- United States

- /

- Software

- /

- NasdaqGS:APP

High Growth Tech Stocks In The US For July 2025

Reviewed by Simply Wall St

The United States market has shown a robust performance, climbing 1.7% over the past week and 18% in the last year, with earnings projected to grow by 15% annually in the coming years. In this thriving environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation, scalability, and adaptability to leverage these favorable conditions effectively.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 25.17% | 38.20% | ★★★★★★ |

| Circle Internet Group | 30.81% | 60.66% | ★★★★★★ |

| Ardelyx | 20.96% | 62.26% | ★★★★★★ |

| TG Therapeutics | 26.14% | 39.04% | ★★★★★★ |

| Alkami Technology | 20.57% | 76.67% | ★★★★★★ |

| AVITA Medical | 27.39% | 61.05% | ★★★★★★ |

| Alnylam Pharmaceuticals | 24.07% | 59.30% | ★★★★★★ |

| Ascendis Pharma | 34.90% | 59.91% | ★★★★★★ |

| Caris Life Sciences | 24.80% | 72.64% | ★★★★★★ |

| Lumentum Holdings | 21.59% | 106.24% | ★★★★★★ |

Click here to see the full list of 220 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

AppLovin (APP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AppLovin Corporation develops a software-based platform that aids advertisers in optimizing the marketing and monetization of their content globally, with a market cap of $118.44 billion.

Operations: The company generates revenue primarily through two segments: Apps, which contributed $1.43 billion, and Advertising, which brought in $3.70 billion. The focus is on enhancing marketing and monetization strategies for advertisers both domestically and internationally.

