- United States

- /

- IT

- /

- NasdaqGS:WIX

Wix.com (WIX) Valuation Check After Earnings Beat, 2025 Guidance Hike and AI Expansion

Reviewed by Simply Wall St

Wix.com (WIX) just delivered an earnings beat, lifted its 2025 revenue outlook, and saw a major institutional investor boost its stake, together with an active buyback that signals managements confidence.

See our latest analysis for Wix.com.

Even with upbeat earnings, higher 2025 guidance, and the Base44 acquisition strengthening its AI tools, Wix.com’s recent share price return has been weak. Short term pressure contrasts with a stronger three year total shareholder return, suggesting sentiment could be stabilizing rather than collapsing.

If this mix of volatility and growth potential has your attention, it is also a good moment to scout other high growth tech names through high growth tech and AI stocks.

With shares down sharply year to date but still trading at a sizable discount to analyst targets and intrinsic estimates, the key question now is whether Wix is genuinely undervalued or if future growth is already reflected in the current price.

Most Popular Narrative: 38.8% Undervalued

With Wix.com closing at $102.64, the most widely followed narrative pegs fair value far higher, implying substantial upside if its long term plan plays out.

AI powered feature rollouts (e.g., generative engine optimization, AI marketing agent, advanced business solutions) are driving higher user monetization and enabling price optimization, which can contribute to rising average revenue per user and enhance gross margins.

Want to see how sustained double digit growth, fatter margins, and a punchy future earnings multiple all fit together? The narrative math may surprise you.

Result: Fair Value of $167.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising AI competition and heavier spending on infrastructure and marketing could squeeze margins, slowing Wix’s path to the narrative’s implied upside.

Find out about the key risks to this Wix.com narrative.

Another View: Rich on Earnings

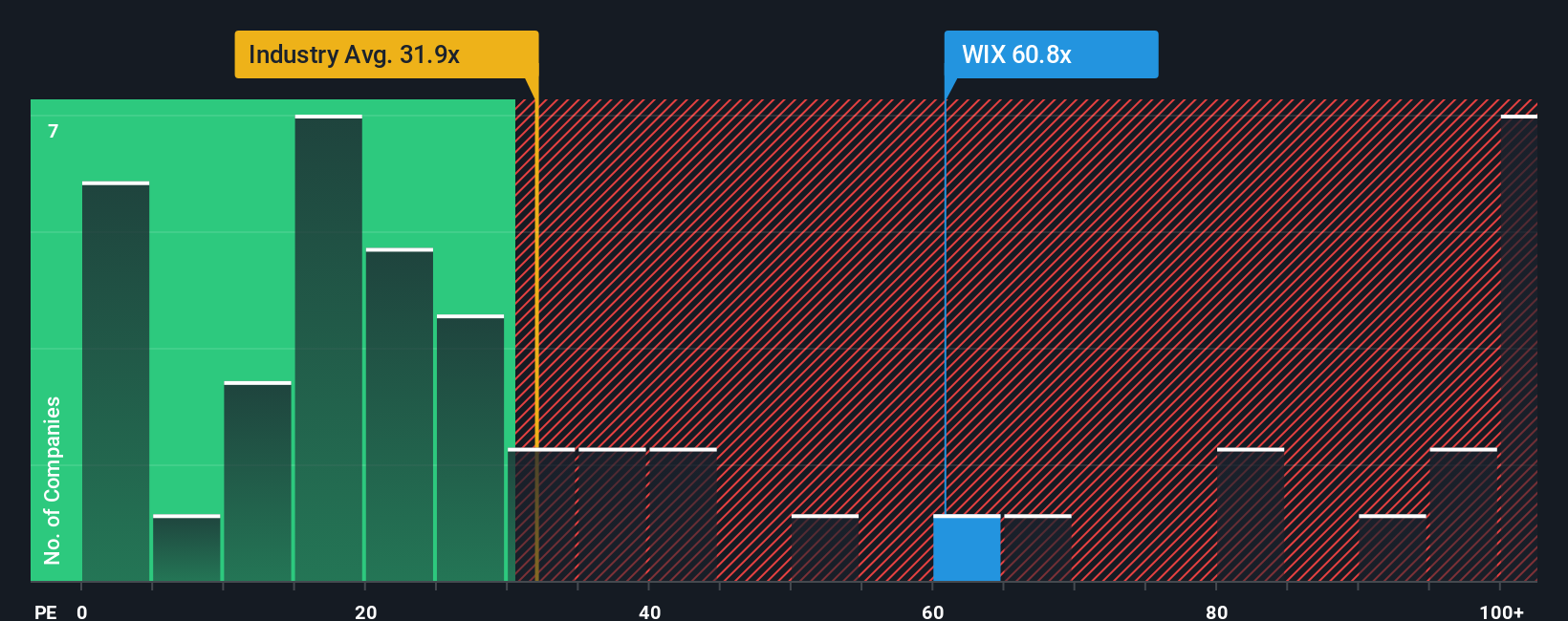

On earnings, the picture flips. Wix trades on a 40.4x price to earnings ratio, above both the US IT sector at 30x and its own 37x fair ratio, and even slightly richer than peers at 40.1x. Is this premium a signal of quality or downside risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wix.com Narrative

If you see things differently, or want to dig into the numbers yourself, you can build a fresh Wix.com story in minutes: Do it your way.

A great starting point for your Wix.com research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, take a moment to scan fresh opportunities with the Simply Wall St Screener so you are not leaving compelling ideas on the table.

- Target long term compounding potential with these 910 undervalued stocks based on cash flows, where solid businesses trade at prices that still leave room for meaningful upside.

- Capitalize on powerful market narratives by checking these 81 cryptocurrency and blockchain stocks, focused on companies building real businesses around digital assets and blockchain infrastructure.

- Secure more predictable cash returns through these 15 dividend stocks with yields > 3%, centered on companies sharing profits with investors via attractive, sustained payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wix.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WIX

Wix.com

Operates a cloud-based web development platform for registered users and creators worldwide.

High growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026