US$0.426 million. The company raised its 2025 revenue guidance to approximately US$1.22 billion and launched AI-driven CRM tools enhancing its competitive edge in the B2C sector without substantial insider trading activity recently observed.

- Get an in-depth perspective on Klaviyo's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Klaviyo's current price could be quite moderate.

RH (RH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RH operates as a retailer and lifestyle brand in the home furnishings market across several countries, including the United States, Canada, and parts of Europe, with a market cap of approximately $2.87 billion.

Operations: The company's revenue segments include Waterworks, generating $195.70 million, and Restoration Hardware (RH), contributing $3.14 billion.

Insider Ownership: 16.7%

RH has demonstrated robust growth, with second-quarter 2025 earnings surging to US$51.71 million from US$28.95 million a year prior, despite tariff-related challenges impacting fiscal guidance. The company recently expanded its luxury retail footprint with the opening of RH Manhasset and completed a significant share buyback program totaling approximately US$2.75 billion since 2018. Insider trading activities show more buying than selling in recent months, supporting confidence in RH's strategic direction amidst forecasted slower revenue growth compared to the broader market.

- Navigate through the intricacies of RH with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of RH shares in the market.

Seize The Opportunity

- Click here to access our complete index of 202 Fast Growing US Companies With High Insider Ownership.

- Ready To Venture Into Other Investment Styles? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RH

RH

Operates as a retailer and lifestyle brand in the home furnishings market in the United States, Canada, the United Kingdom, Germany, Belgium, and Spain.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives