- United States

- /

- Software

- /

- NasdaqGS:VRNS

Varonis Systems, Inc.'s (NASDAQ:VRNS) Business Is Trailing The Industry But Its Shares Aren't

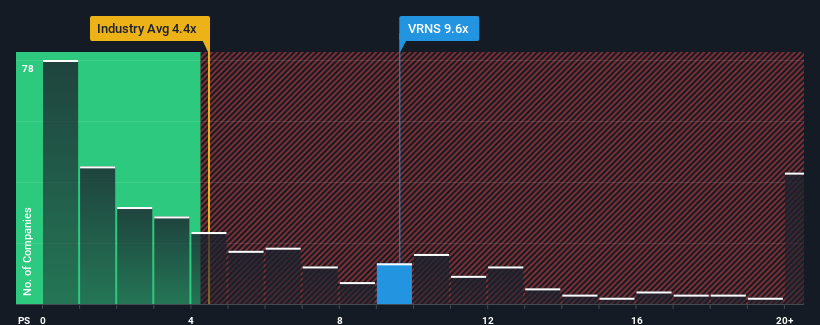

You may think that with a price-to-sales (or "P/S") ratio of 9.6x Varonis Systems, Inc. (NASDAQ:VRNS) is a stock to avoid completely, seeing as almost half of all the Software companies in the United States have P/S ratios under 4.4x and even P/S lower than 1.8x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Varonis Systems

How Varonis Systems Has Been Performing

With revenue growth that's inferior to most other companies of late, Varonis Systems has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Varonis Systems will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

Varonis Systems' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.6% last year. Pleasingly, revenue has also lifted 81% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 12% per year during the coming three years according to the analysts following the company. With the industry predicted to deliver 17% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Varonis Systems' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Varonis Systems' P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Varonis Systems, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Varonis Systems that you need to be mindful of.

If you're unsure about the strength of Varonis Systems' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VRNS

Varonis Systems

Provides software products and services that continuously discover and classify critical data, remediate exposures, and detect advanced threats with AI-powered technology in North America, Europe, APAC, and rest of world.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives