- United States

- /

- IT

- /

- NasdaqGS:WIX

Wix.com Ltd.'s (NASDAQ:WIX) 26% Price Boost Is Out Of Tune With Revenues

Wix.com Ltd. (NASDAQ:WIX) shares have continued their recent momentum with a 26% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 54% in the last year.

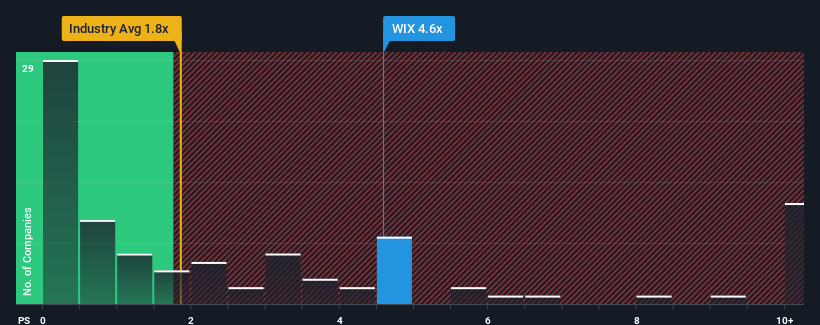

Following the firm bounce in price, when almost half of the companies in the United States' IT industry have price-to-sales ratios (or "P/S") below 1.8x, you may consider Wix.com as a stock not worth researching with its 4.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Wix.com

How Wix.com Has Been Performing

With revenue growth that's inferior to most other companies of late, Wix.com has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Wix.com will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Wix.com?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Wix.com's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. This was backed up an excellent period prior to see revenue up by 66% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 11% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 14% per year, which is noticeably more attractive.

With this information, we find it concerning that Wix.com is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Wix.com's P/S?

Shares in Wix.com have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Wix.com, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You always need to take note of risks, for example - Wix.com has 1 warning sign we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Wix.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:WIX

Wix.com

Operates as a cloud-based web development platform for registered users and creators worldwide.

High growth potential low.