- United States

- /

- Software

- /

- NasdaqGS:VRNS

Why Varonis Systems (VRNS) Is Up 5.5% After Integrating Security Signals With Microsoft Purview

Reviewed by Sasha Jovanovic

- On November 18, 2025, Varonis Systems announced the integration of its data security posture management signals into Microsoft Purview, enabling unified visibility into sensitive data across platforms such as Salesforce and Microsoft 365.

- This collaboration addresses the increasing risks associated with rapid data growth and sprawl by offering security teams streamlined risk oversight and operational simplicity across diverse cloud environments.

- We'll now examine how this expanded integration with Microsoft Purview could influence Varonis Systems' investment narrative around SaaS growth and platform capabilities.

The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Varonis Systems Investment Narrative Recap

To be a Varonis Systems shareholder, you need conviction in the growth of enterprise data security and the company’s ability to leverage its SaaS platform to capture this demand, despite current earnings pressure from its SaaS transition. The recent integration with Microsoft Purview strengthens Varonis’ ecosystem presence but does not immediately resolve the main near-term challenge: translating strong SaaS ARR growth into improved reported profitability. The most important short-term catalyst remains continued SaaS adoption and cross-platform security partnerships, while the biggest risk is persistent operating margin compression.

One recent development closely related to this integration is Varonis’ July 2025 partnership with Microsoft to secure next-gen workplace AI, further embedding its solutions within enterprise cloud environments. This supports the broader catalyst of expanding global cloud coverage, which could enhance customer acquisition and increase recurring revenue as organizations invest in unified data security tools.

However, investors should also be mindful that unlike product expansions, challenges to consistent long-term margin improvement can...

Read the full narrative on Varonis Systems (it's free!)

Varonis Systems' narrative projects $911.4 million revenue and $119.3 million earnings by 2028. This requires 15.3% yearly revenue growth and a $222.2 million increase in earnings from -$102.9 million.

Uncover how Varonis Systems' forecasts yield a $52.63 fair value, a 59% upside to its current price.

Exploring Other Perspectives

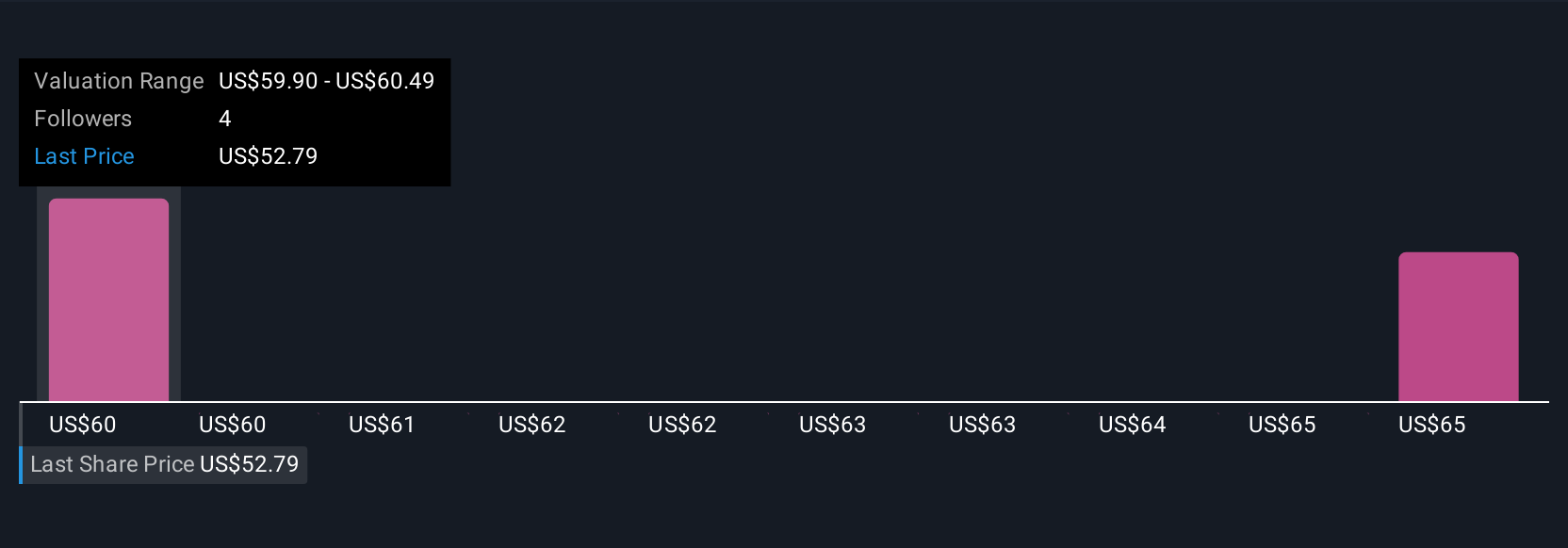

Simply Wall St Community contributors set fair values for Varonis between US$52.63 and US$70, with three unique perspectives collected. While many see significant upside, ongoing margin pressures could limit progress toward these estimates, so weigh both risks and opportunities as you review other viewpoints.

Explore 3 other fair value estimates on Varonis Systems - why the stock might be worth over 2x more than the current price!

Build Your Own Varonis Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Varonis Systems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Varonis Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Varonis Systems' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRNS

Varonis Systems

Provides software products and services that continuously discover and classify critical data, remediate exposures, and detect advanced threats with AI-powered technology in North America, Europe, APAC, and rest of world.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

The Real Power Behind Alphabet’s Growth

RELX: The Quiet Compounder Powering Law, Science, and Risk Intelligence

Why CVS’s Valuation Signals Opportunity

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026