- United States

- /

- Software

- /

- NasdaqCM:WULF

High Insider Ownership Growth Stocks To Watch In May 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has shown a robust annual growth of 7.2% and anticipates an earnings increase of 14% per annum in the coming years. In this context, growth companies with high insider ownership can be appealing as they often indicate confidence from those closest to the business while potentially aligning with broader market optimism.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.1% | 34.1% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39.5% |

| FTC Solar (NasdaqCM:FTCI) | 32.7% | 61.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.2% | 65.1% |

| Niu Technologies (NasdaqGM:NIU) | 36% | 82.8% |

| Astera Labs (NasdaqGS:ALAB) | 15.3% | 61.4% |

| Clene (NasdaqCM:CLNN) | 19.4% | 64% |

| BBB Foods (NYSE:TBBB) | 16.2% | 29.9% |

| Enovix (NasdaqGS:ENVX) | 12.1% | 58.4% |

| Upstart Holdings (NasdaqGS:UPST) | 12.6% | 100.2% |

Let's explore several standout options from the results in the screener.

Astrana Health (NasdaqCM:ASTH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Astrana Health, Inc. is a healthcare management company offering medical care services in the United States, with a market cap of approximately $1.80 billion.

Operations: The company's revenue is primarily derived from three segments: Care Delivery ($136.67 million), Care Partners ($1.95 billion), and Care Enablement ($155.45 million).

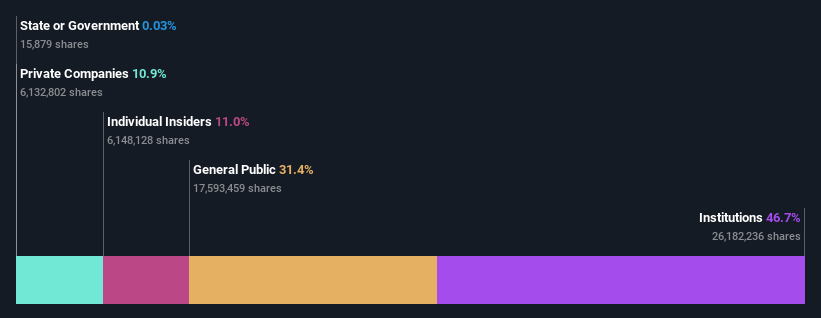

Insider Ownership: 11%

Astrana Health demonstrates potential as a growth company with high insider ownership, despite recent challenges. The company's revenue is forecast to grow at 14.2% annually, outpacing the broader US market. However, profit margins have declined from 4.4% to 2.1%. Recent executive changes include appointing Glenn W. Sobotka as Chief Accounting Officer, which could impact financial strategy positively given his extensive experience in senior roles across health companies like Arkos and Carbon Health.

- Delve into the full analysis future growth report here for a deeper understanding of Astrana Health.

- Upon reviewing our latest valuation report, Astrana Health's share price might be too pessimistic.

TeraWulf (NasdaqCM:WULF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TeraWulf Inc. operates as a digital asset technology company in the United States, with a market cap of approximately $1.15 billion.

Operations: The company generates revenue primarily from digital currency mining, amounting to $140.05 million.

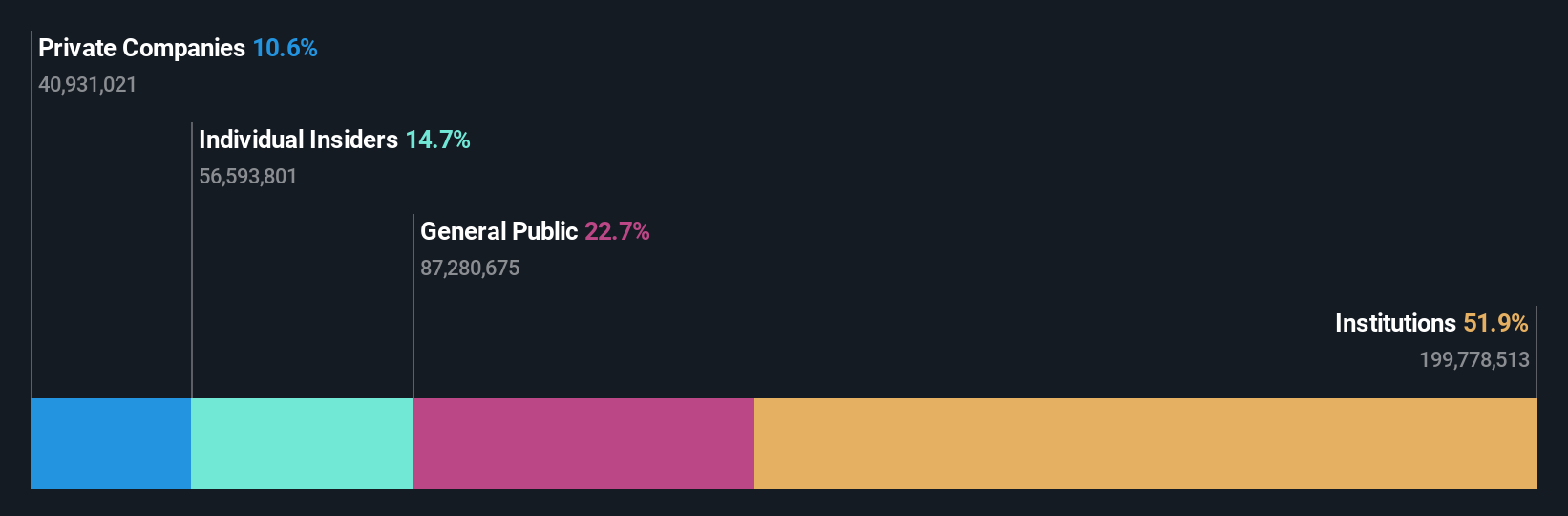

Insider Ownership: 14.3%

TeraWulf shows promise with a forecasted revenue growth of 40% annually, surpassing the US market's average. While it aims to achieve profitability within three years, its financial position is strained with less than a year of cash runway. Despite recent shareholder dilution, the company completed a $150 million buyback program. Recent earnings reported sales of US$140.05 million, doubling from the previous year, though net losses remain significant at US$72.42 million.

- Click here to discover the nuances of TeraWulf with our detailed analytical future growth report.

- Our valuation report unveils the possibility TeraWulf's shares may be trading at a premium.

JinkoSolar Holding (NYSE:JKS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JinkoSolar Holding Co., Ltd. is involved in the design, development, production, and marketing of photovoltaic products, with a market cap of approximately $905.47 million.

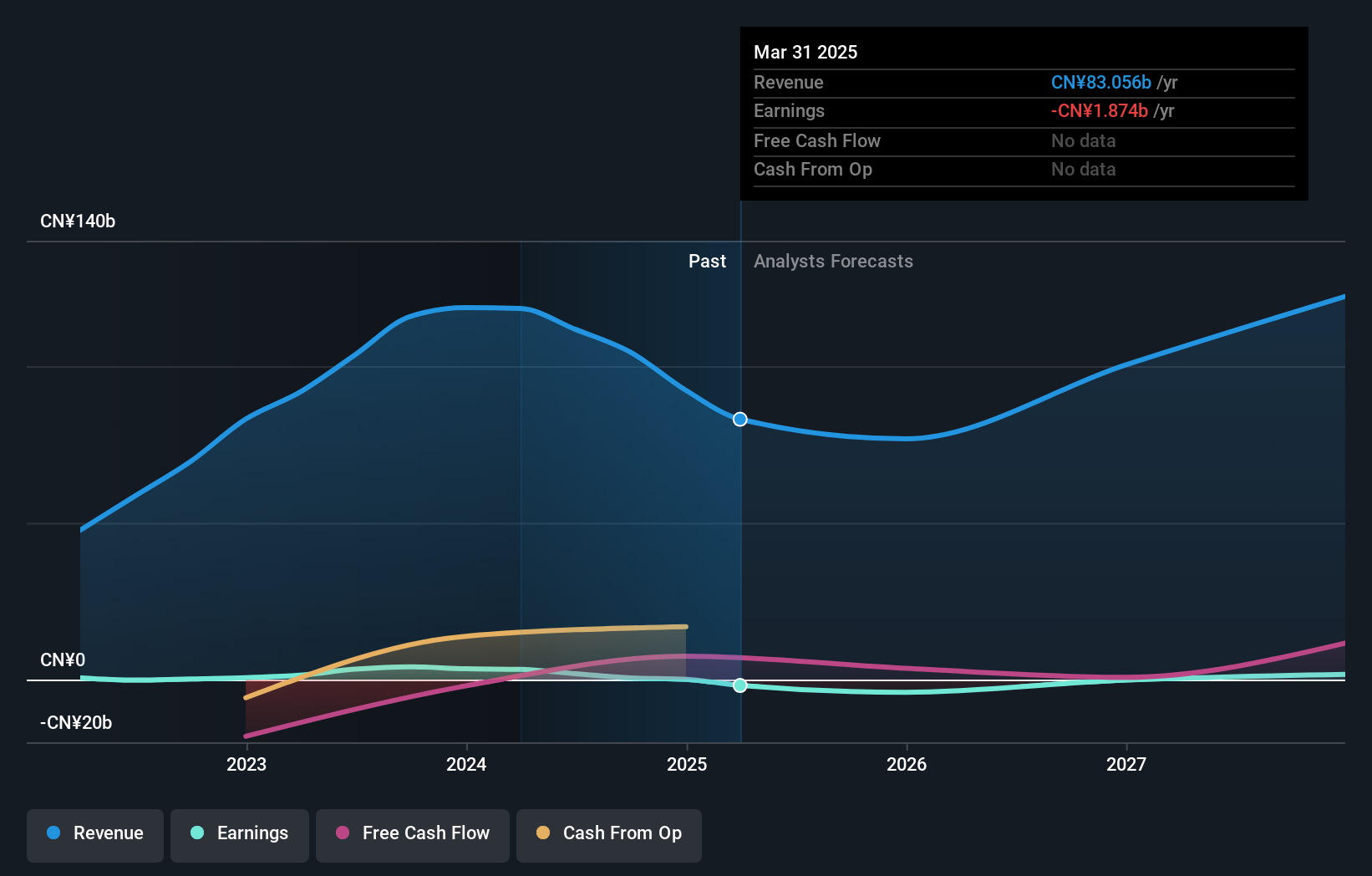

Operations: The company generates revenue primarily through its manufacturing segment, which accounted for CN¥83.06 billion.

Insider Ownership: 38.5%

JinkoSolar Holding is navigating challenges with a recent net loss of CNY 1,318.88 million in Q1 2025, despite aiming for profitability within three years. The company forecasts substantial growth in module shipments and production capacity by the end of 2025, aligning with its expected annual profit growth above market averages. However, legal issues persist due to a patent lawsuit from First Solar. JinkoSolar trades significantly below its estimated fair value but carries high debt levels.

- Navigate through the intricacies of JinkoSolar Holding with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report JinkoSolar Holding implies its share price may be lower than expected.

Where To Now?

- Click here to access our complete index of 203 Fast Growing US Companies With High Insider Ownership.

- Interested In Other Possibilities? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade TeraWulf, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TeraWulf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:WULF

TeraWulf

Operates as a digital asset technology company in the United States.

High growth potential low.

Similar Companies

Market Insights

Community Narratives