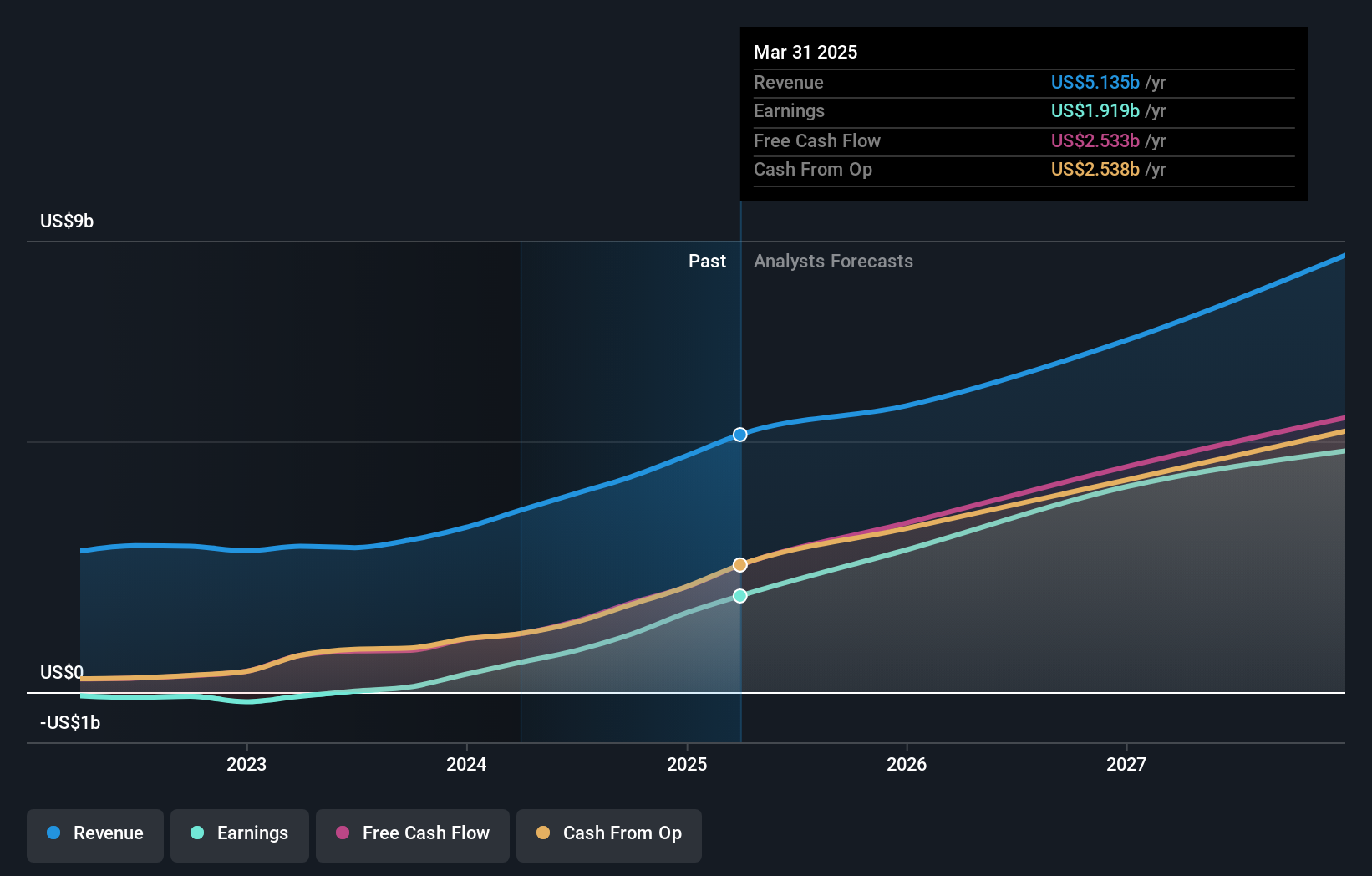

AppLovin's recent performance underscores its robust position in the tech sector, with a notable 222.9% surge in earnings over the past year, outpacing the software industry's growth of 18.7%. This growth trajectory is supported by an aggressive R&D focus, where significant investment is channeled towards innovation—evident from R&D expenses which are strategically aligned to foster advancements in mobile advertising technologies. Furthermore, AppLovin's strategic index movements and inclusion in the Russell Top 200 Growth Benchmark reflect its evolving market presence and investor confidence. The introduction of Chartboost by LoopMe on AppLovin’s MAX platform marks a pivotal enhancement to their service offerings, potentially revolutionizing publisher monetization strategies through advanced bidding capabilities. This development not only diversifies revenue streams but also amplifies operational efficiencies within the digital advertising ecosystem.

- Delve into the full analysis health report here for a deeper understanding of AppLovin.

Gain insights into AppLovin's historical performance by reviewing our past performance report.

Intuit (INTU)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Intuit Inc. is a company that offers financial management, compliance, and marketing products and services in the United States, with a market capitalization of approximately $213.89 billion.

Operations: Intuit generates revenue primarily from its Global Business Solutions segment, which accounts for $10.62 billion, followed by Consumer at $4.85 billion and Credit Karma at $2.10 billion. The Pro-Tax segment contributes a smaller portion with $618 million in revenue.

Intuit's recent unveiling of the Intuit Enterprise Suite marks a significant leap in AI-driven business management solutions, particularly for mid-market companies. This suite integrates ERP-level capabilities with AI agents that automate financial and project management tasks, enhancing productivity and decision-making. With R&D expenses constituting a notable portion of its budget, Intuit is not just keeping pace but setting trends in tech innovation. The recent expansion of the IDEAS program further exemplifies Intuit’s commitment to leveraging its technological advancements to support diverse business needs across various cities and veteran communities, promising robust growth prospects in an evolving market landscape.

- Navigate through the intricacies of Intuit with our comprehensive health report here.

Assess Intuit's past performance with our detailed historical performance reports.

Workday (WDAY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Workday, Inc. offers enterprise cloud applications globally and has a market capitalization of approximately $63.81 billion.

Operations: The company generates revenue primarily from its cloud applications, amounting to $8.70 billion.

Workday's integration with Payactiv, enhancing financial wellness for employees, underscores its strategic focus on human capital management solutions. This partnership, leveraging direct API integration for seamless service delivery, exemplifies Workday's commitment to improving workforce engagement through innovative technology. Despite a challenging year with a one-off loss of $253 million affecting earnings and profit margins dropping to 5.6% from 19.7%, the company's revenue growth remains robust at 11.4% annually, outpacing the US market average of 9%. Moreover, Workday's forecasted earnings growth of 29.9% annually signals strong future potential in leveraging AI and software solutions to drive operational efficiencies and client satisfaction.

- Take a closer look at Workday's potential here in our health report.

Gain insights into Workday's past trends and performance with our Past report.

Seize The Opportunity

- Click here to access our complete index of 220 US High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APP

AppLovin

Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives