- United States

- /

- IT

- /

- NasdaqGS:VRSN

Is VeriSign Still a Smart Bet After 46.9% Gain in 2024?

Reviewed by Bailey Pemberton

If you are holding VeriSign stock or thinking about grabbing some shares, you are probably wondering whether it is time to ride the wave higher or lock in your gains. After all, the stock has been on quite a journey lately, and investors are taking notice. In just the past year, VeriSign rewarded shareholders with a remarkable 46.9% return. Year-to-date, it is up 33.1%, far outperforming much of the broader market. Even with a recent short-term dip of -4.0% over the past week, and a marginal pullback of -2.5% over the past month, the long-term direction remains firmly upward. Many see this as a sign of resilience, even as markets digest changing risk appetites and a shifting landscape for domain services providers.

But price action only tells part of the story. To truly understand where VeriSign’s stock stands, valuation is key. By our scorecard, which rates companies out of 6 based on whether they're undervalued by a range of financial checks, VeriSign comes in at 3. This suggests it is undervalued in half of the metrics we examine. That is a promising sign for value-focused investors, but the real insights come from looking at which valuation methods point to opportunity versus risk.

In the next section, we will dig into these specific valuation techniques, examining how VeriSign stacks up under different lenses. If you are searching for a fresh angle that could change how you look at valuations altogether, make sure to stick around for our final take at the end.

Approach 1: VeriSign Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This helps investors gauge what the company is really worth, rather than just relying on the current share price.

For VeriSign, the latest data shows current Free Cash Flow (FCF) at $943 million. Analyst estimates project FCF growth over the next five years, starting with $946 million in 2026 and rising to $1,255 million by 2029. Beyond that, Simply Wall St extrapolates continued growth, reaching $1,337.9 million in 2030, all quoted in US dollars. These cash flow projections are grounded in a 2 Stage Free Cash Flow to Equity approach, which considers both explicit analyst forecasts and longer-term conservative growth assumptions.

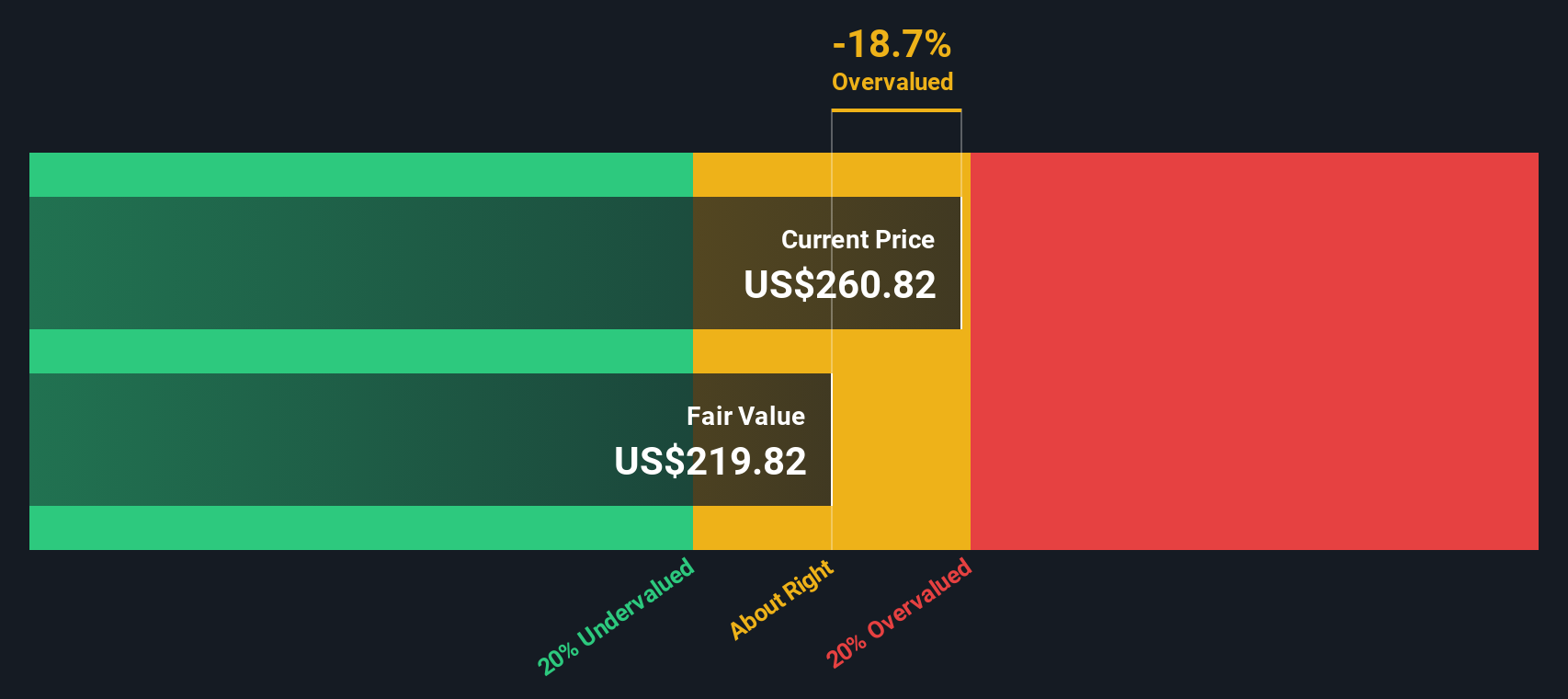

Based on this DCF analysis, VeriSign's intrinsic fair value is estimated at $216.72 per share. However, this valuation model suggests the stock is currently trading at a 26.0% premium to its underlying value, making it overvalued according to these cash flow projections.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests VeriSign may be overvalued by 26.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: VeriSign Price vs Earnings (PE)

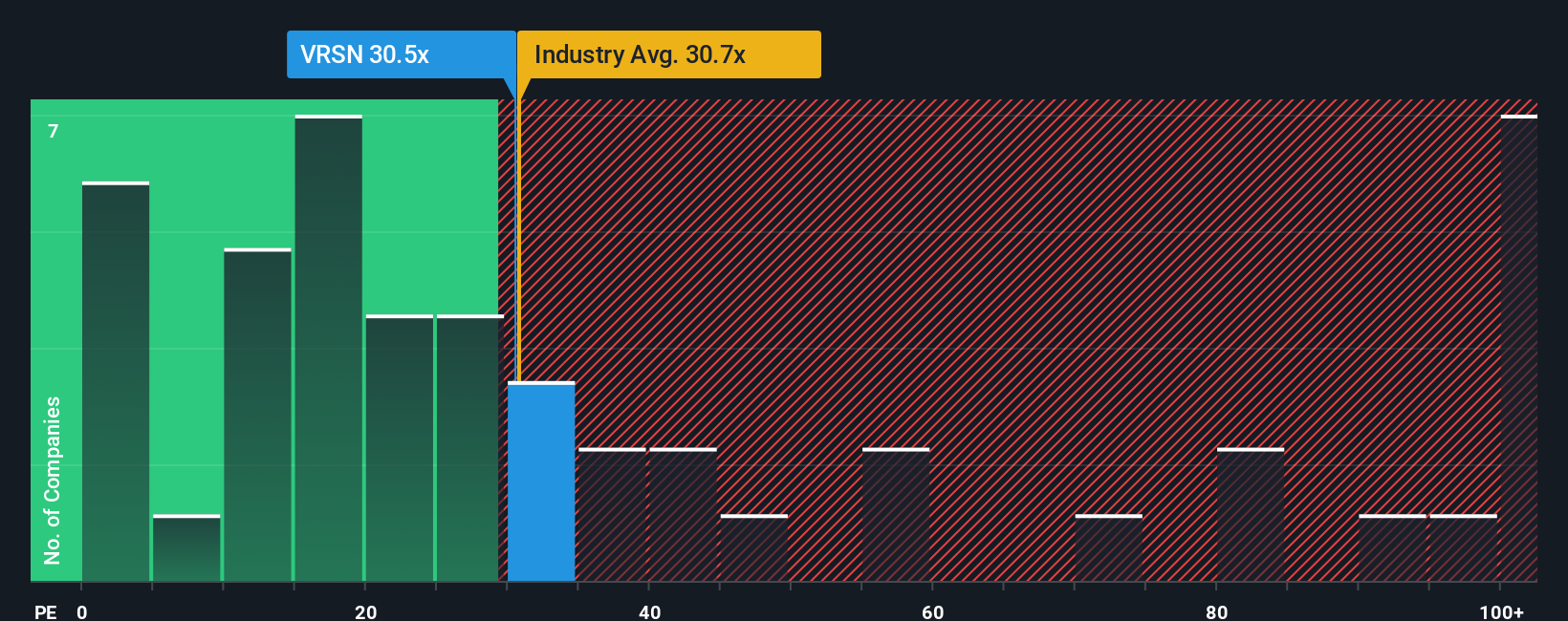

For companies like VeriSign that consistently generate profits, the Price-to-Earnings (PE) ratio is one of the most widely trusted methods to assess value. The PE ratio reflects how much investors are willing to pay for each dollar of earnings, making it especially useful for established, cash-generative businesses with steady profits.

The “fair” PE for any company is shaped by expectations for future growth and the risks the business faces. Higher earnings growth or lower risk typically commands a higher multiple, while slower growth or greater risk does the opposite. With VeriSign, the current PE stands at 31.9x, which is slightly below the IT industry average of 33.2x and noticeably lower than the peer group average of 49.5x.

To go a step beyond simply comparing ratios, Simply Wall St calculates a “Fair Ratio.” This proprietary measure factors in more than just sector benchmarks. It considers elements like earnings quality, profit margins, expected growth, market cap, and company-specific risks. For VeriSign, the Fair Ratio is 31.9x, closely matching its current PE. This suggests that, when you account for all the moving parts, the stock is priced about where it should be now.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your VeriSign Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is more than just a number; it is the story you believe about a company and how that story translates into your own assumptions about its future revenue, earnings, margins, and ultimately, fair value.

Rather than relying solely on backward-looking metrics or analyst consensus, Narratives let you outline your personal perspective, whether you see VeriSign benefiting from new domain trends, facing regulatory headwinds, or leveraging its robust cash flow to reward shareholders. Each Narrative directly links these beliefs to a financial forecast and a calculated fair value, making it much easier to see how changes in the company’s story could affect its attractiveness as an investment.

Best of all, Narratives are easy to build and explore within the Simply Wall St Community, where millions of investors share dynamic perspectives. As real-world news or earnings updates roll in, these Narratives can refresh automatically, ensuring your view is always up to date.

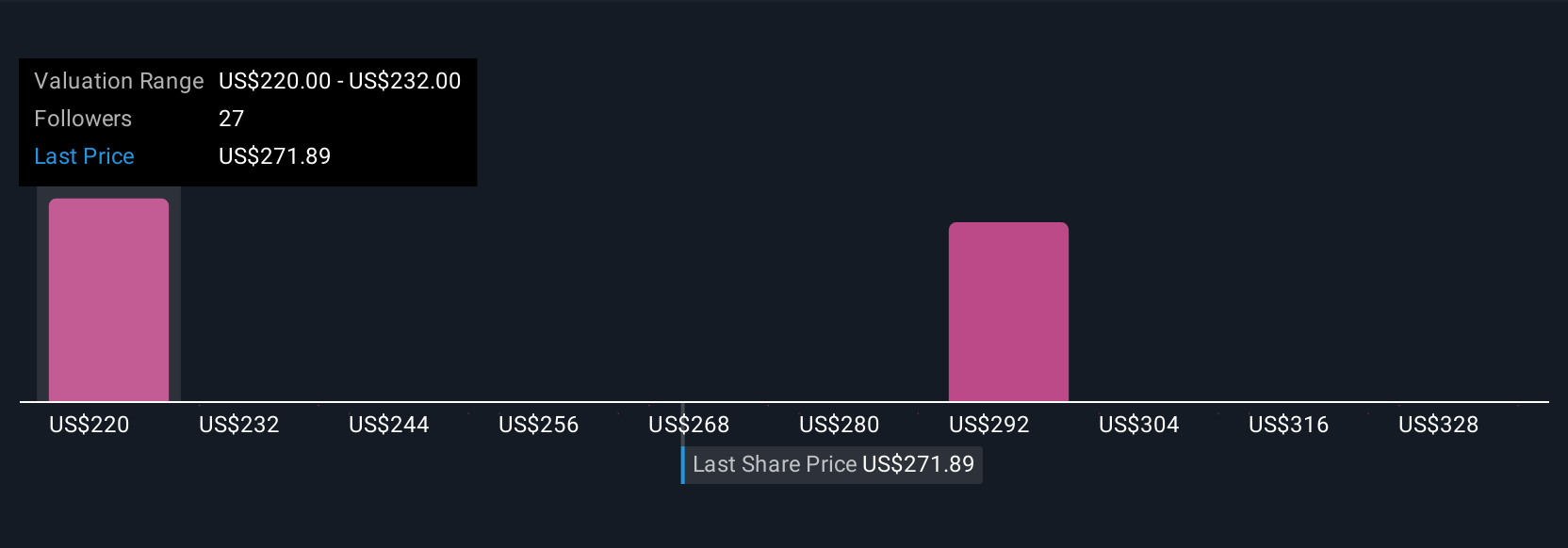

For example, the most optimistic Narrative on VeriSign assumes aggressive domain growth and a PE of 33.3x, leading to a fair value of $340.00 per share, while the most cautious Narrative expects slower trends for a fair value of just $250.00. This is a wide range, but a powerful tool for deciding when to buy or sell based on your convictions versus the current price.

Do you think there's more to the story for VeriSign? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRSN

VeriSign

Provides internet infrastructure and domain name registry services that enables internet navigation for various recognized domain names worldwide.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives