- United States

- /

- IT

- /

- NasdaqGS:WIX

Adjustments and Future Projections are the Q1 Hallmarks for Wix.com Ltd.'s (NASDAQ:WIX) Earnings

Wix.com Ltd.'s ( NASDAQ:WIX ) posted earnings this Monday, with an emphasis that management is going to focus on profitability. The company expects to grow the free cash flow margin from 5% to 20% in 2025 - a good three years from now.

Now is a great time to reevaluate the business and see if it makes sense for investors in this early stage of profitability.

Earnings Performance

The highlights from the latest Q1 earnings are:

- Q1 revenue at US$342m, up 14% y/y, within estimates. Quarterly growth slowed from 16% in the previous quarter.

- Q1 EPS US$-3.95*, vs the average projection of US$-0.64 per share. Non-GAAP EPS at US$-0.72.

- Q1 gross margin at 61%, in-line with the previous quarter, a slight increase in the business solutions segment.

- Free cash flow for Q1 was US$-33.6m, and US$-20.329 in the last 12 months.

- Wix estimates Q2 revenue of $342-$346 million, an 8-10% increase, below analysts' forecasts of US$356m.

*Includes approximately $116 million of unrealized losses, net of taxes, from equity investments, primarily attributed to the decrease in share price of monday.com (Nasdaq: MNDY ). Wix holds some 2.65% in the company. Our report indicates that it is a high risk/reward stock .

Management indicated that they will be focusing on profitability and strive to increase the FCF margin from 5% to 20% by FY 2025. The free cash flows are still negative, and management is relying on adjusting CapEx in order to bring them on the right side of 0.

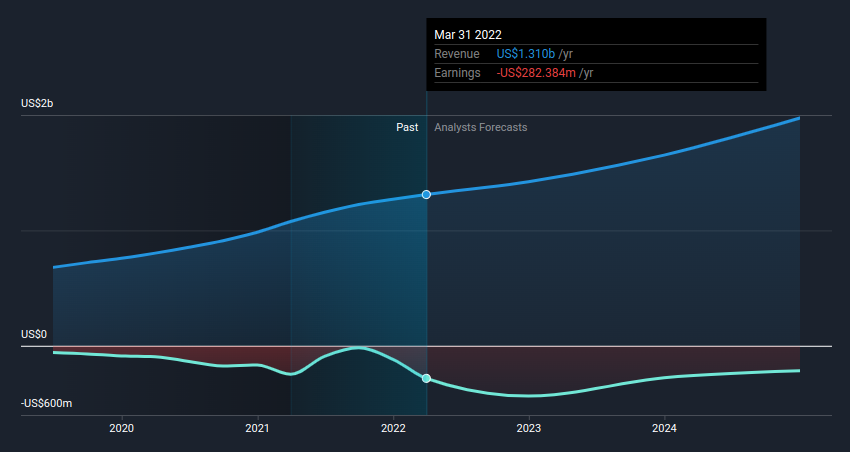

In the chart below, we can see what analysts are expecting to see for WIX in the future. While revenue is expected to grow, there is a significant build-up needed before analysts see profitability.

Business Review

Wix.com Ltd., exists since 2006, has a cloud-based platform that enables anyone to create a website or web application.

As opposed to competitors such as Shopify ( NYSE:SHOP ), Wix is more geared towards capturing market share of the service industry. Their business solutions offer advanced functionalities such as appointments, online payments etc. This is great for businesses offering services, such as clinics, restaurants, architecture studios...

Our analysis shows that the company has significant upside . However, Wix has not validated their business model yet, as the company is only now stressing a dedication to profitability. Investors should look at the risks before making their mind up on Wix.

Next Steps:

There are key fundamentals of Wix.com which are not covered in this article, but we must stress again that this is merely a basic overview. For a more comprehensive look at Wix.com, take a look atWix.com's company page on Simply Wall St .

We've also compiled a list ofkeyaspectsyou should further research:

- Competitors: Technology shifts, and it becomes increasingly cheaper to create web sites/apps, view the list of key companies fighting for the same market share.

- Management Team : An experienced management team on the helm increases our confidence in the business – take a look at who sits on Wix.com’s board and the CEO’s background .

- Other High-Performing Stocks : Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here .

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wix.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:WIX

Wix.com

Operates a cloud-based web development platform for registered users and creators worldwide.

High growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion